Retail Banking Setup

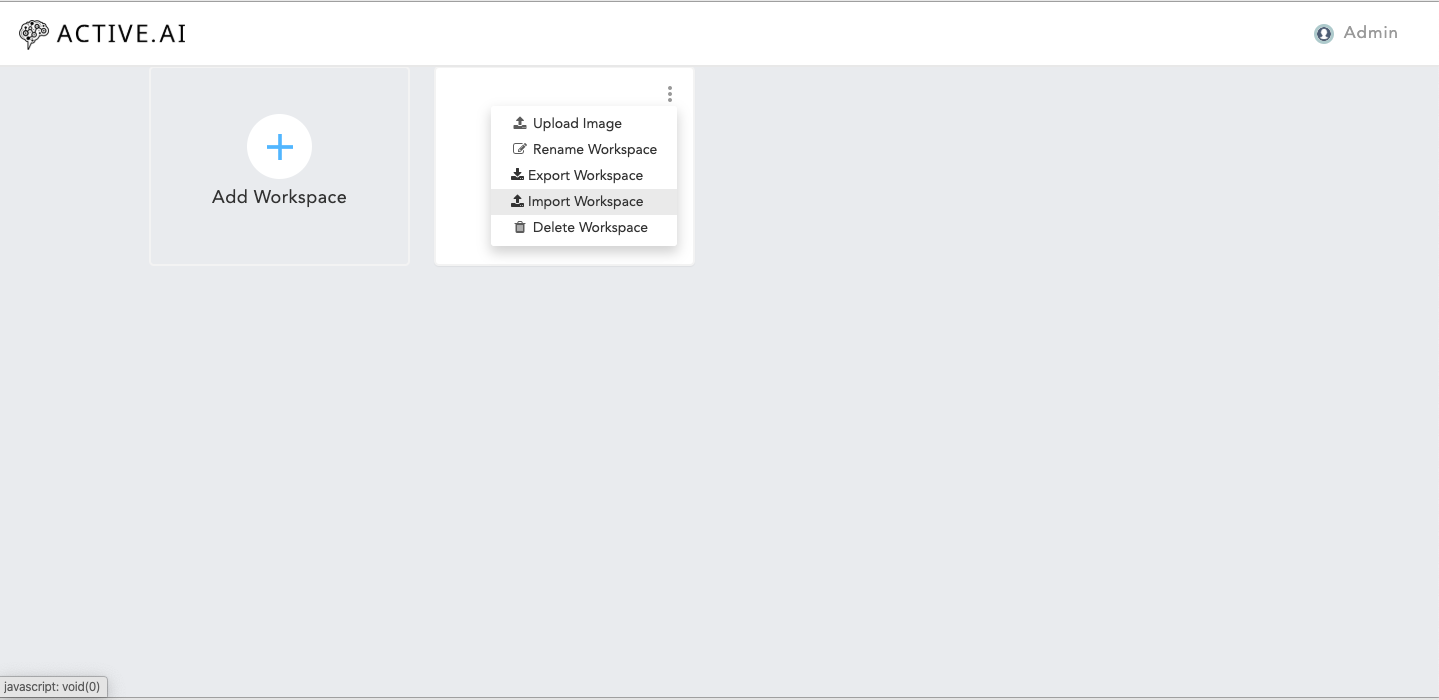

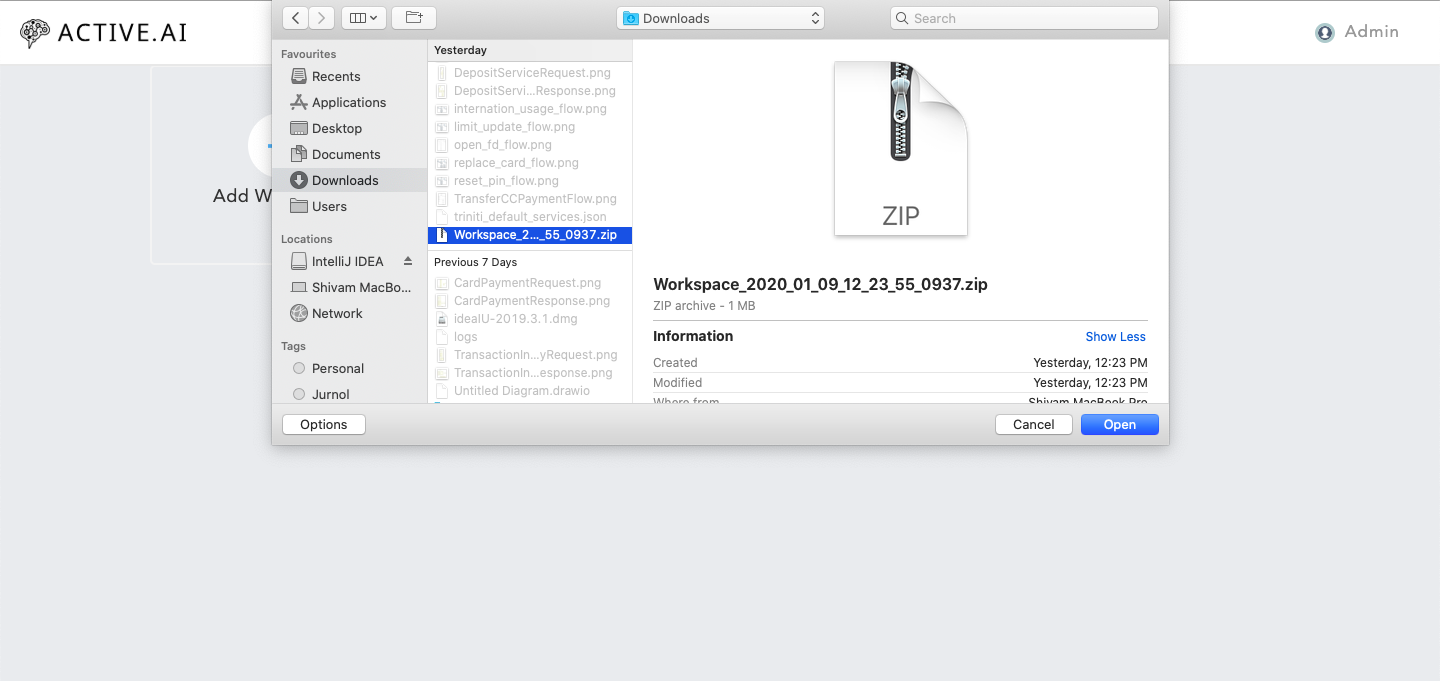

Import Workspace

Follow the below steps for importing a existing workspace -

Download the workspace zip from below artifactory link- Workspace

Click on import workspace.

Select the downloaded workspace.

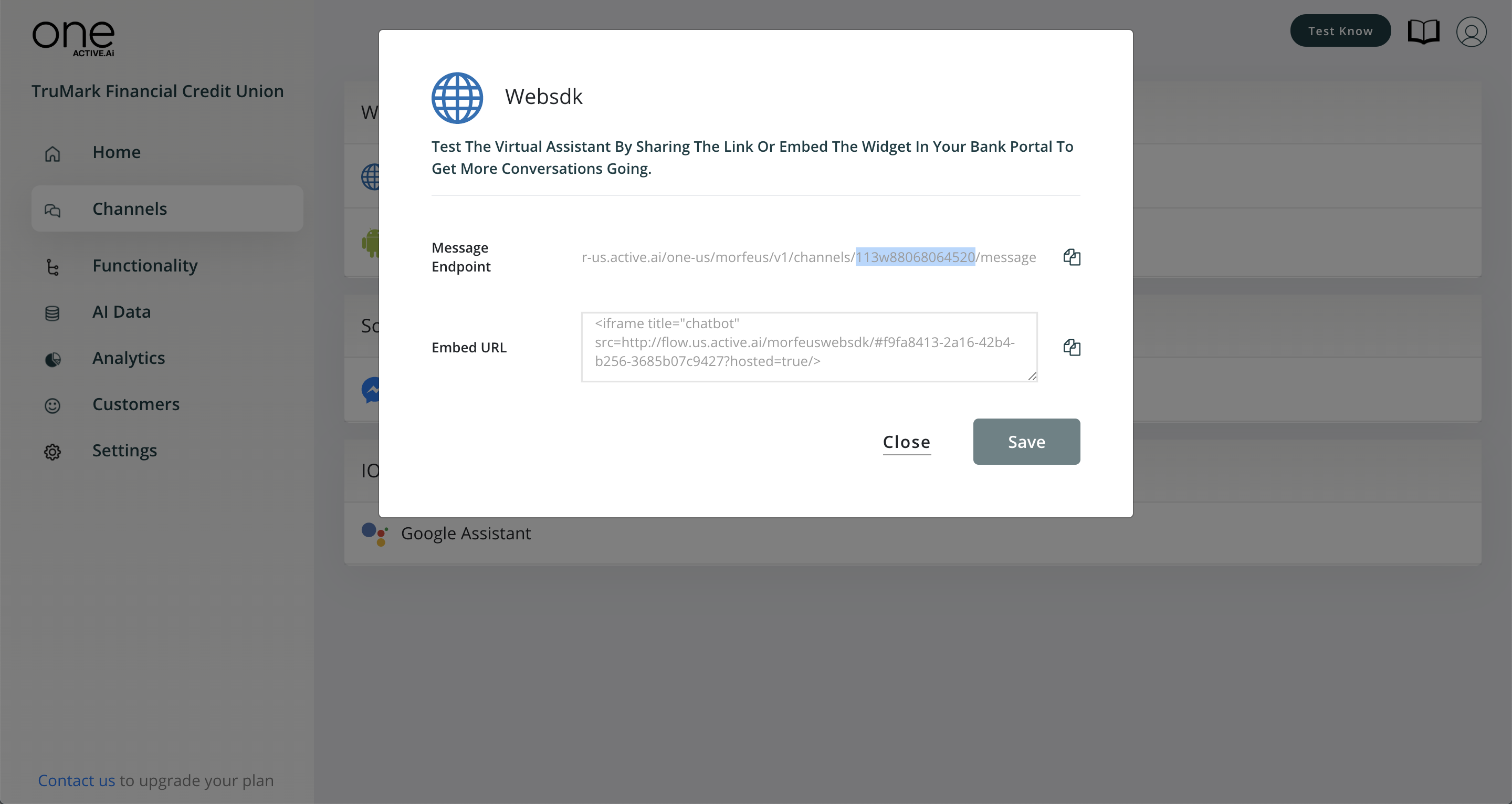

Change the botId in your index.js file. $TOMCAT_LOCATION/WEBAPPS/MORFEUSWEBSDK/JS/index.js

Step-by-Step setup

Download zip files from artifactory which contains required jars to be deployed

- Retail banking jars were used to handle business logic specific to all use-cases like Fund Transfer, Balance enquiry, Bill Payment etc. Retail Banking jars location click here

- Common jars help to provide a generic implementation for all Products like Retail Banking, Corporate Banking. Common jars location click here then extract and deploy in folowing location :-

- Tomcat :-

- Configure location for usage of jars on $TOMCAT_LOCATION/CONF/Catalina/morfeus.xml TOMCAT_LOCATION → location where we have deployed out tomcat instance

- Dump all the jars obtained from above link in configured path.

- JBoss :-

- Need to download Morfeus war for configuring the jars.Morfeus War for Jboss location click here

- Configure location for usage of jars on $JBOSS_LOCATION/morfeus/WEB-INF/jboss-deployment-structure.xml JBOSS_LOCATION → location where we have deployed out jboss instance for eg :-

- Dump all the jars obtained from above link in configured path($JBOSS_LOCATION standalone/deployments).

- Weblogic :-

- Need to Configure the CommonJars.war in deployment-morfeus and we need to packed all the retail-banking jars into CommonJars.war .

- Configure location for usage of jars on $Weblogic_LOCATION/CommonJars/WEB-INF/lib/rb.jar, Weblogic_LOCATION → location where we have deployed out jboss instance

- Dump all the jars obtained from above link in configured path.

- Tomcat :-

Download rb-deployments.zip folder from the artifactory which contains properties, templates, hooks, and messages. ($RESOURCE_LOCATION - > location from where you have downloaded file from here)

Load the configurations to DB.

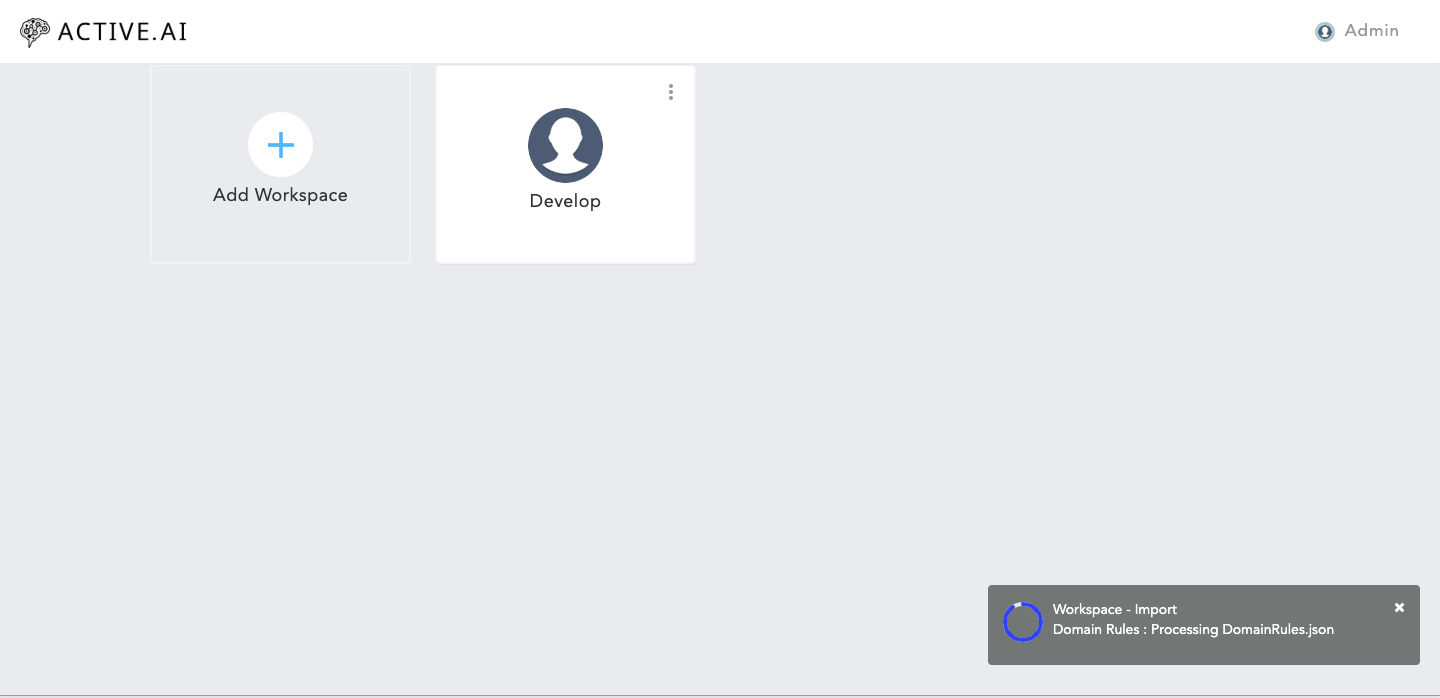

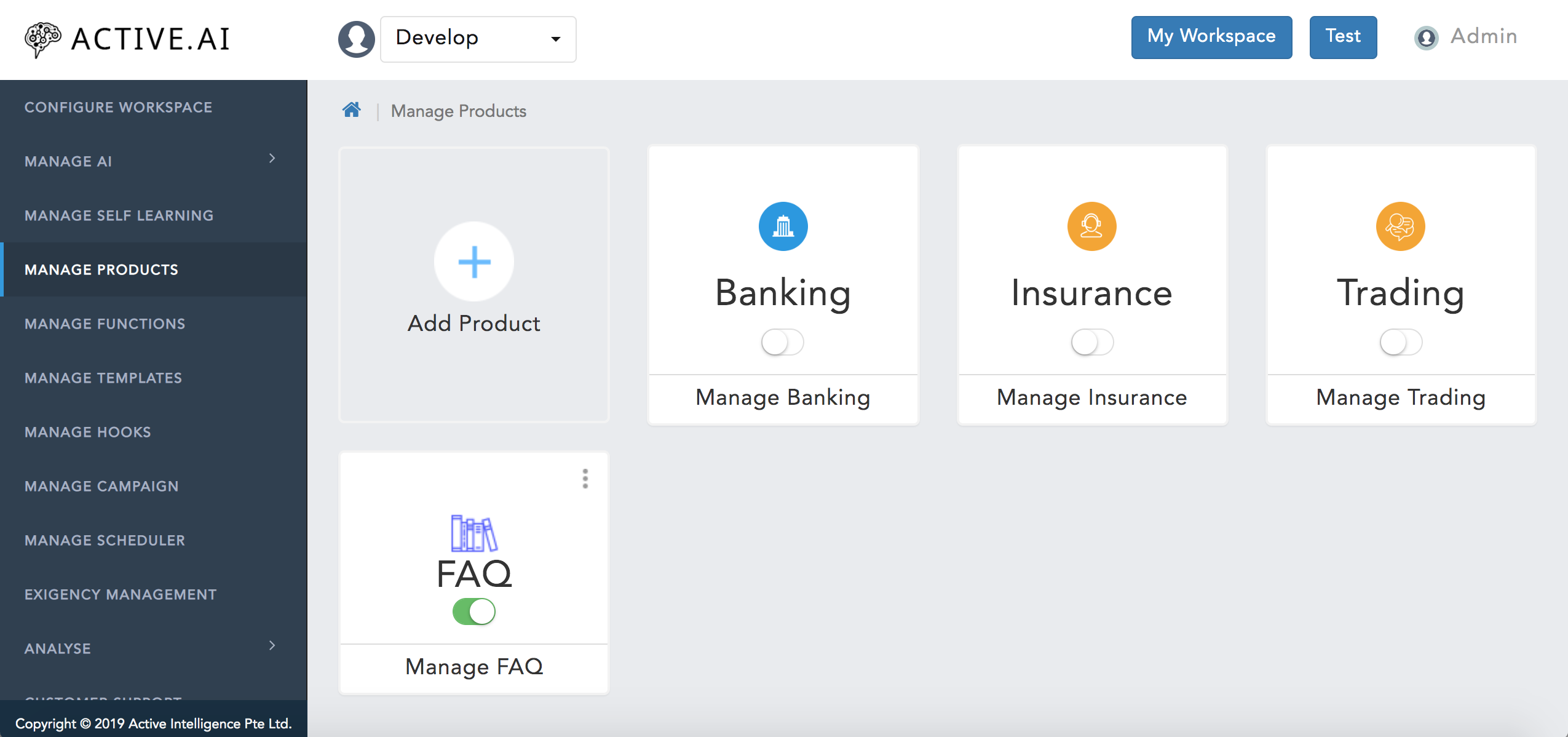

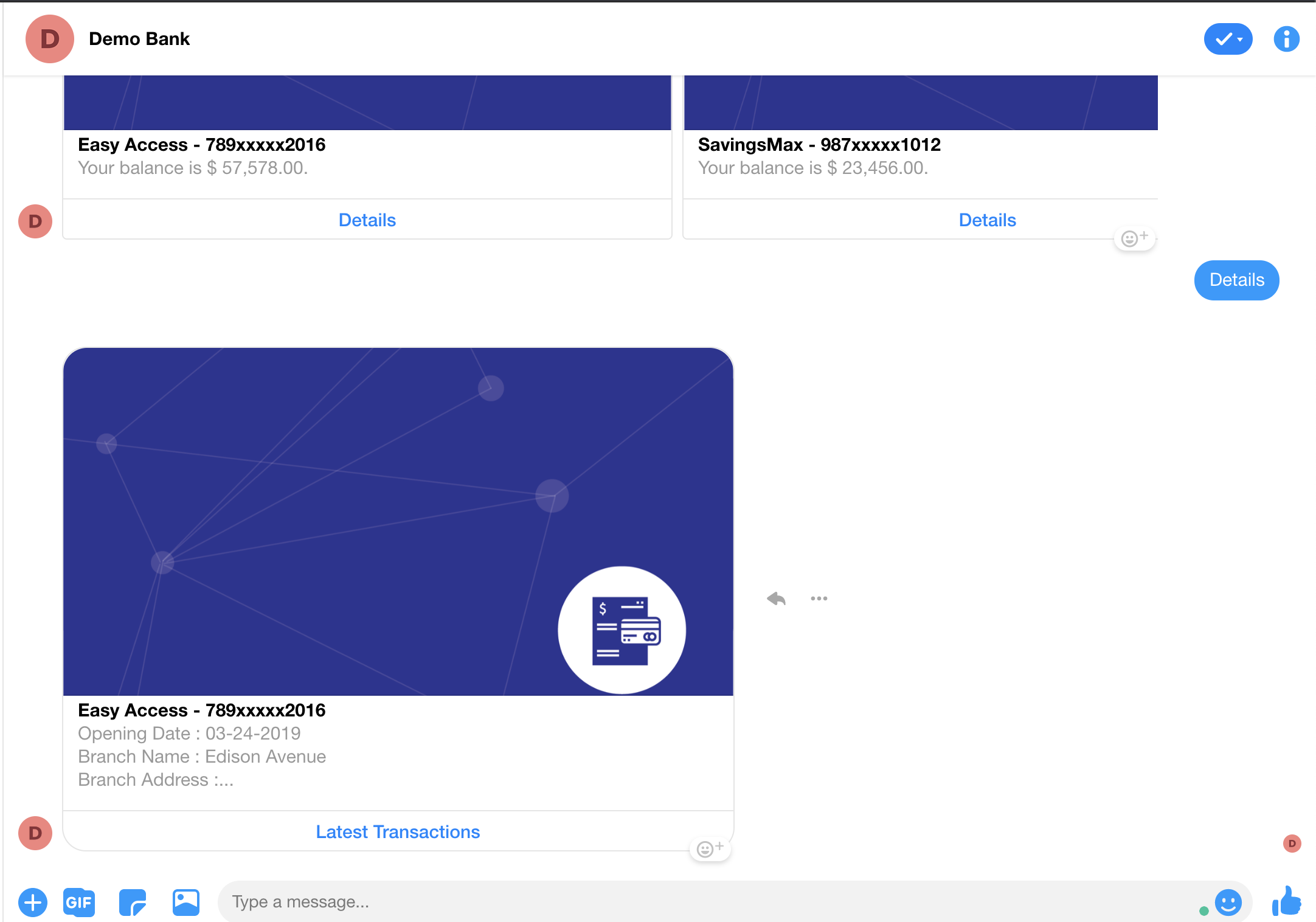

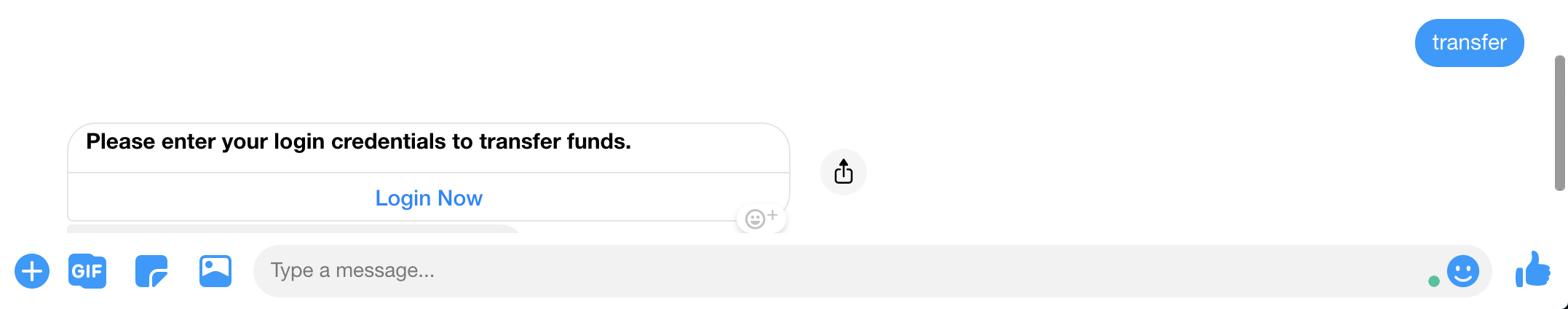

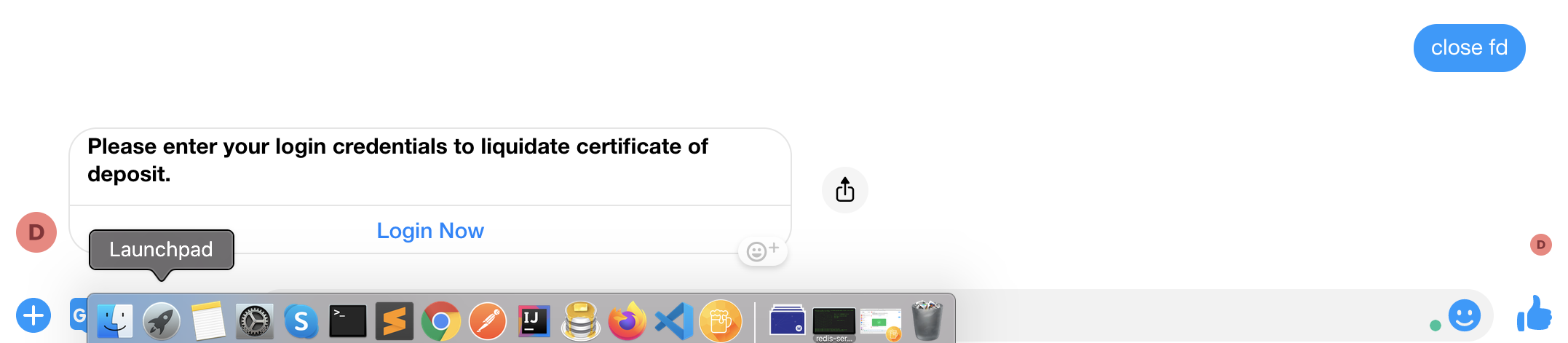

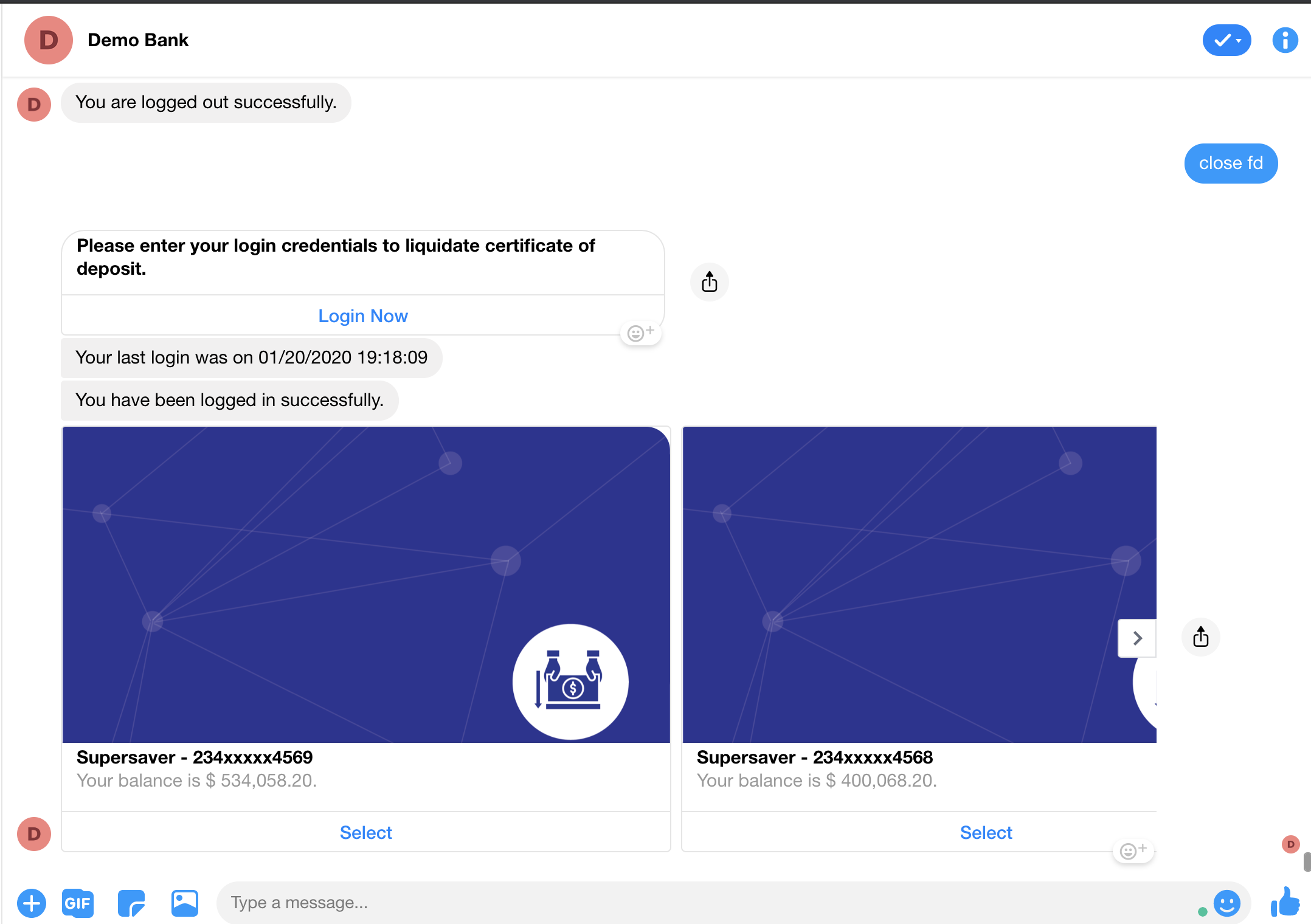

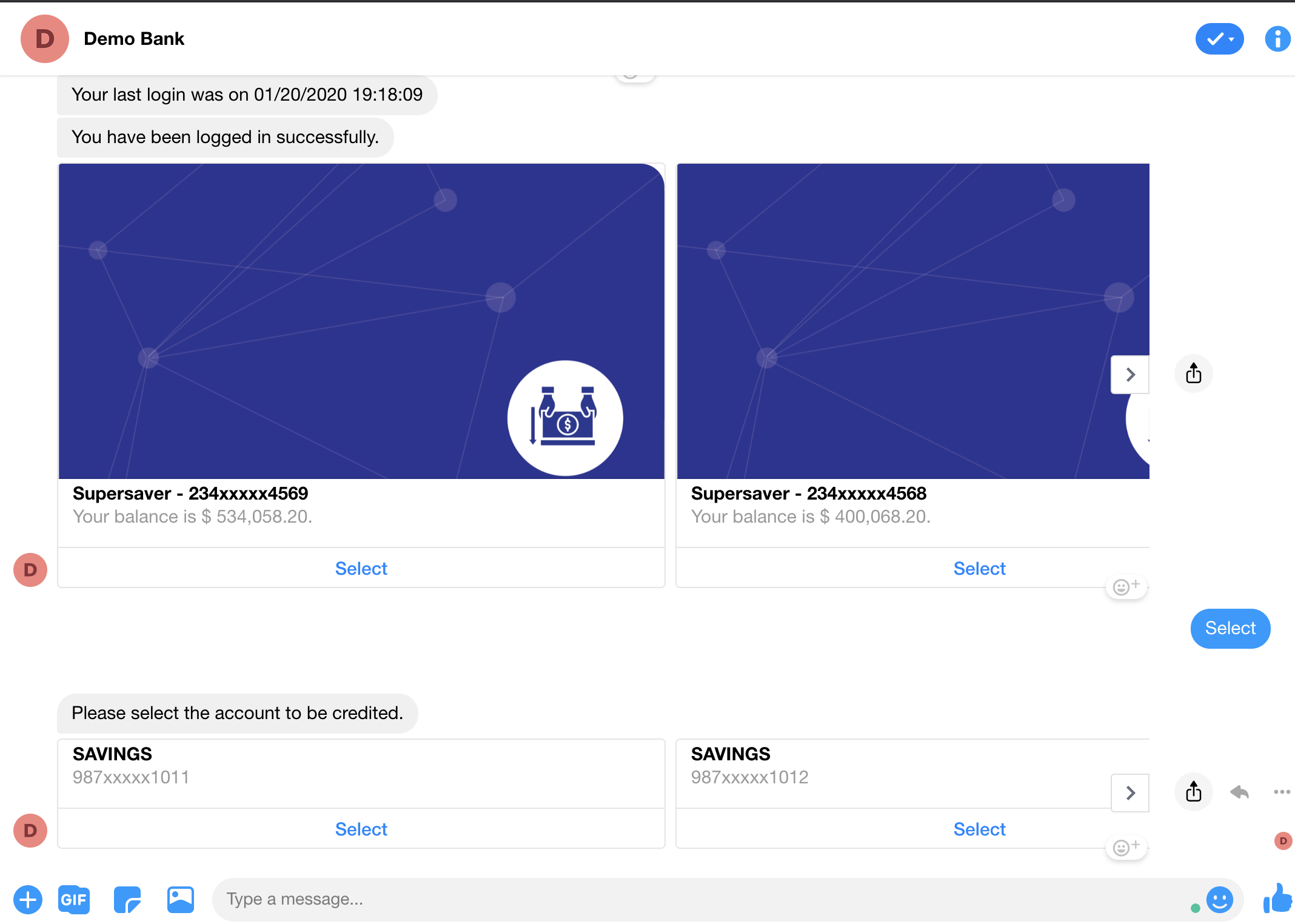

You can insert values either by database insertion or there is an Post rest API call {protocol}://({domainName}/morfeus/v1/retailBankingProperty/{botId}/{botDomainId}) with body as a file path of a retail-banking.properties or array list of ruleCode and ruleValue object or both ex:- http://localhost:8080/morfeus/v1/retailBankingProperty/2/1 body:{ "path":"$RESOURCE_LOCATION/properties/retail-banking.properties" }Admin Configurations Open admin console to import messages, templates, and hooks If you already have workspace created (image 1.2), then can straight away import the files

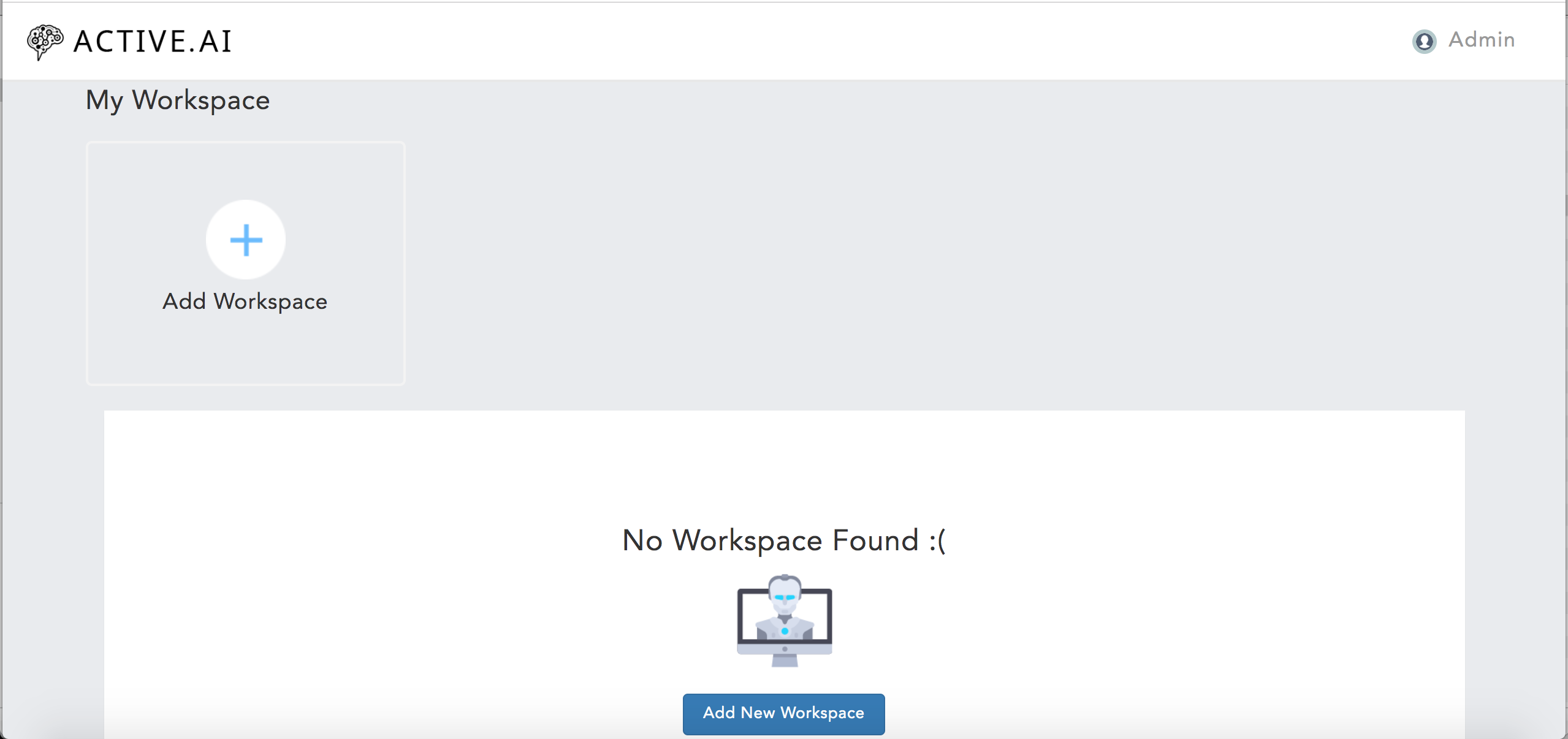

image 1.1 - fresh admin landing page

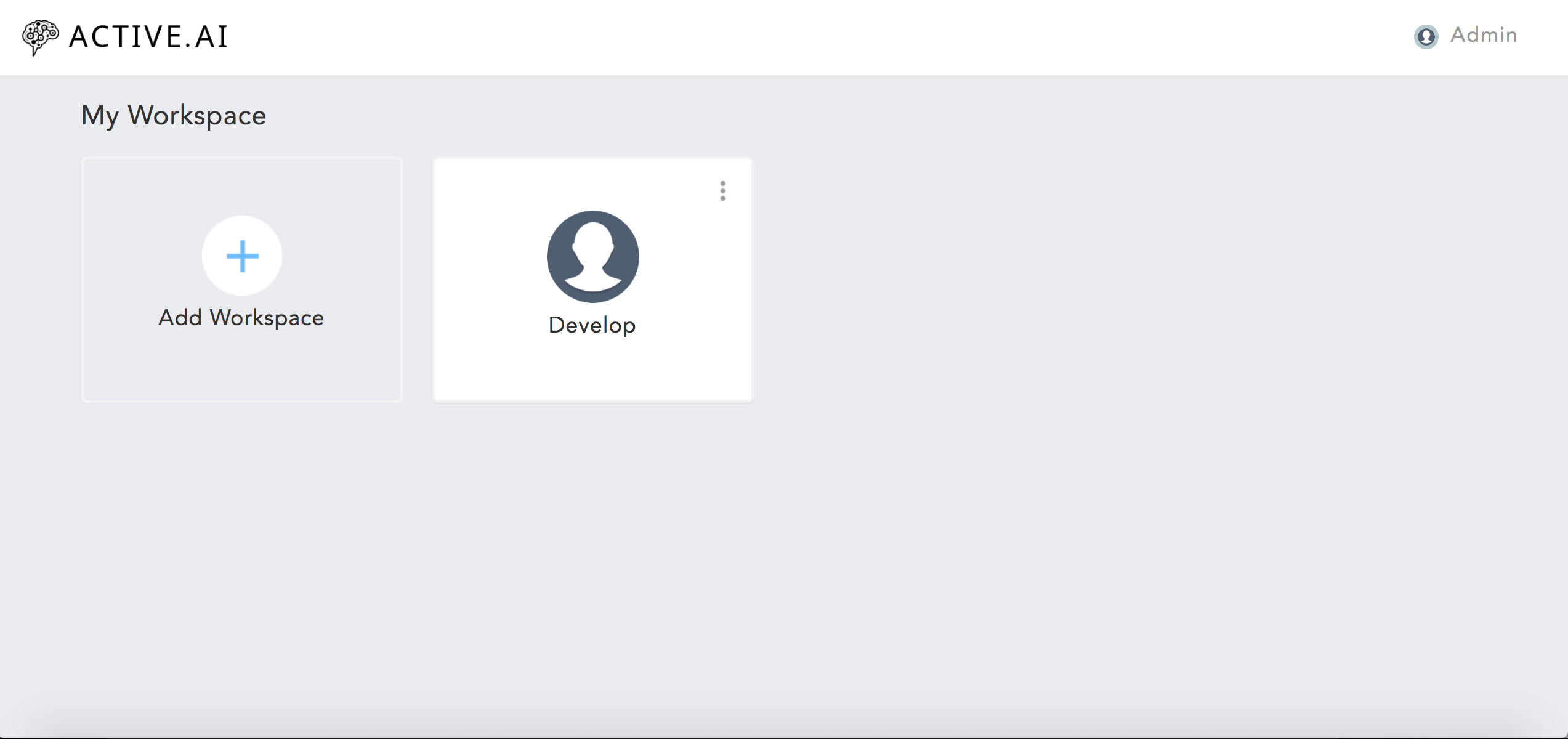

image 1.2 - existing created workspace on the landing page

- Or create a workspace with steps:

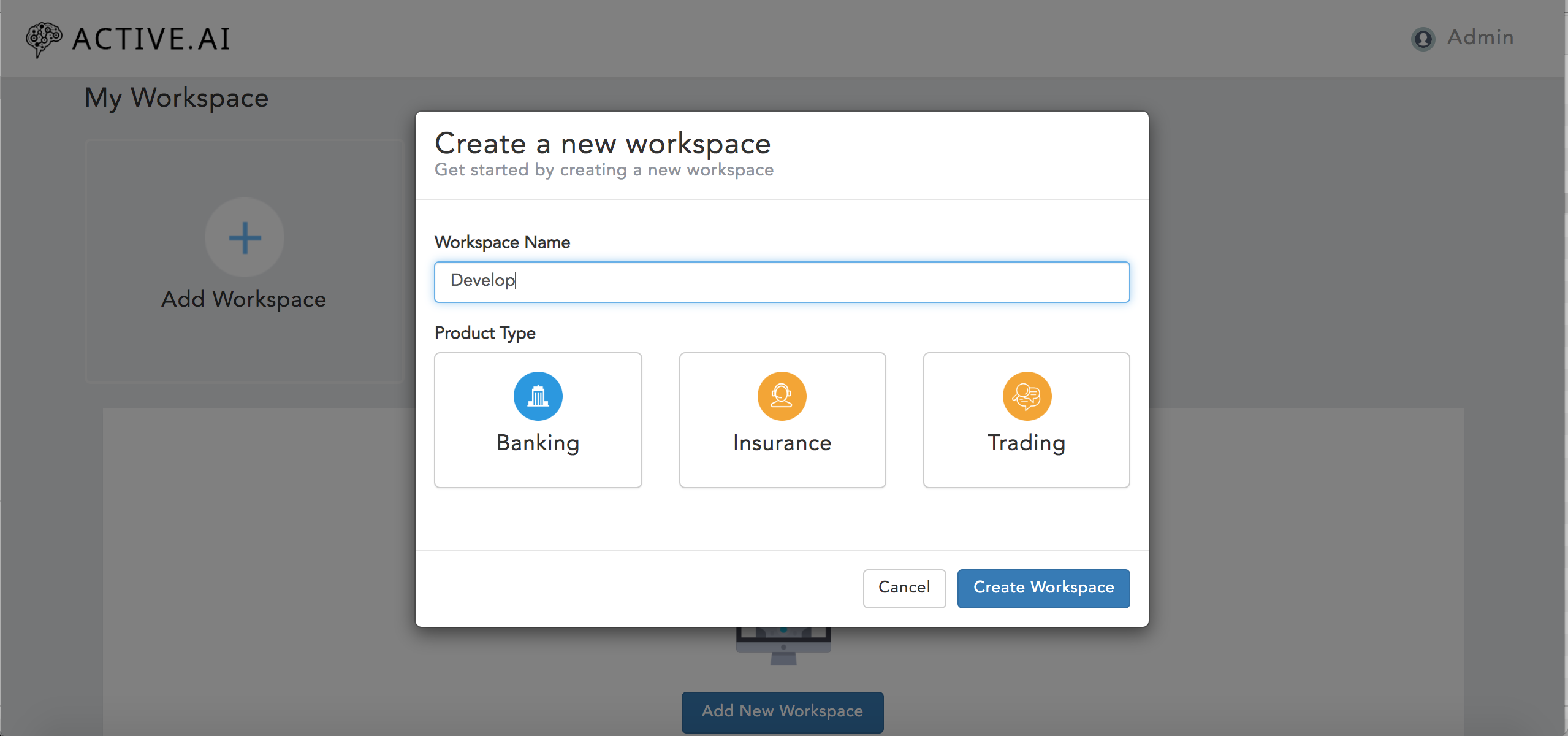

Click on Add Workspace or Add New Workspace (image 1.1) >> provide workspace name (example:- Develop) >> choose "banking" in product type (image 1.3)

image 1.3 - selecting the product type

- Import files:-

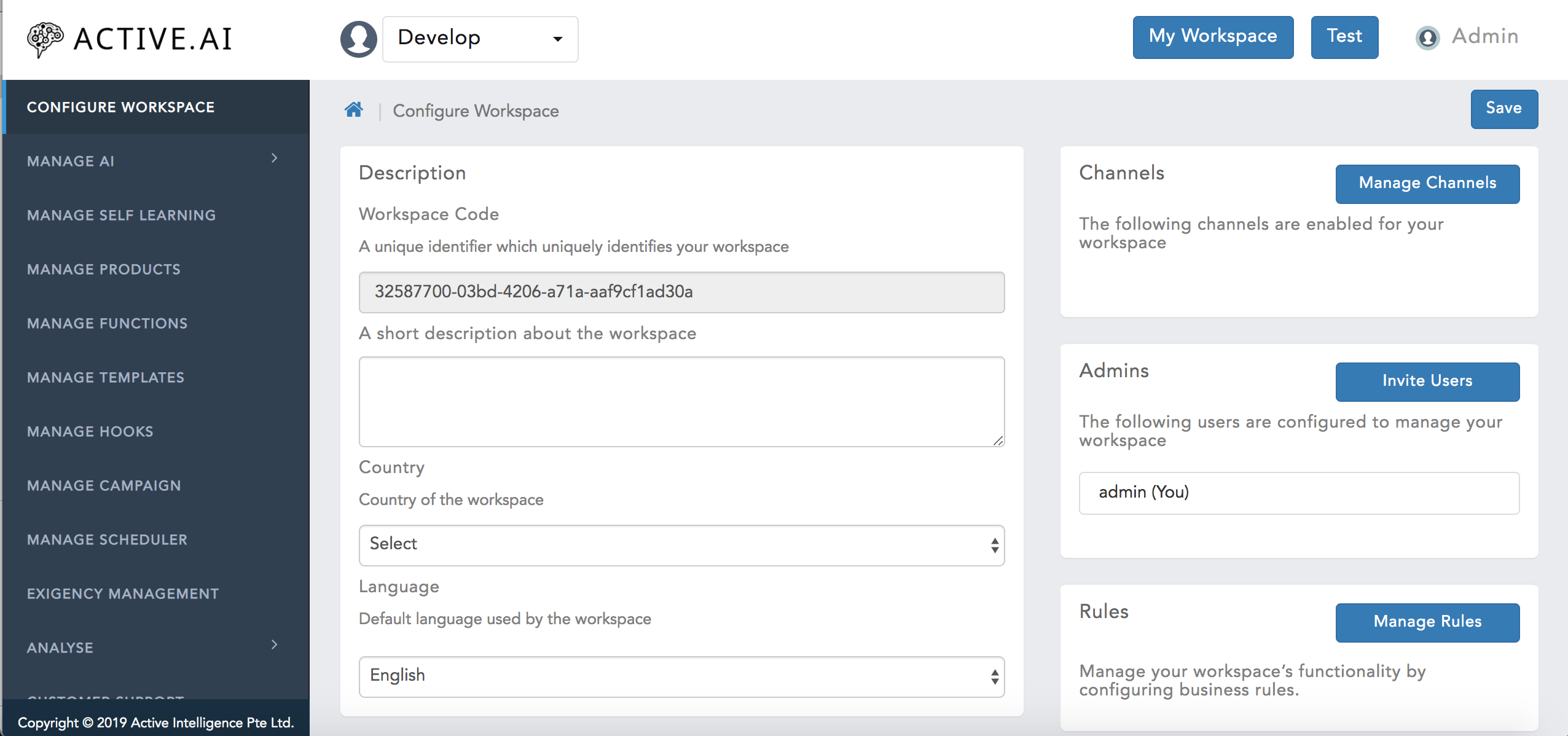

→ Choose workspace to be configured for RB and you’ll be ended with below landing page

image 1.4 - landing page after selecting Workspace

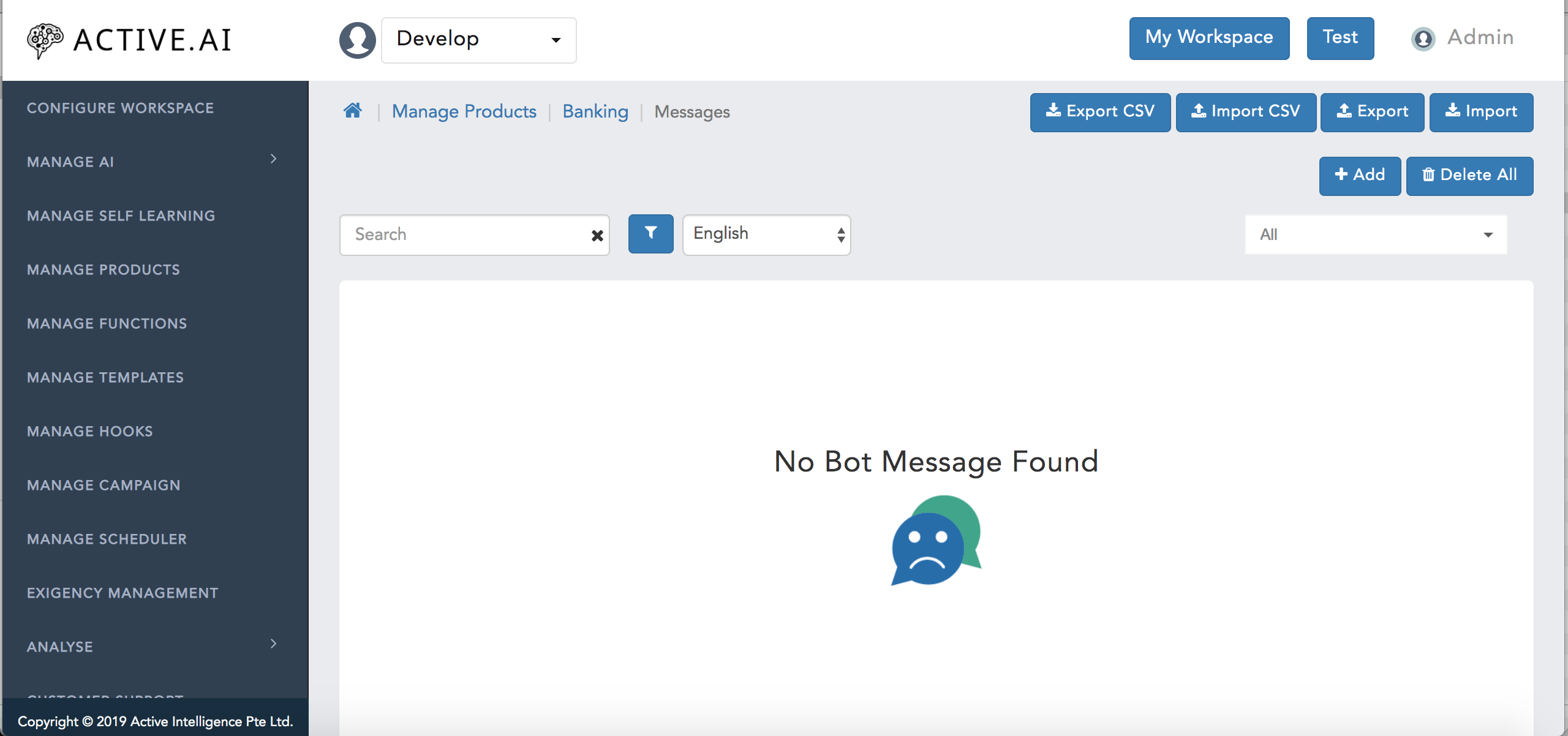

→ Manage products (image 1.4) >> Messages (image 1.5) >> import (image 1.6) >> choose file $RESOURCE_LOCATION/messages/rb-en-us-any-messages.json

image 1.5 - landing page of Manage Products

image 1.6 - landing page of Messages

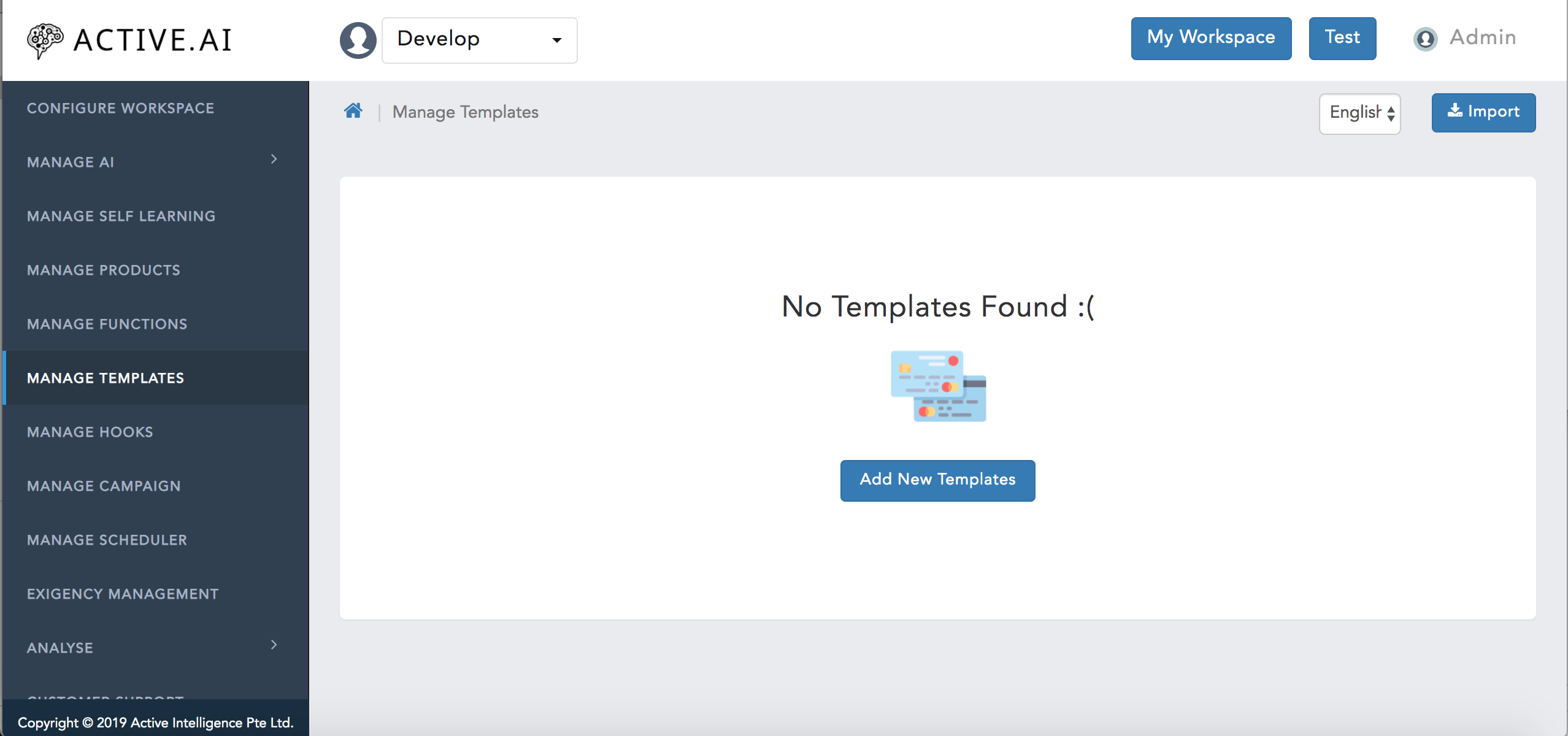

→ Manage Templates (image 1.6) >> import (image 1.7) >> choose file $RESOURCE_LOCATION/templates/rb-v2-templates.json

image 1.7 - landing page of Manage Templates

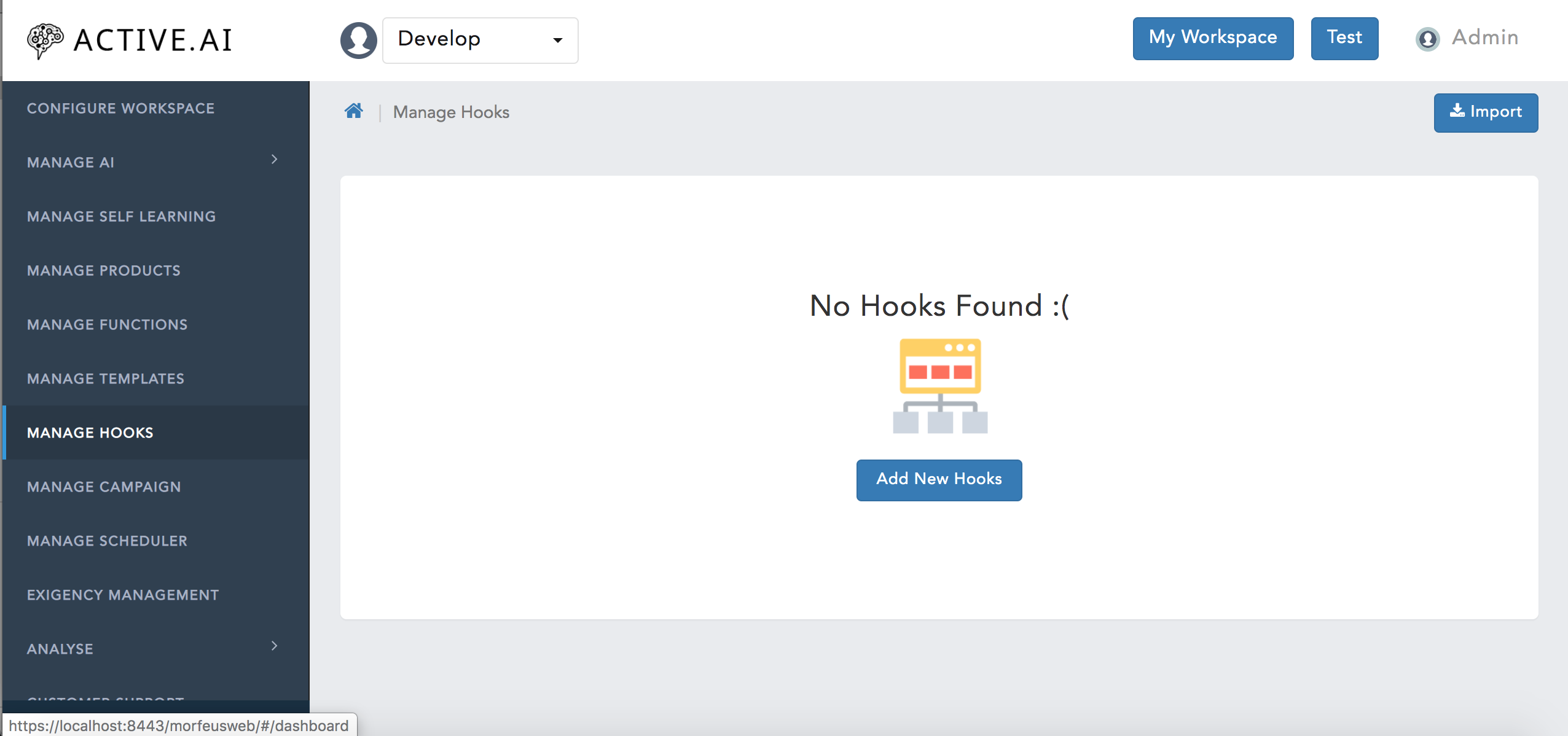

→ Manage Hooks (image 1.5) >> import (image 1.9) >> choose file $RESOURCE_LOCATION/hooks/rb-consolidated-hooks.json (You can also import specific use-case related hooks which are available in the same folder)

image 1.8 - landing page of Manage Hooks

Stub Data Providing to RB using Microservice

Pre-Defined:-

Download RB Stub Bank Integration from artifactory on the location given below and move that to the location $TOMCAT_LOCATION/webapps from here

Download RB Stub Bank consolidated integration jar from artifactory on location give below and move that to the location which we provided on $TOMCAT_LOCATION/CONF/Catalina/morfeus.xml

Download resource file from artifactory($INTEGRATION_RESOURCE_LOCATION) from here with body as a file path -> $INTEGRATION_RESOURCE_LOCATION/properties/microservice-rb.properties and then $INTEGRATION_RESOURCE_LOCATION/properties/microservice-api.properties one after other ex:- http://localhost:8080/morfeus/v1/retailBankingProperty/2/1 body:

JSON { "path":"$INTEGRATION_RESOURCE_LOCATION/properties/microservice-rb.properties" }Open admin console to import integration hooks->Manage Hooks (image 1.4) >> import (image 1.8) >> choose file $INTEGRATION_RESOURCE_LOCATION/hooks/rb-consolidated-hooks.json

Custom

To Check the Customization of Banking Integration Please check here

Product Use cases

The retail banking business solution offers a number of out-of-the-box (OOTB) conversation use cases. The use cases have been designed considered standard banking process flows. Any changes to conversational flows due to business process differences can be achieved by change in configurations or simple customization.

The supported use cases are listed below

| Inquiry | Service requests | Transactions | |

| Generic | Balance inquiry

Account inquiry Account activity Portfolio inquiry Statement ATM / Branch locator SI inquiry Office hours |

Profile update Demand draft request

Forex rate Call back request Live agent transfer Account nickname Report fraud / dispute Generic service request |

|

| Savings & Checking accounts | View payees

View billers Spend analysis Autopay - view Biller - view Nominee details Interest rate inquiry |

Account inquiry

Cheque book request Payee - register Payee - cancel Stop payment Biller - cancel Recharge Biller - register Autopay - cancel Autopay - register Autopay - modify |

Fund transfer - adhoc

Fund transfer - own Fund transfer - third party Payment - Credit Card Payment - loan Payment - third party Payment - biller Payment - adhoc biller Payment - P2P Payment - schedule Payment - cancel Payment - biller Payment - Credit Card other bank Collect request Payment - prepaid |

| Loans | Due inquiry

Due date Tenor details Closure details |

||

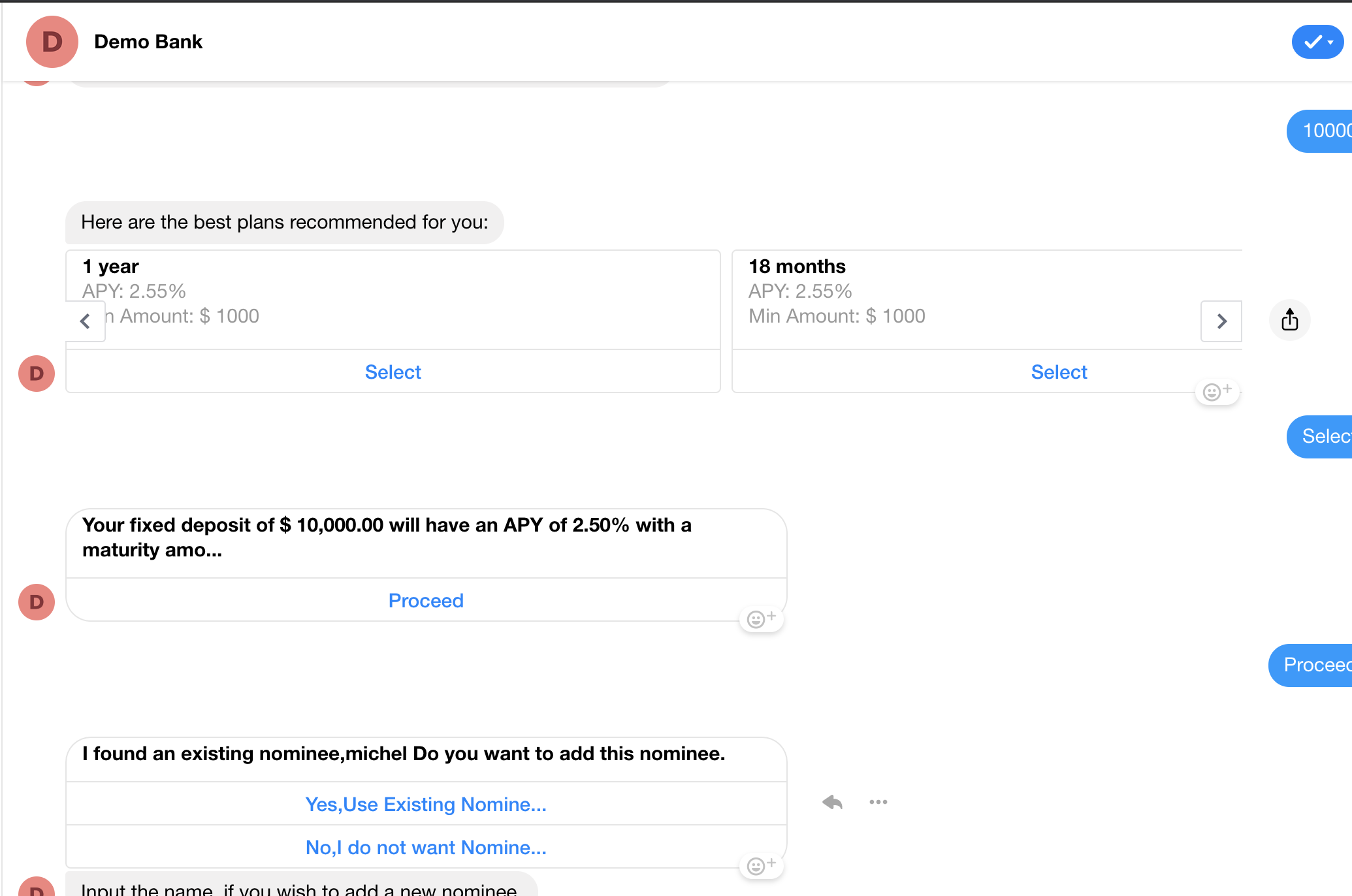

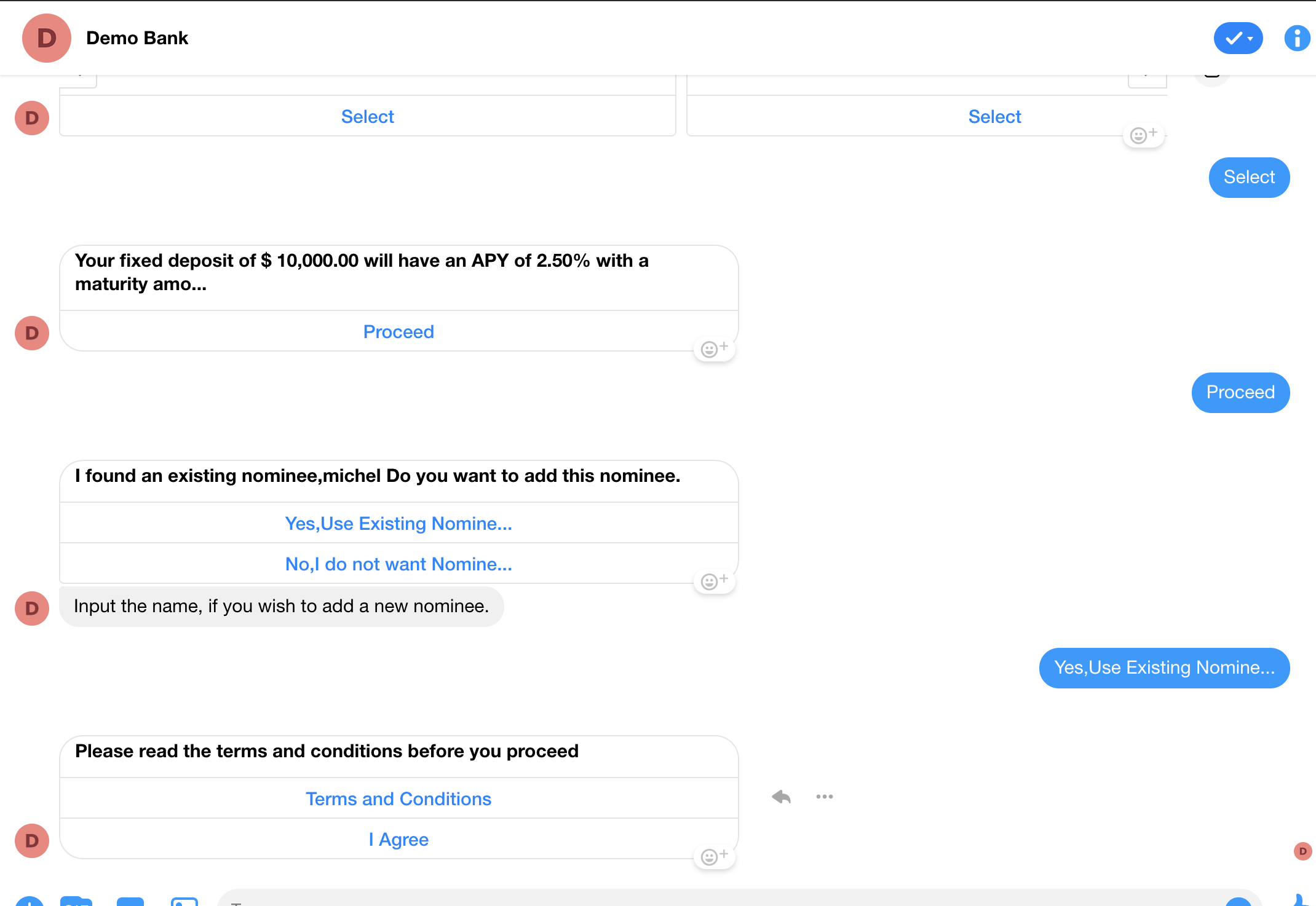

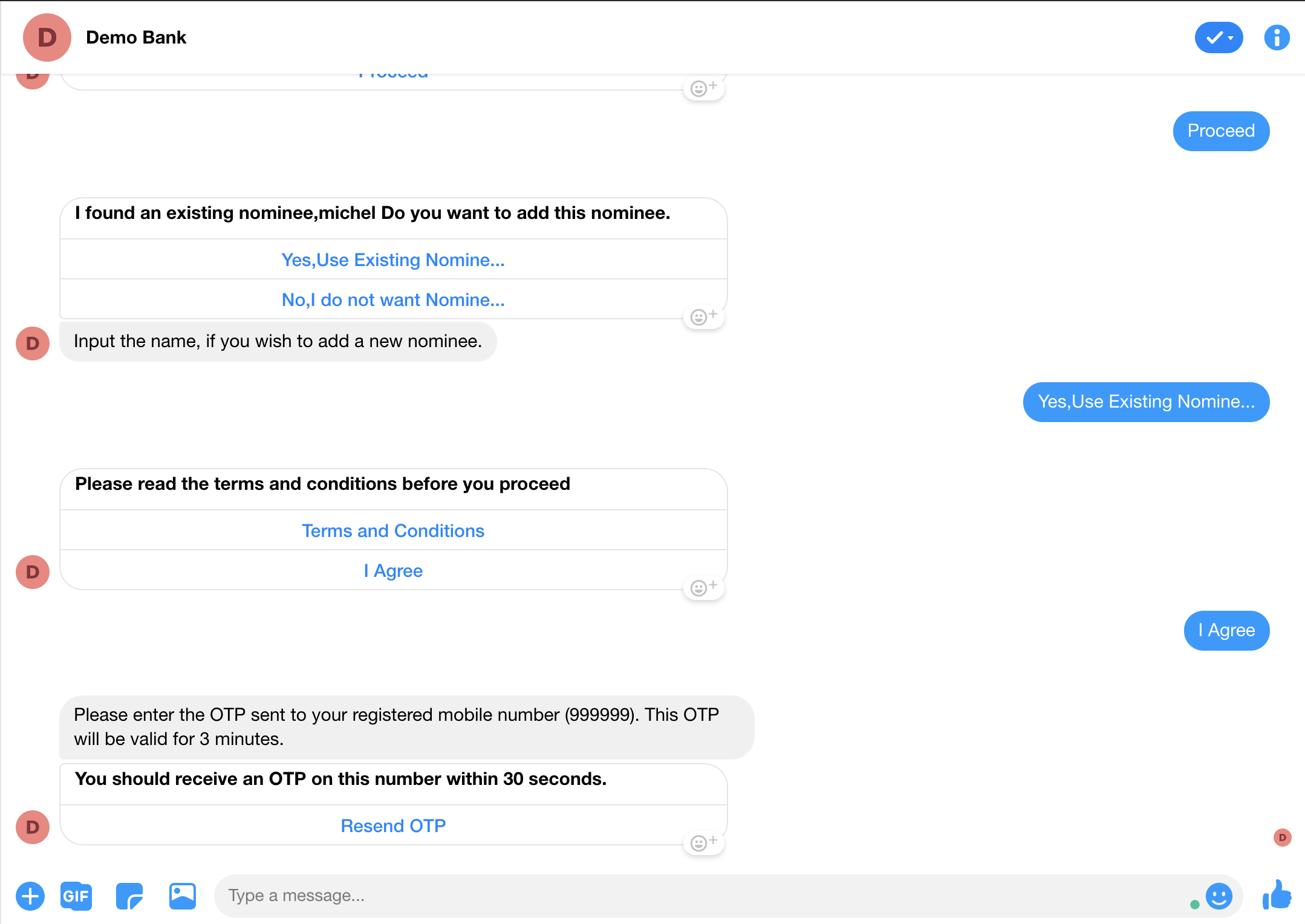

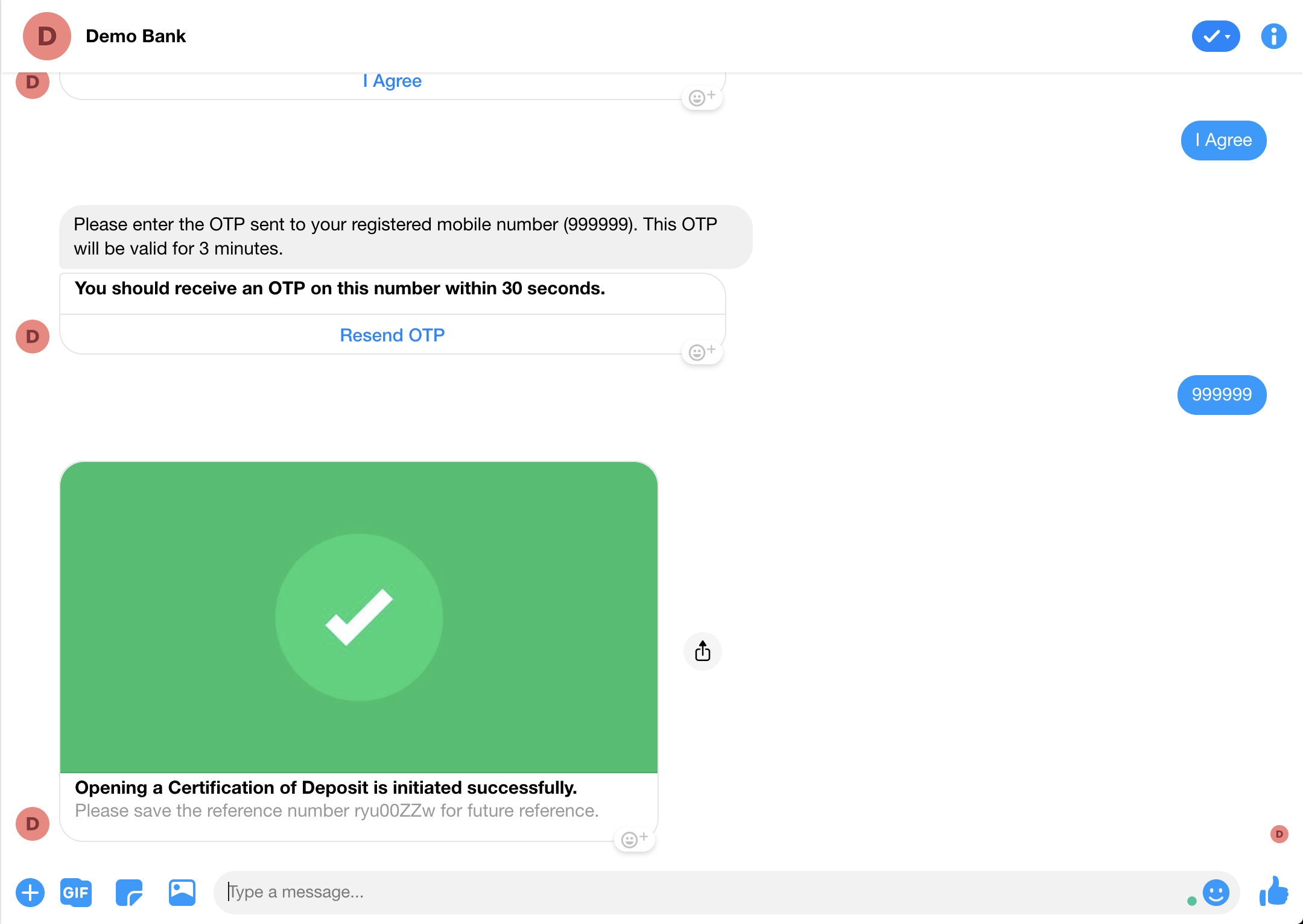

| Deposits | Nominee details

Interest rate inquiry Deposit details Tenor details Closure details |

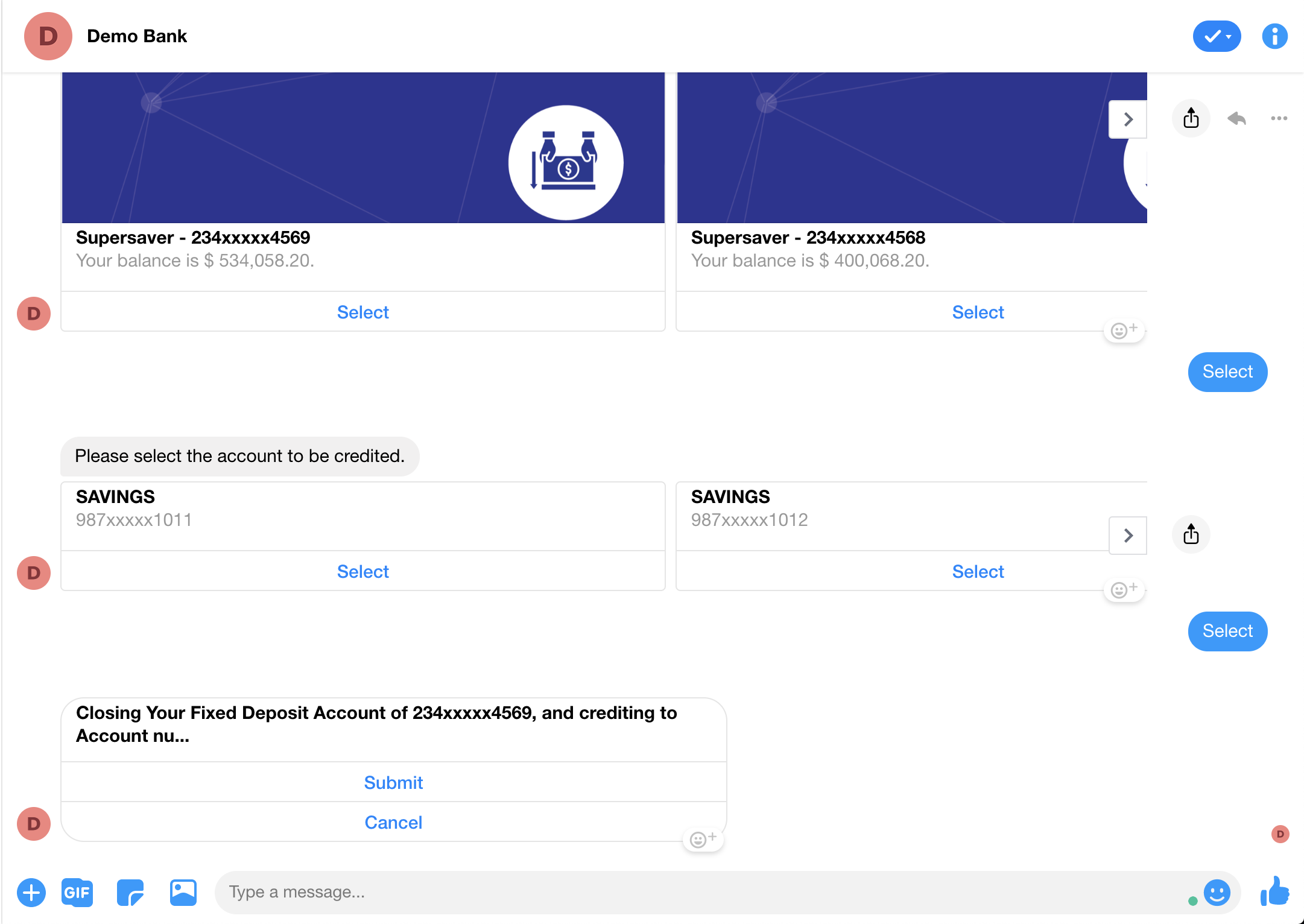

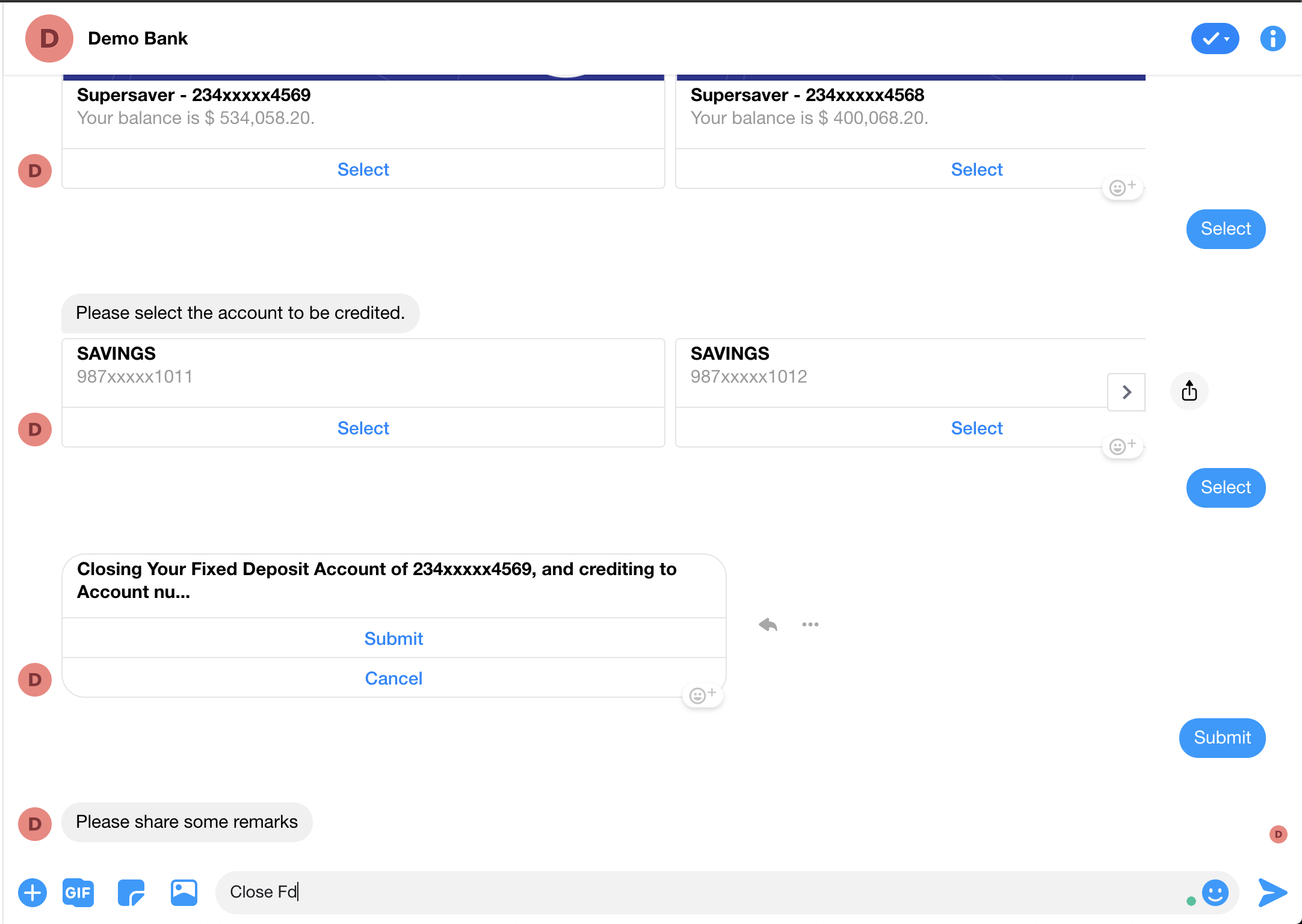

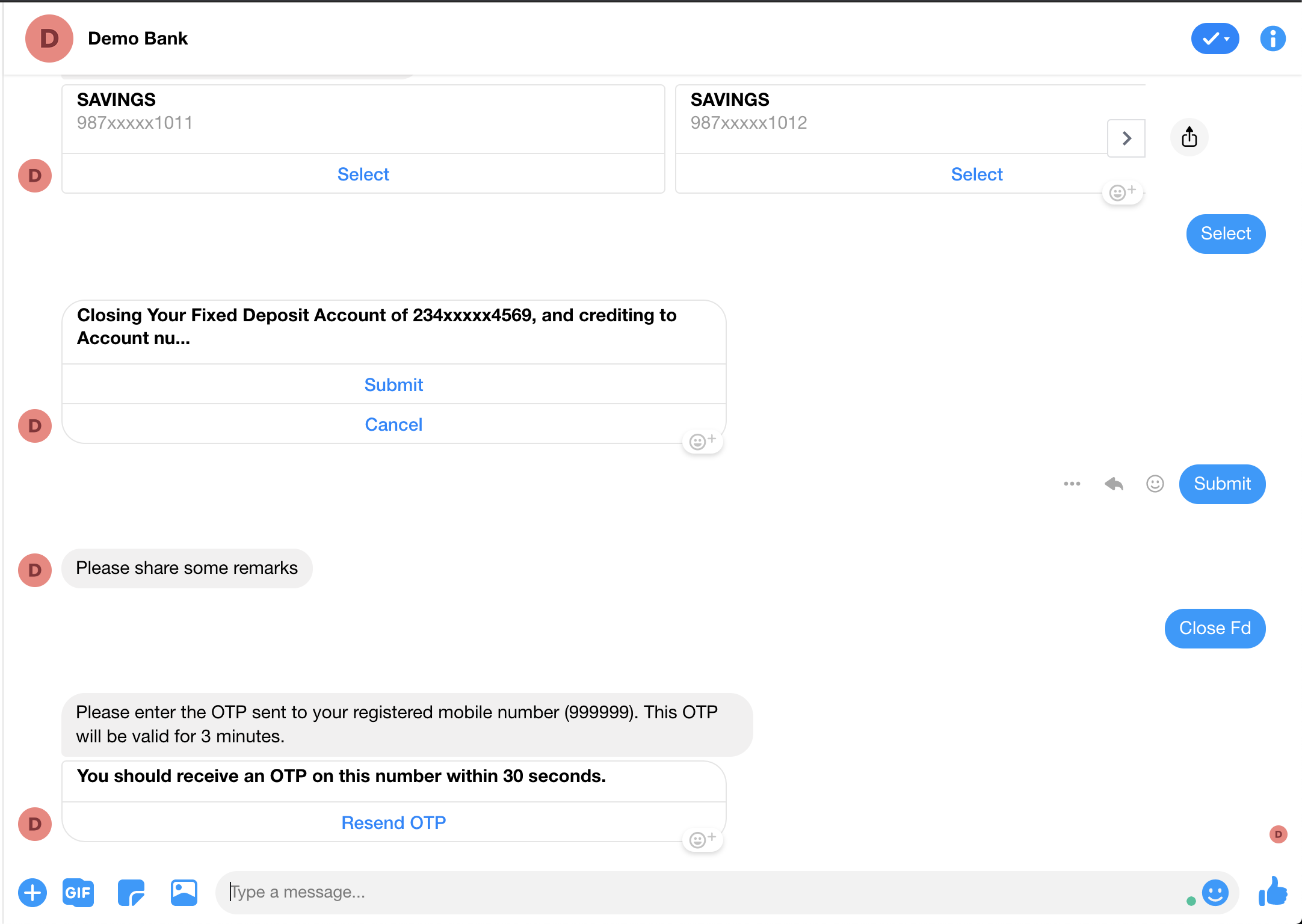

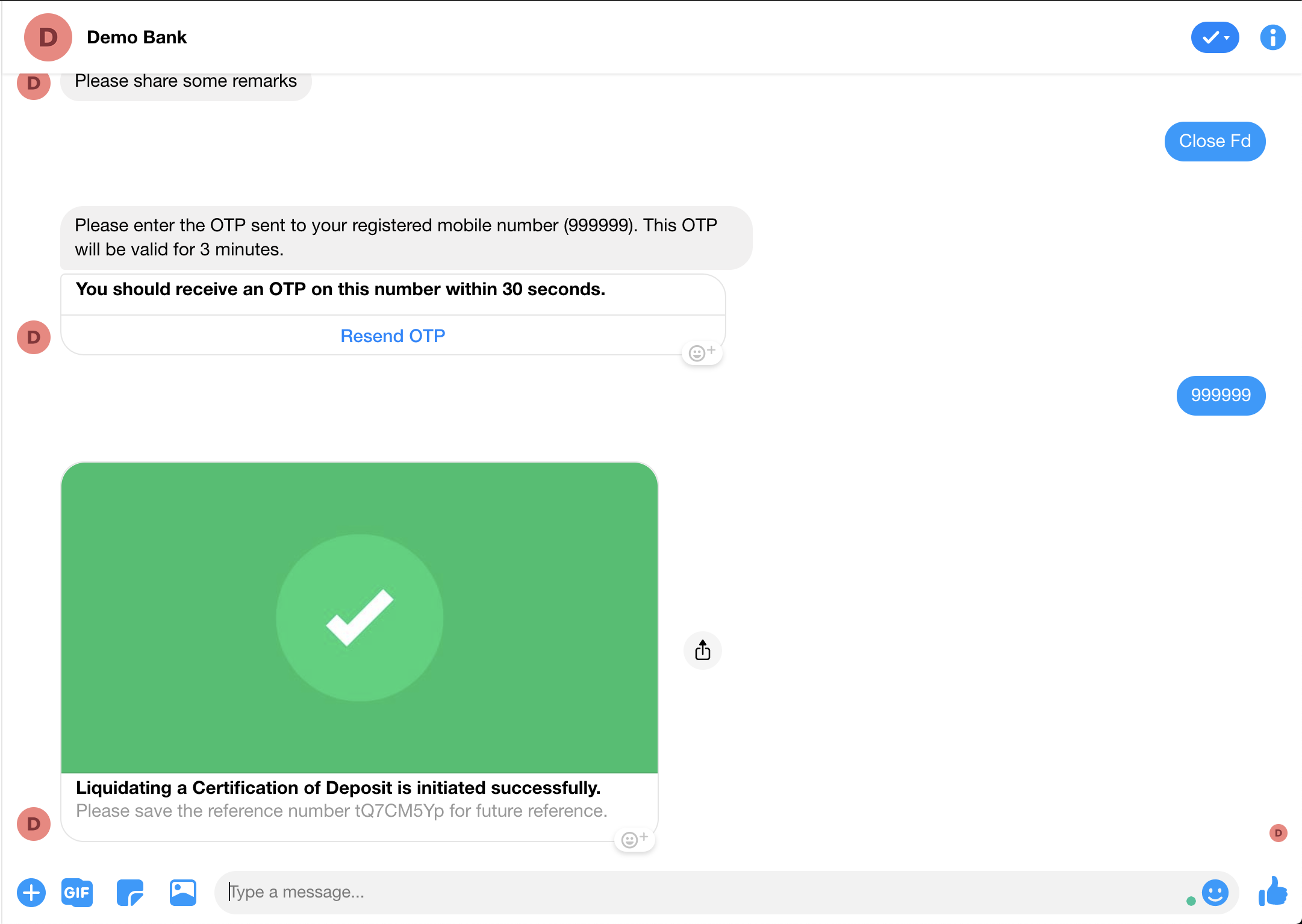

Open Fixed Deposit

Close Fixed Deposit |

|

| Credit card | Account inquiry

View loyalty points View payees View billers Spend analysis Autopay - view Biller - view Charge levied Due details Card details |

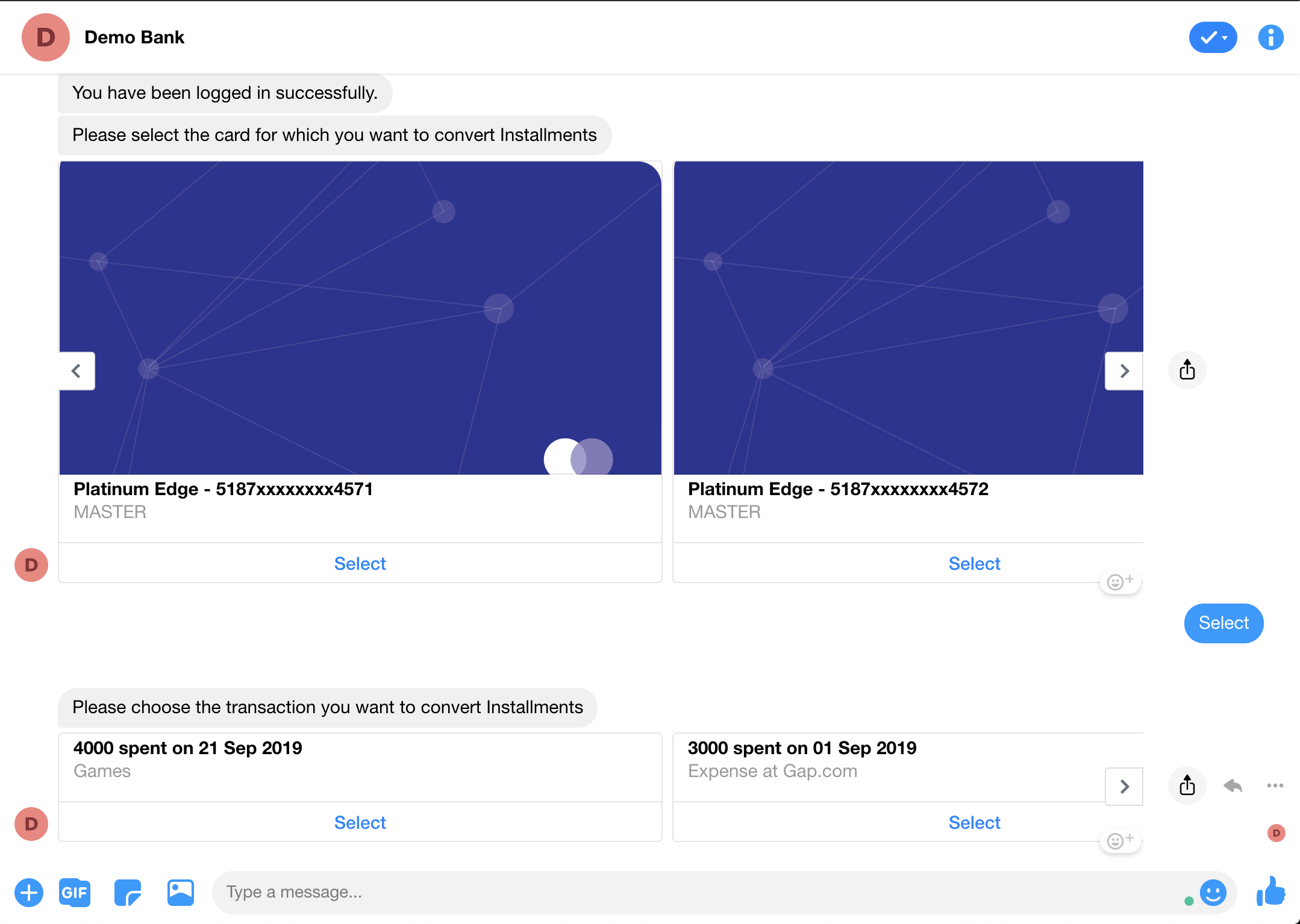

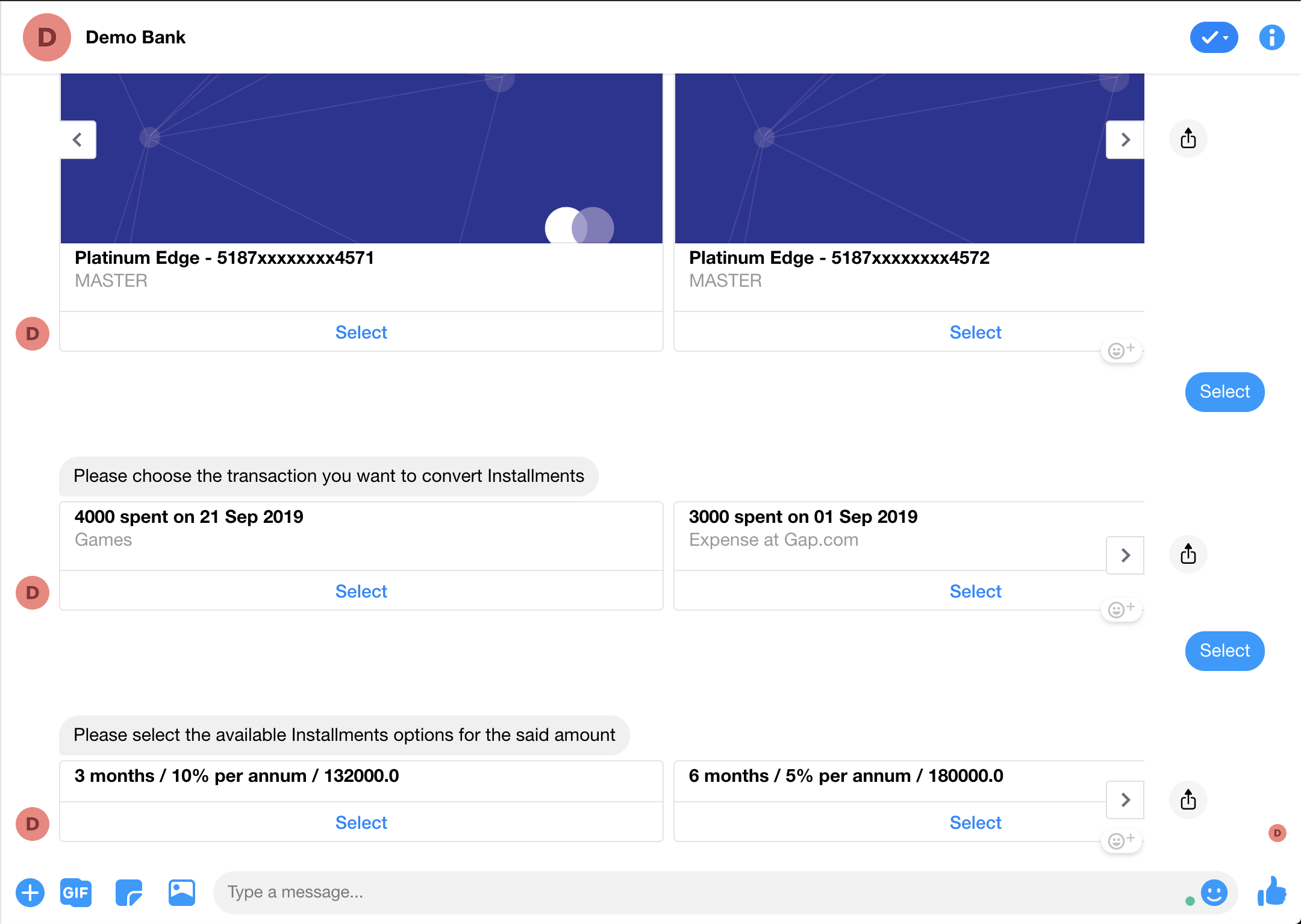

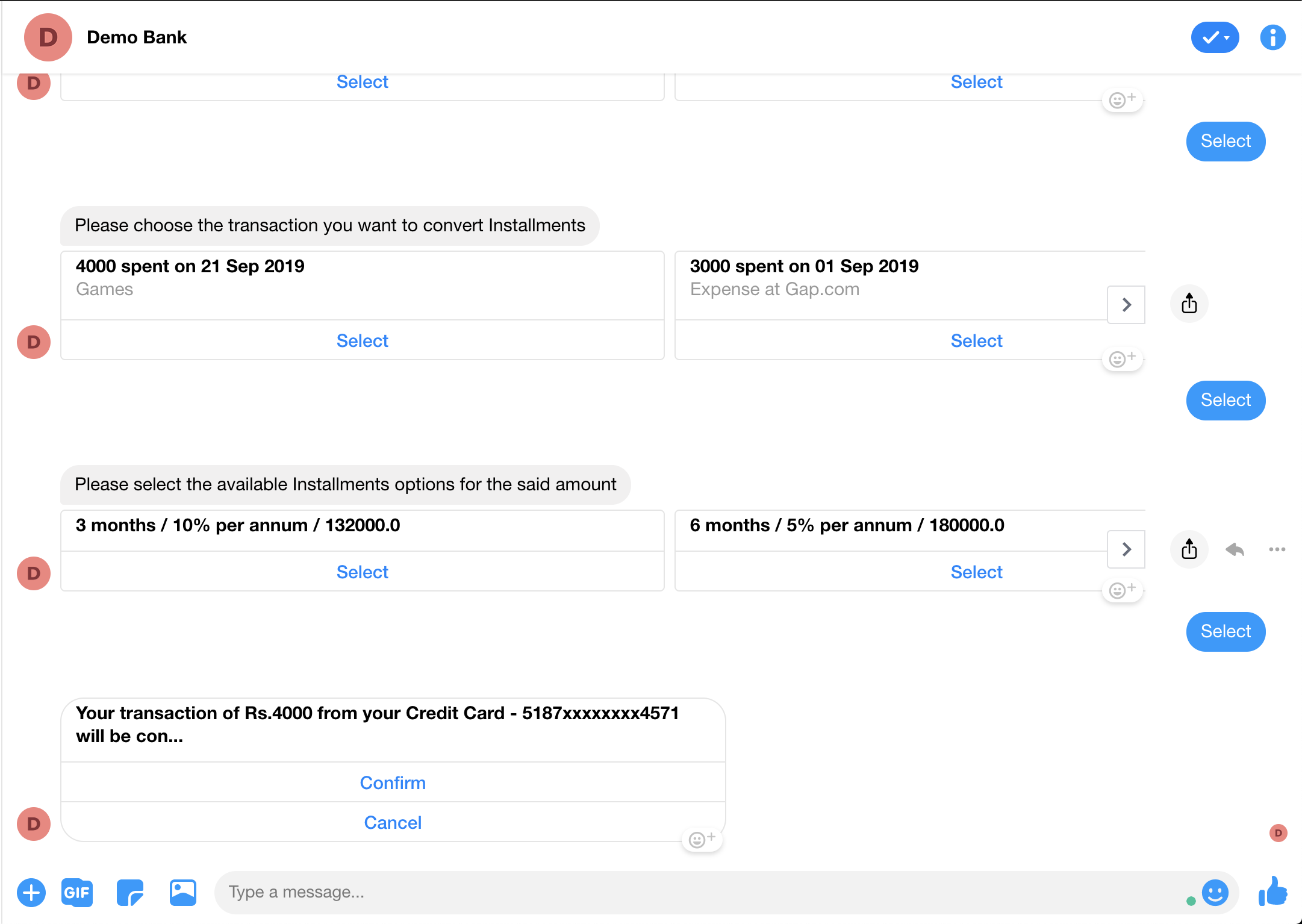

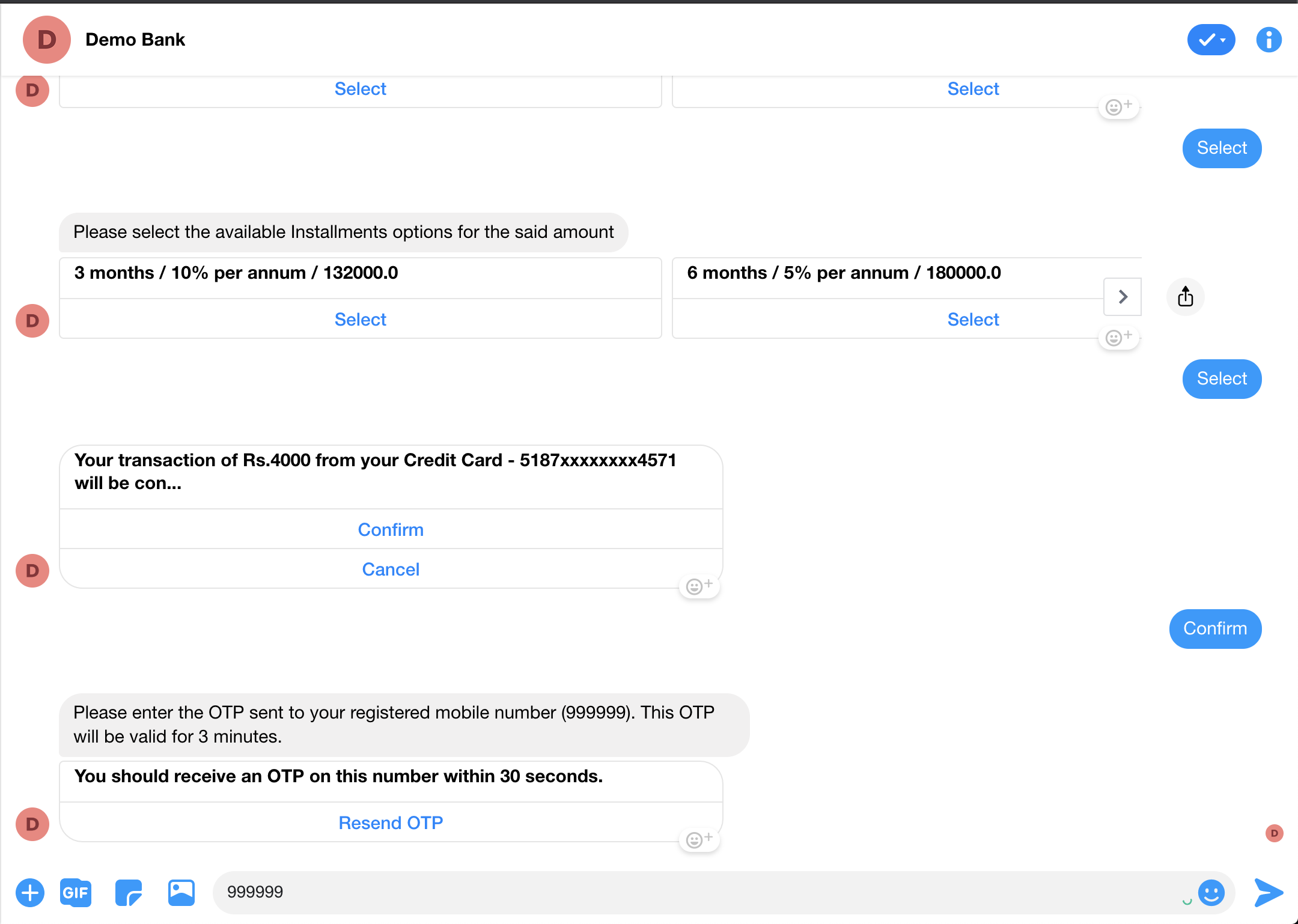

Convert to Installment plan

Block - temporary Reissue card PIN change Block card International usage - Disable Dispute a card transaction Change of limit PIN change Card activation International usage - enable Rewards redemption Biller - cancel Recharge Biller - register Autopay - cancel Autopay - register Autopay - modify Change of limit |

Payment - biller |

Account Inquiry

Overview

| Use case name | Account Inquiry |

| Type | Inquiry |

| Intent | qry-accountenquiry |

| Entities |

|

| Banking products supported | All |

| Channels supported | Web, Mobile, FB messenger, Alexa |

| Login | Yes |

| 2FA | Yes |

| API availability | Yes |

| Integrations done | NA |

| Stub data availability | Yes |

Features

Summary

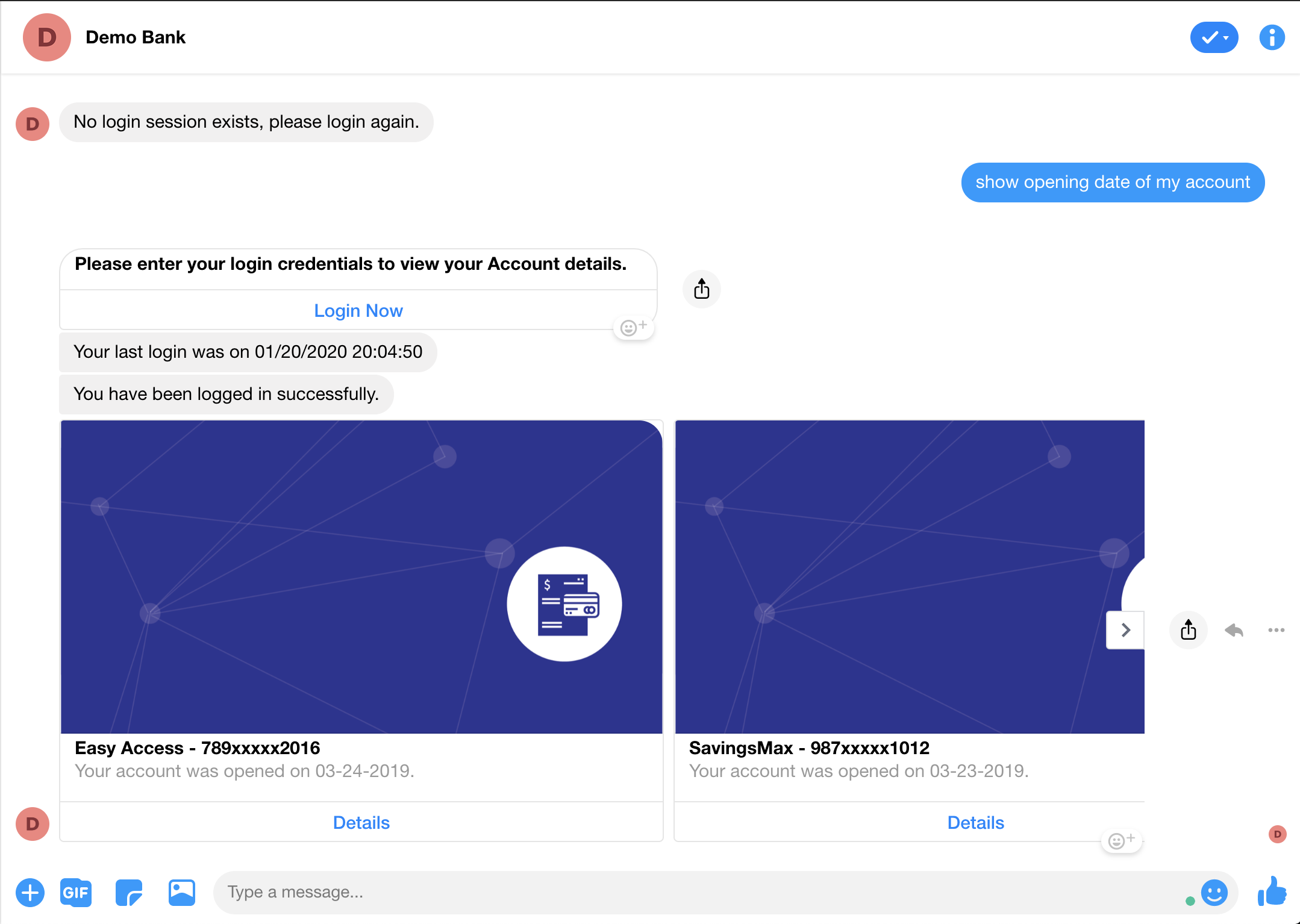

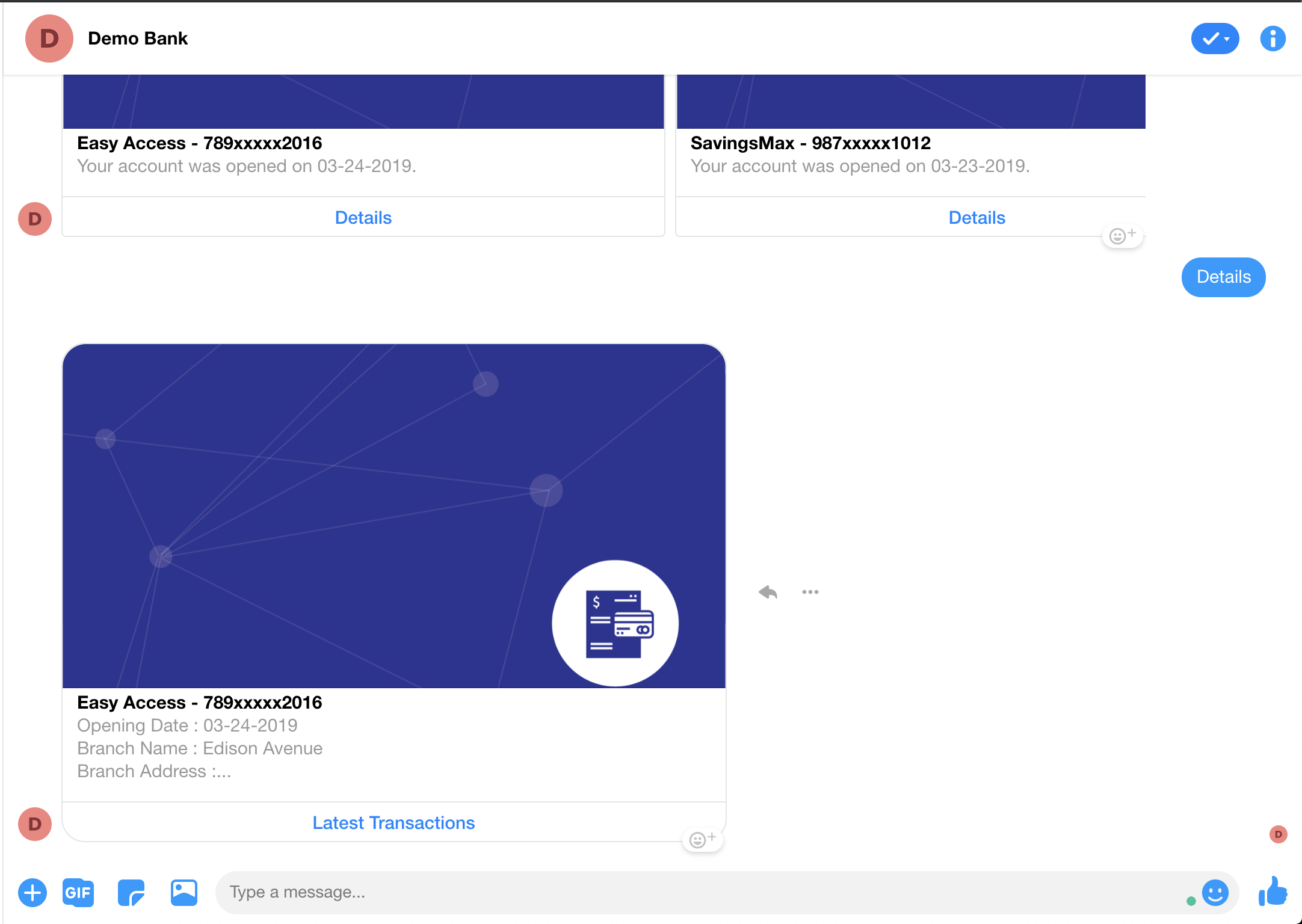

- Users can check for additional details on the account like account opening date, branch etc.

Detailed

User is interested in knowing more details on a relationship like

- Account opening date Shivam

- Account branch

- Deposit maturity date

- Loan last payment date

- Nominee details

- Card limits

System will request selection on the specific account, card or loan on which additional details are requested.

Based on the nature of additional information requested, a template with account ID , name and requested detail

ex: maturity date will be shown

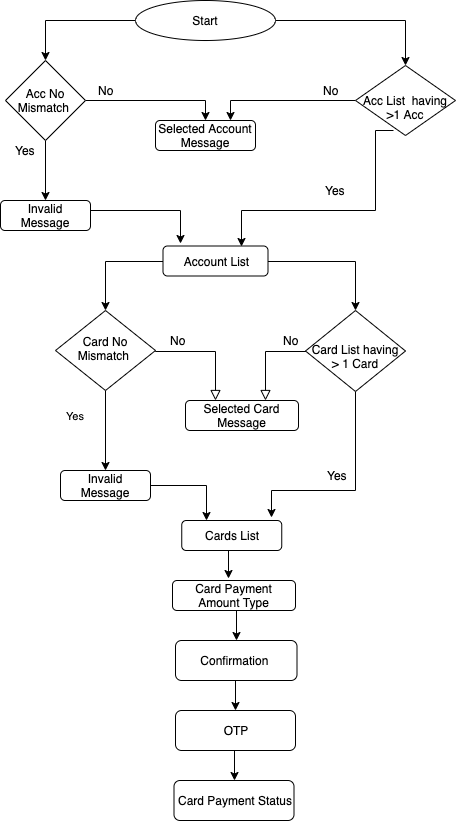

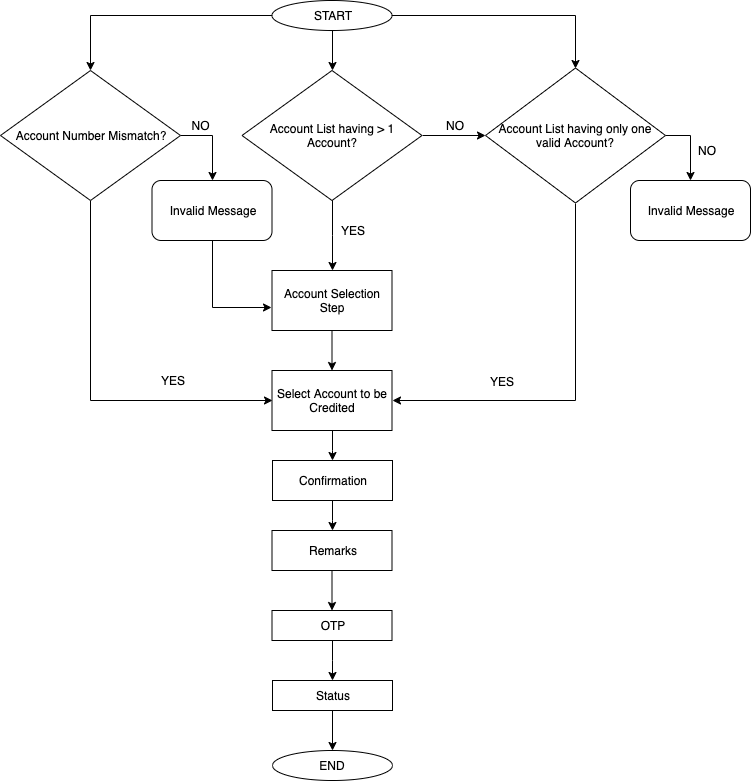

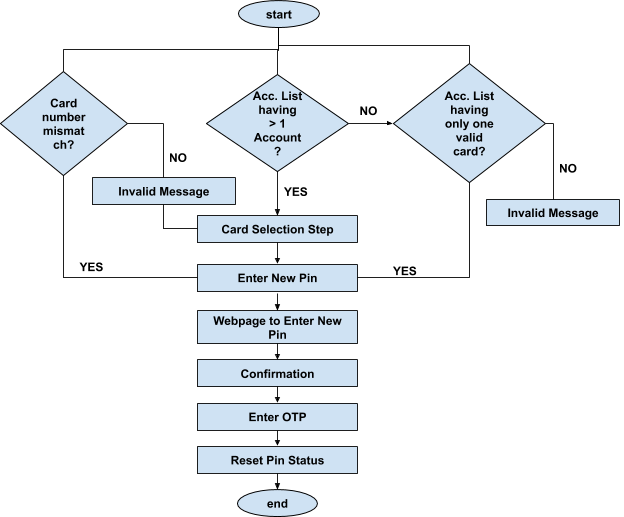

Flow CX

Note: This can be flowchart / GIF or screenshot to represent OOTB flow

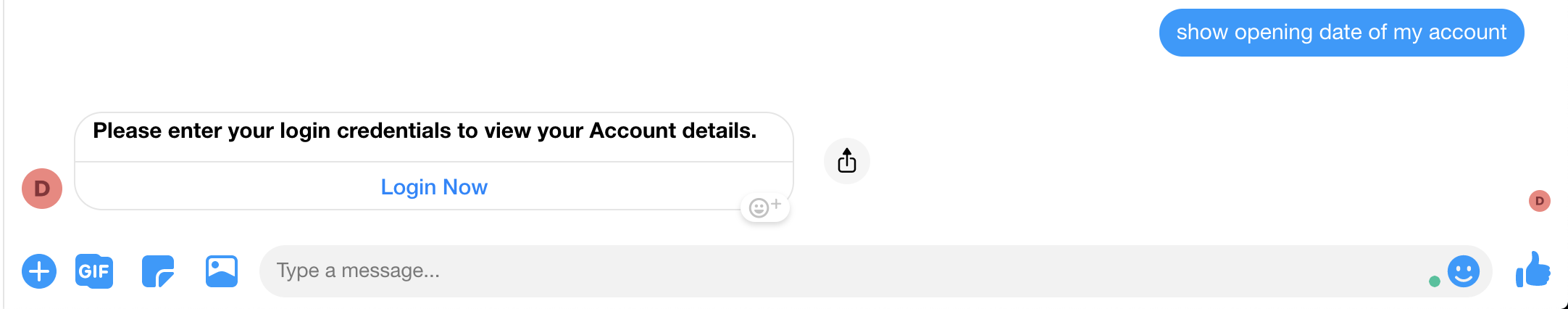

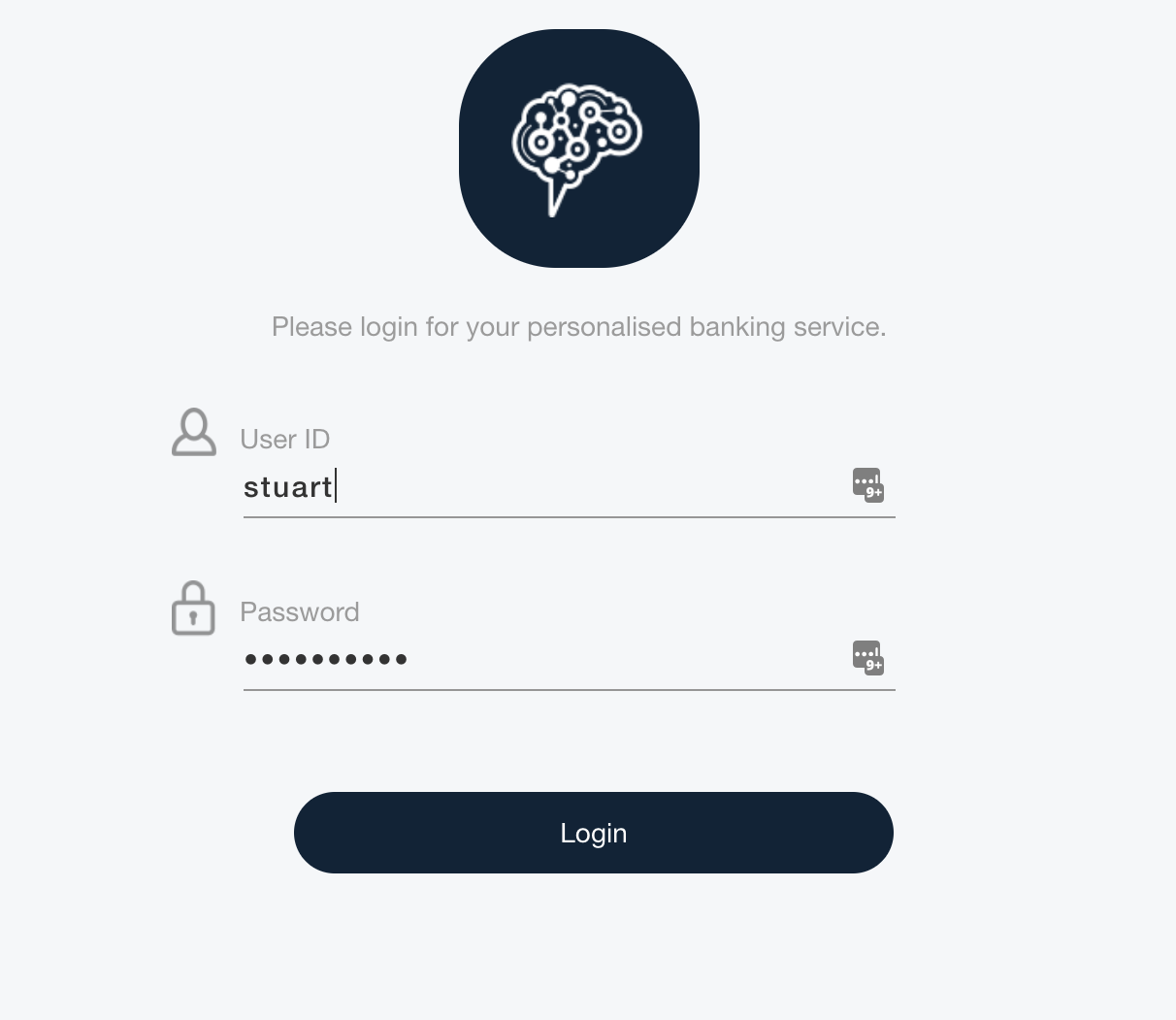

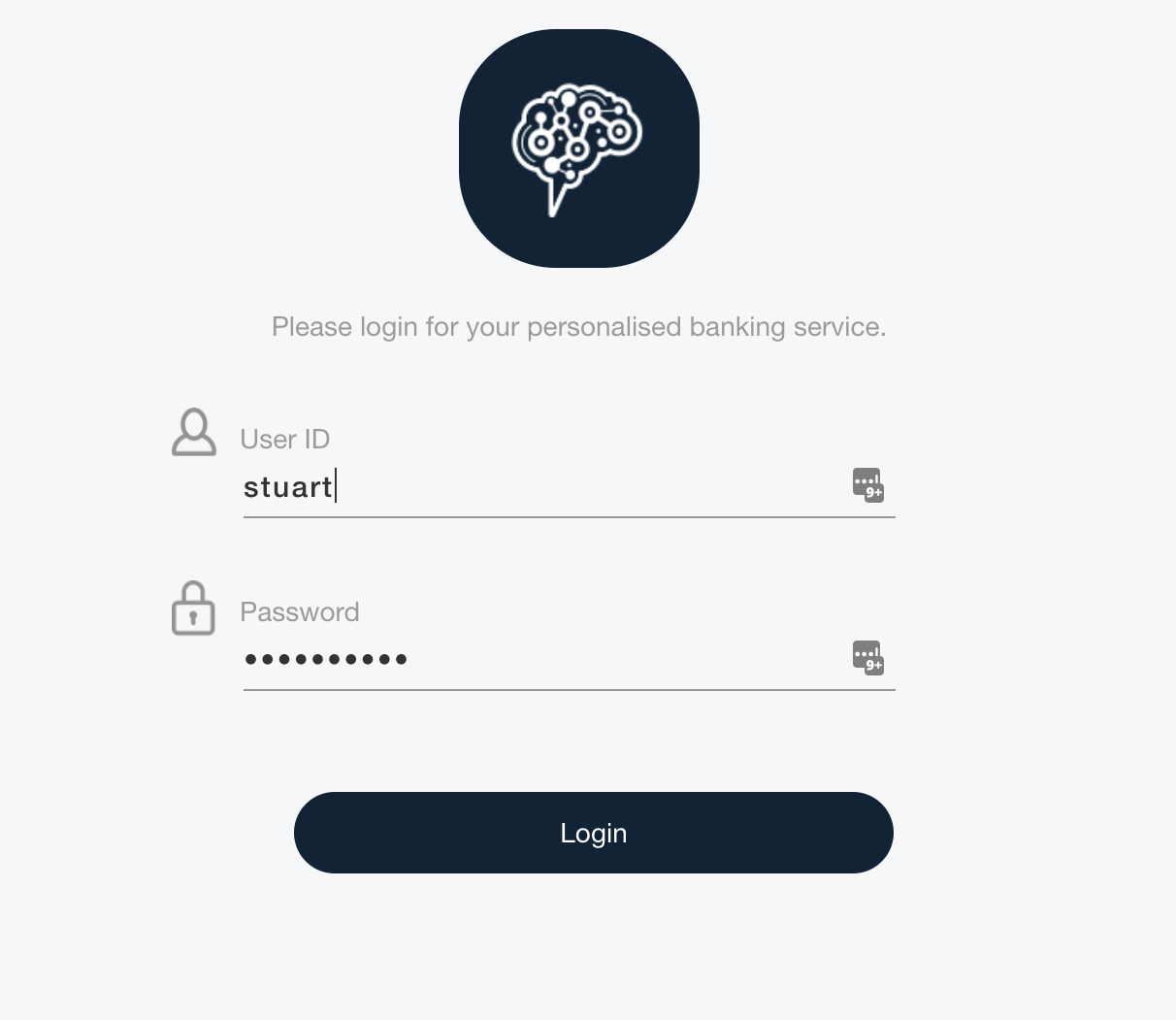

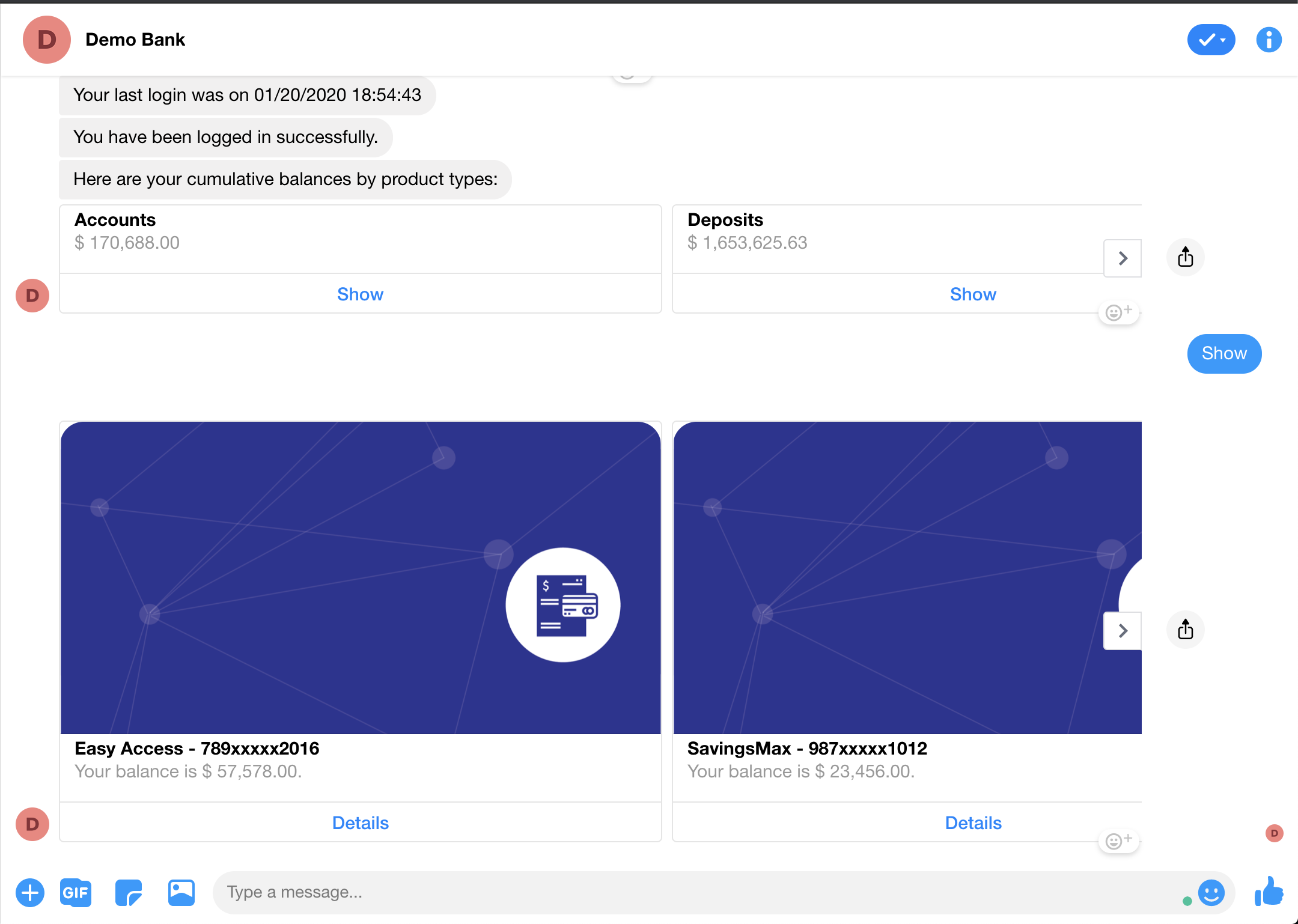

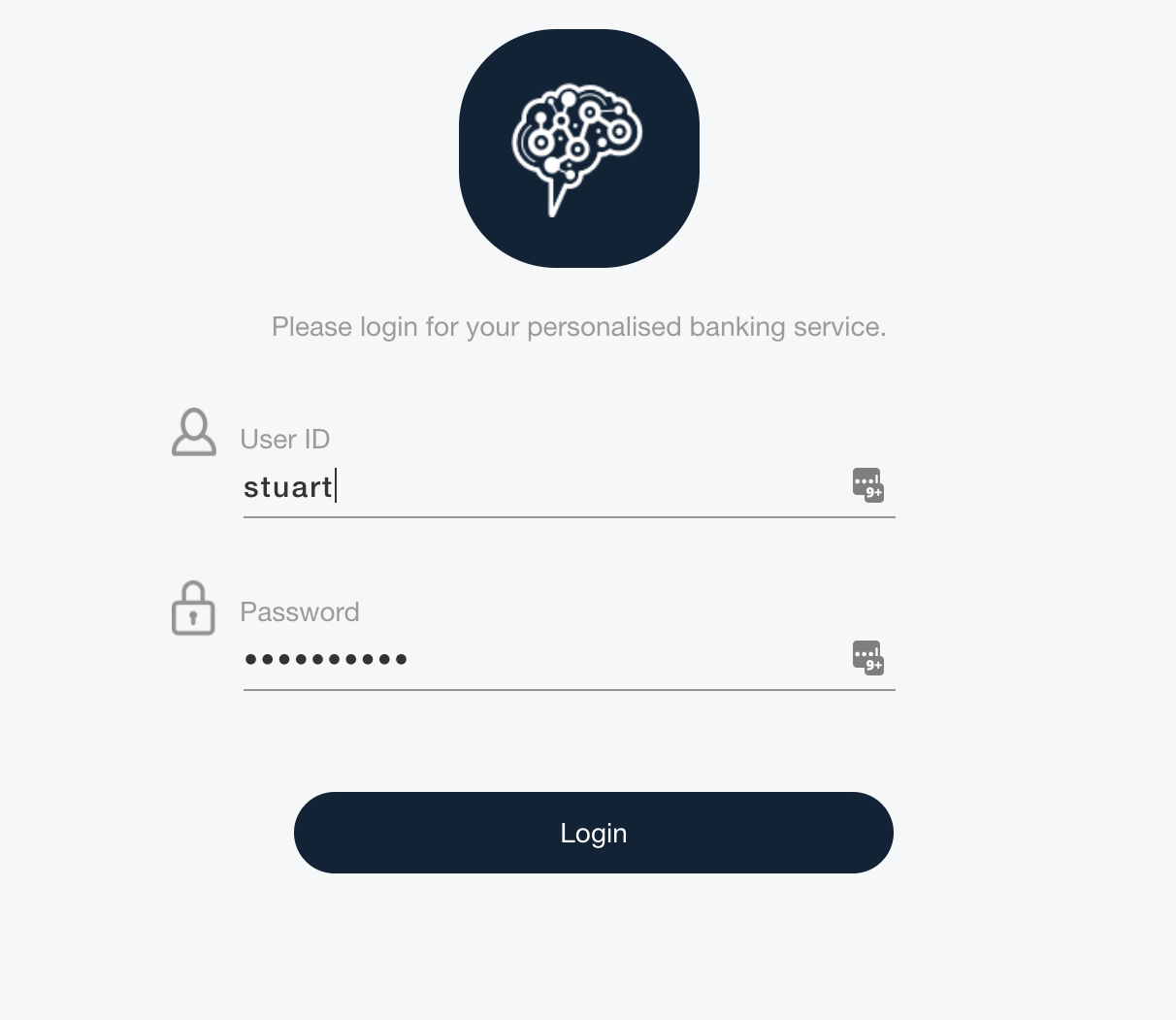

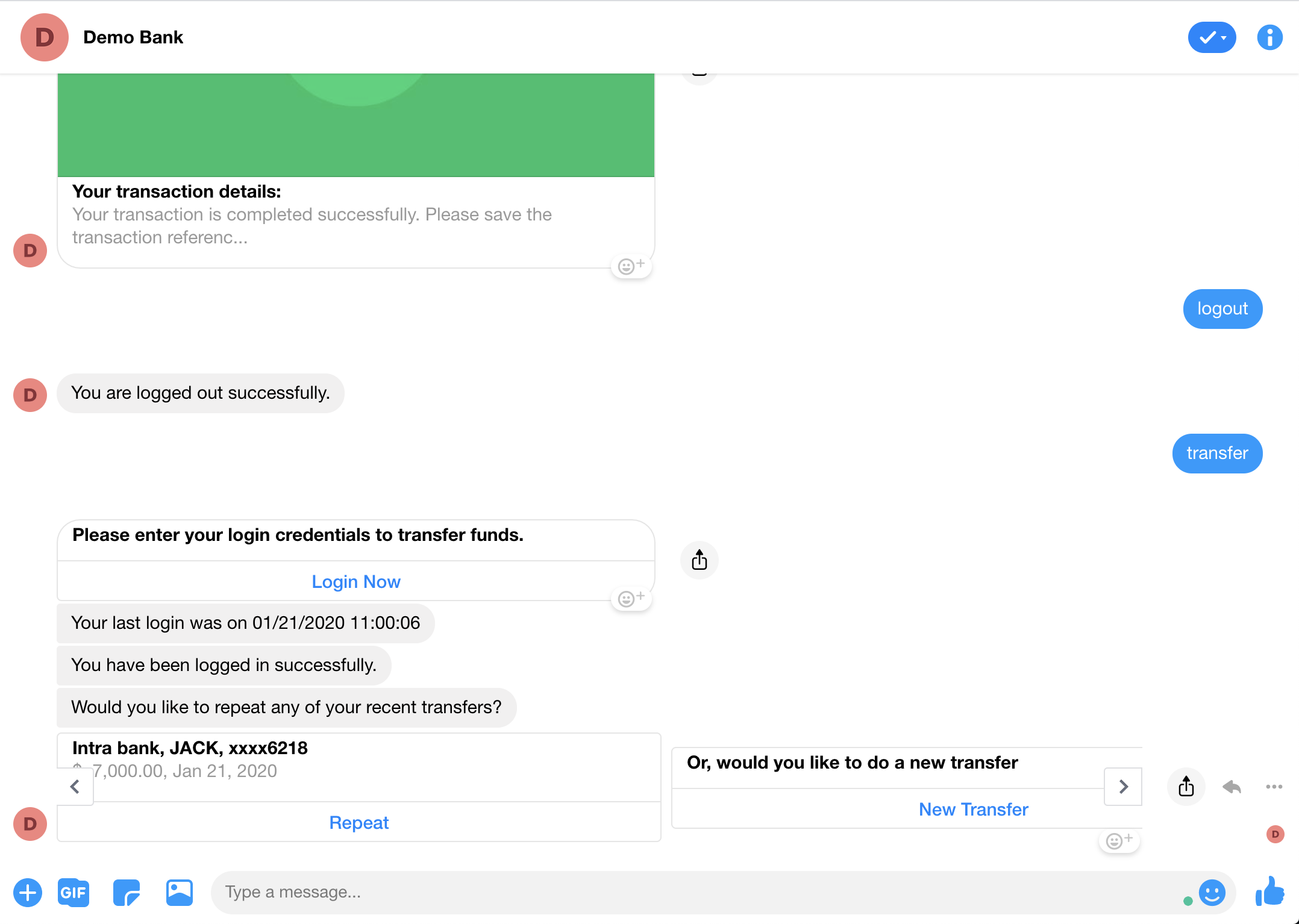

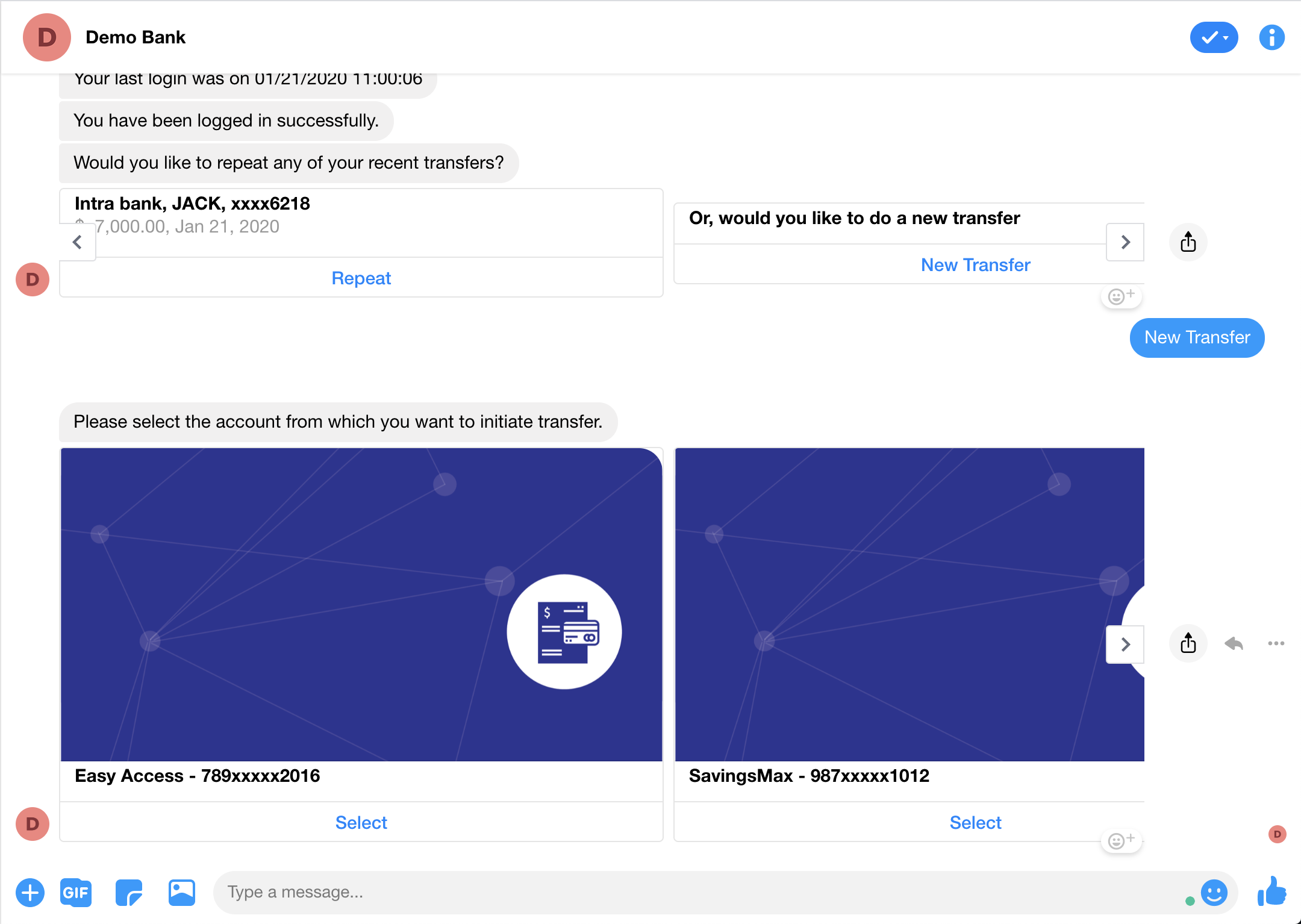

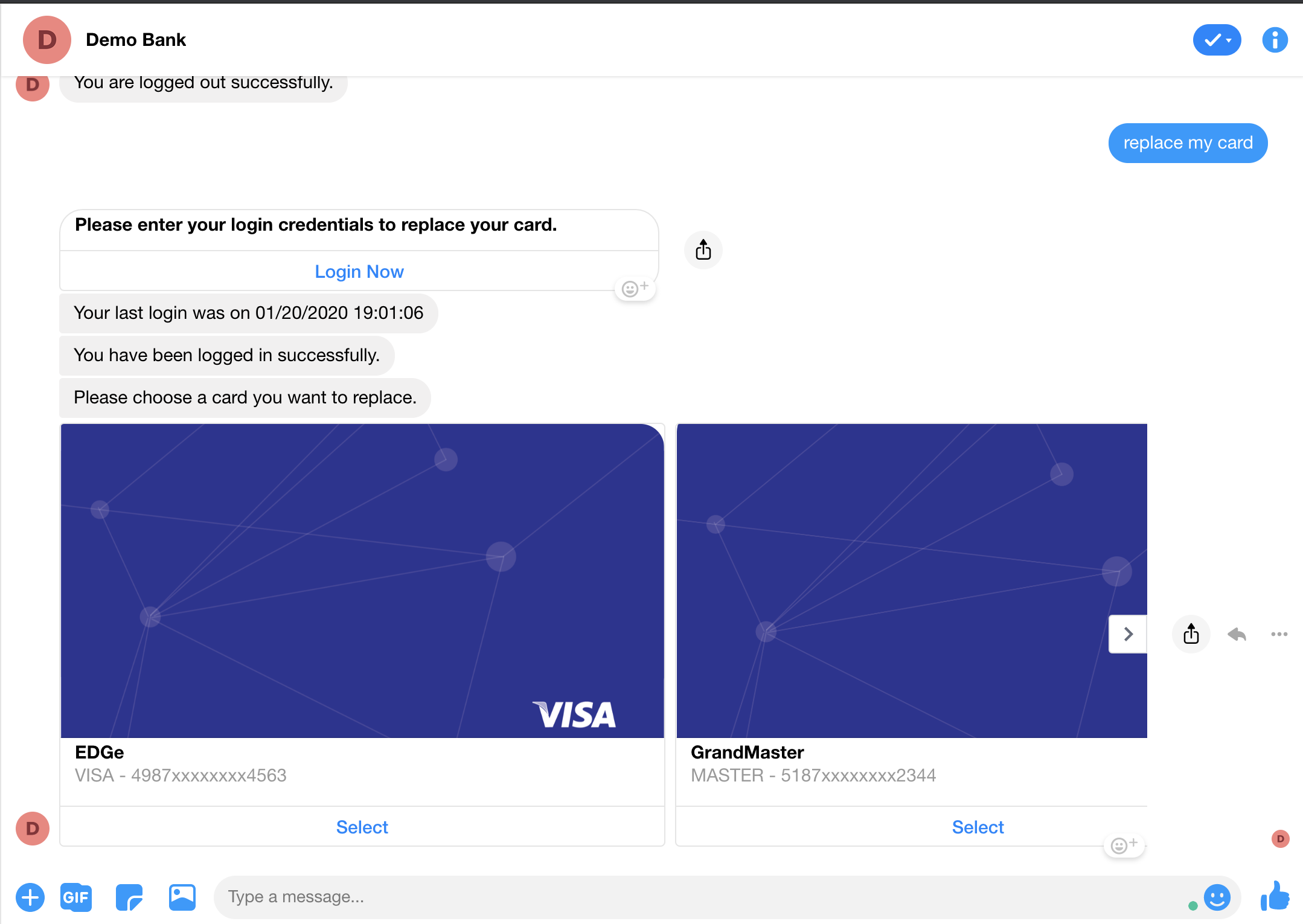

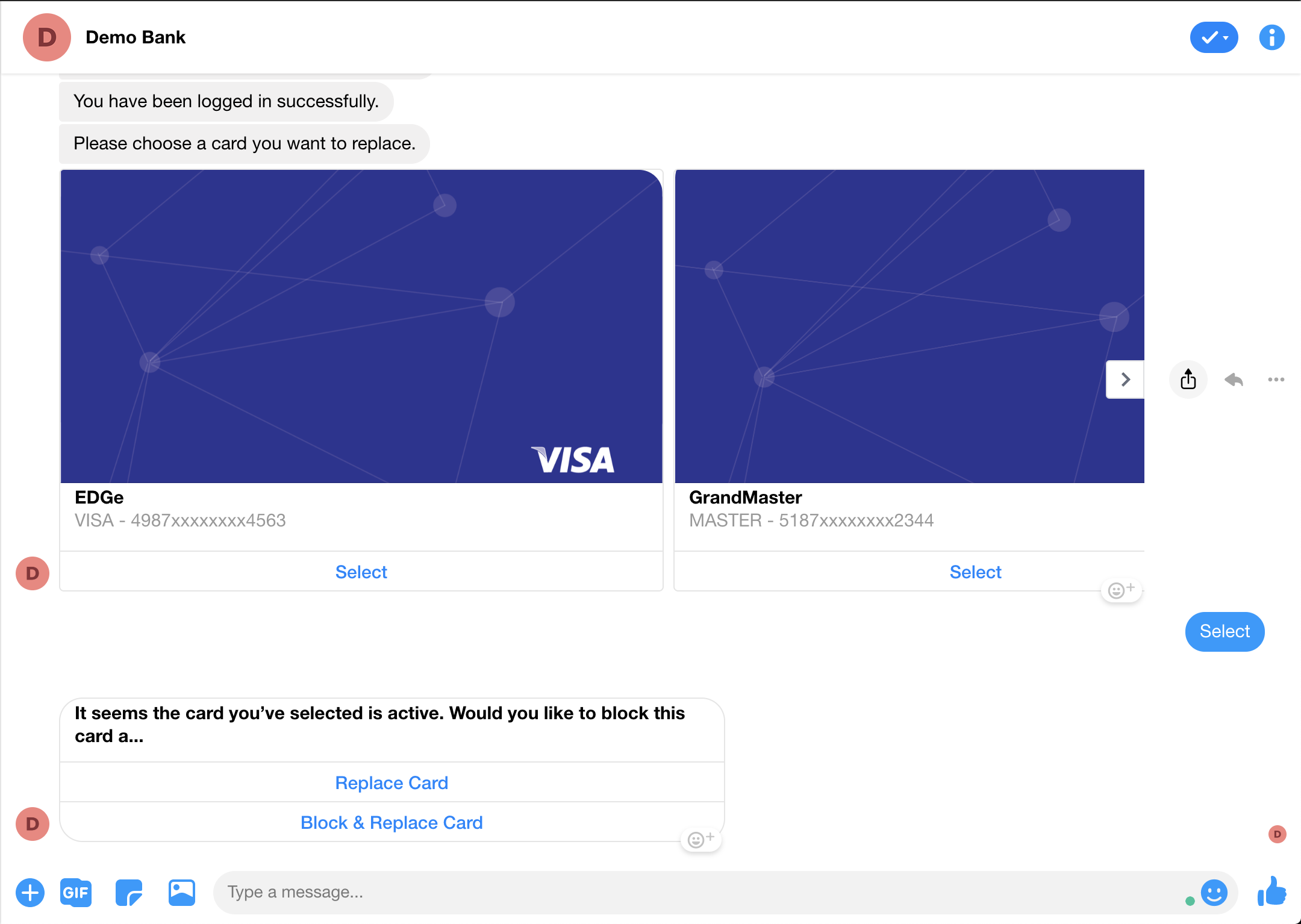

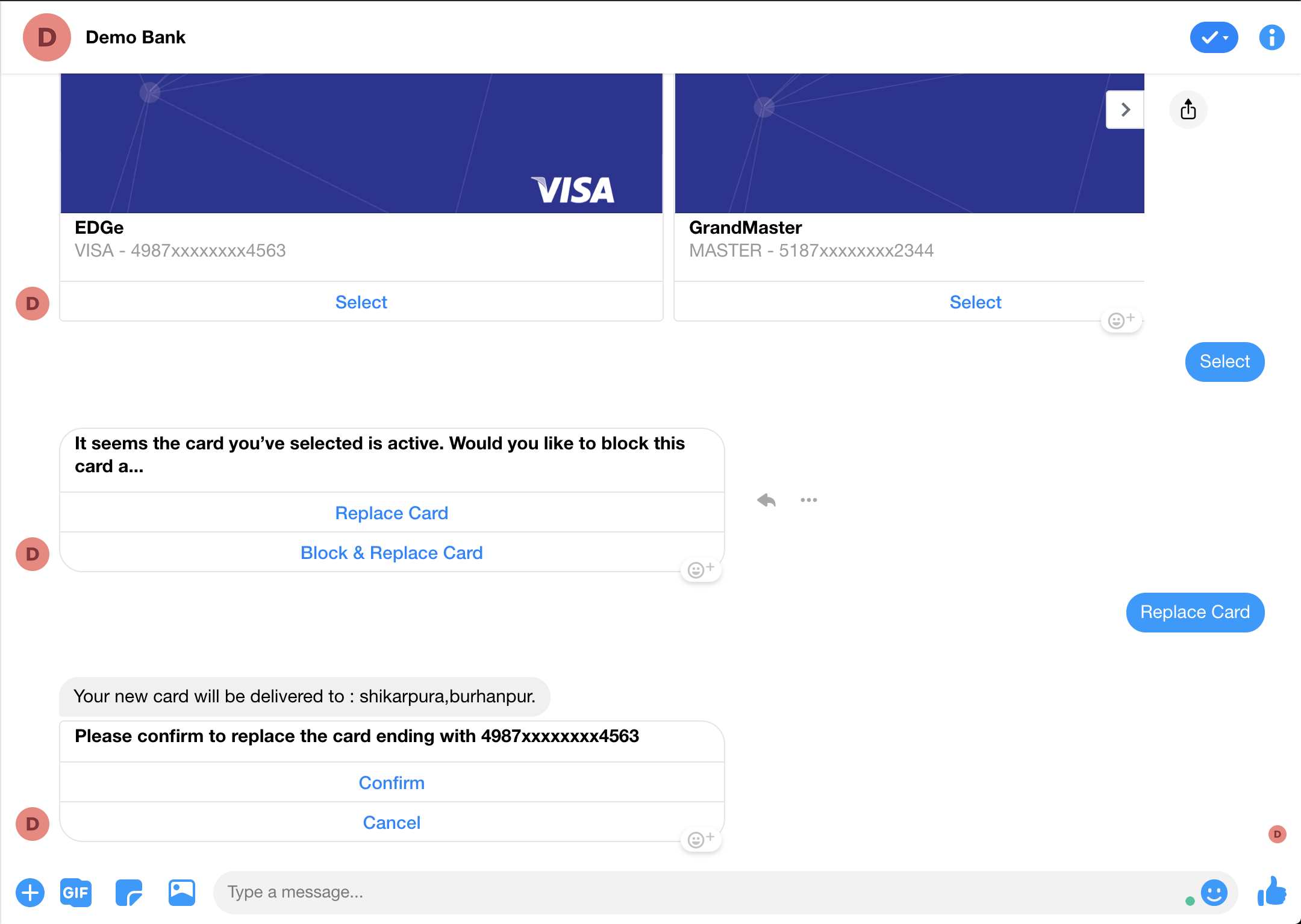

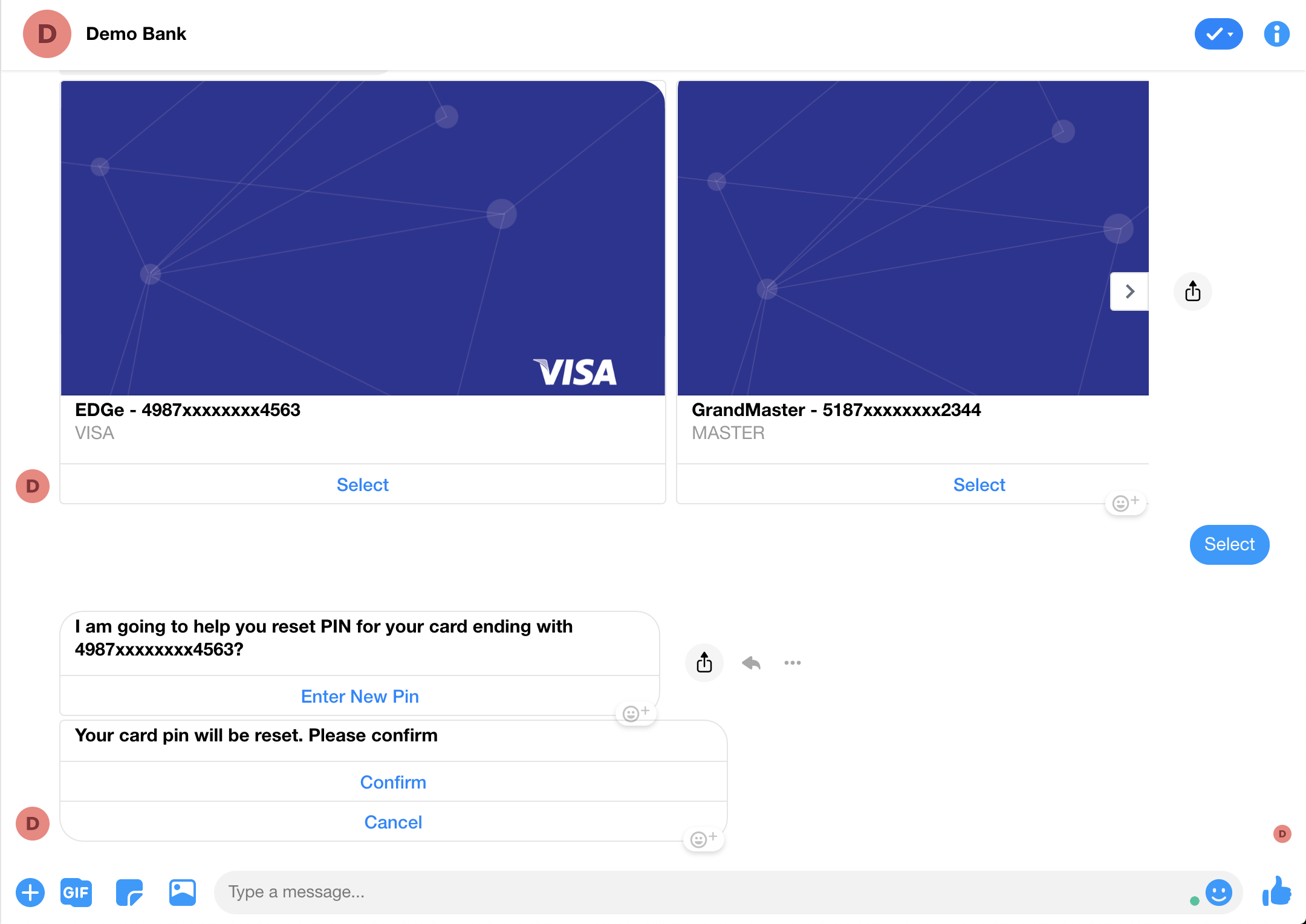

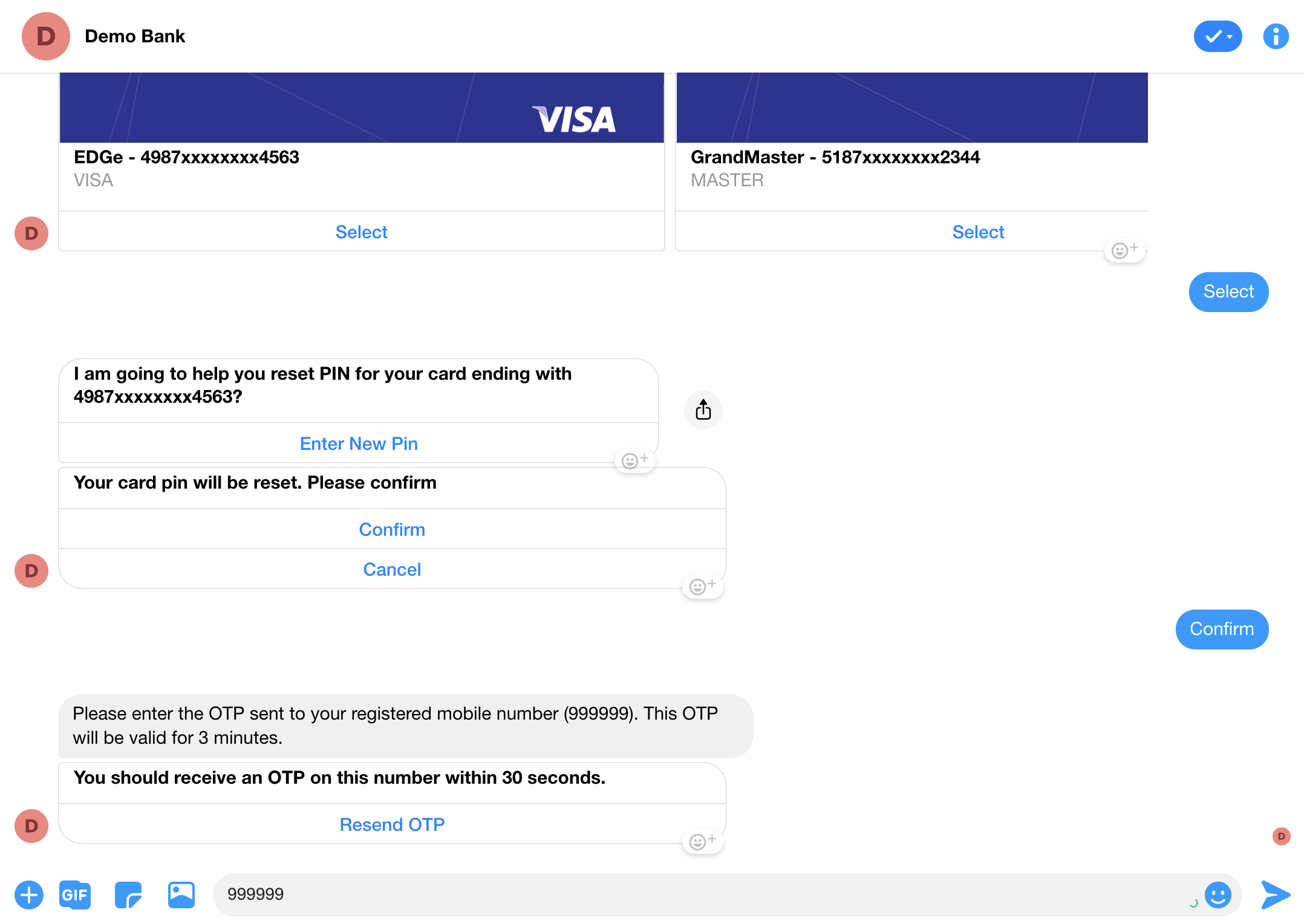

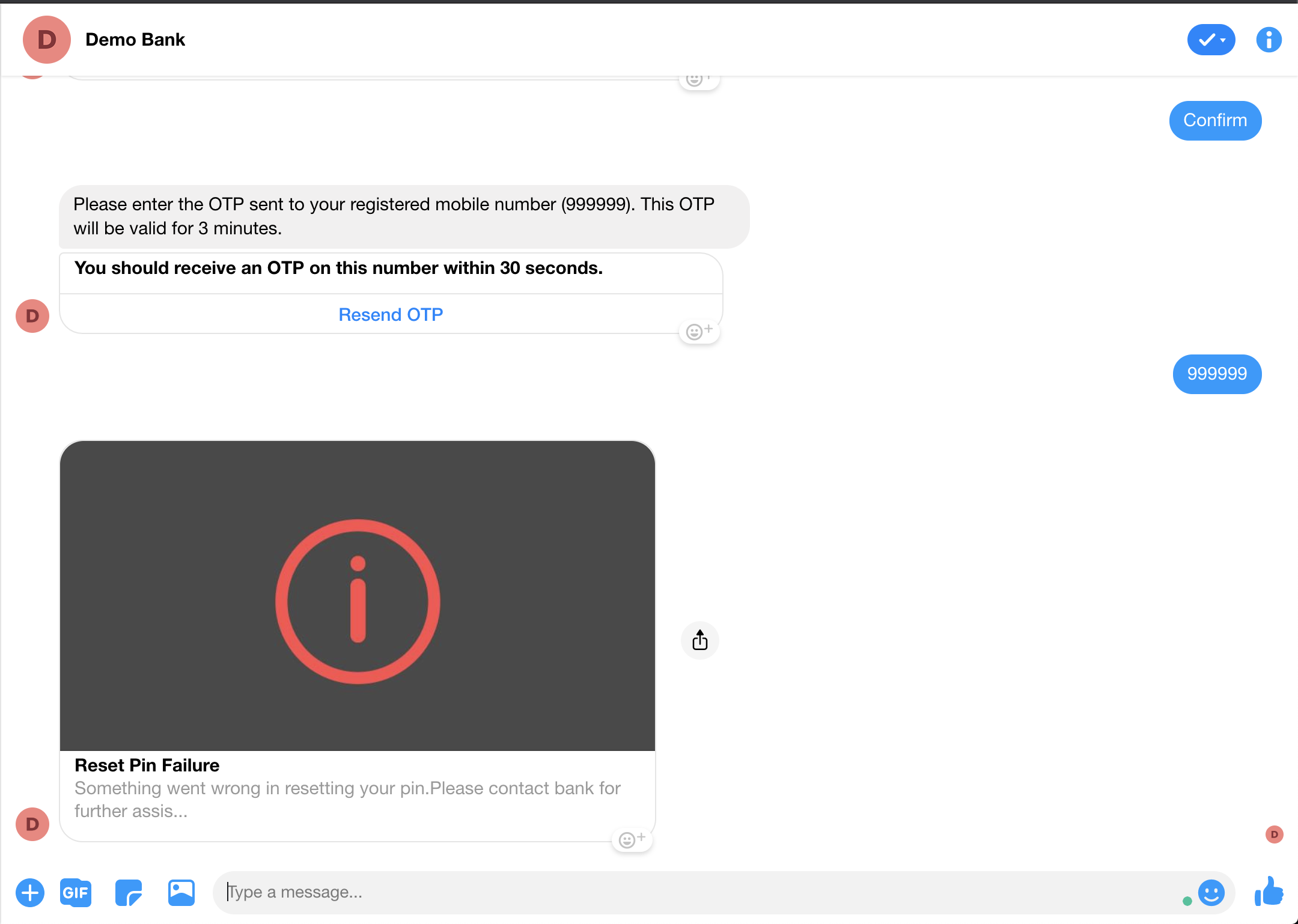

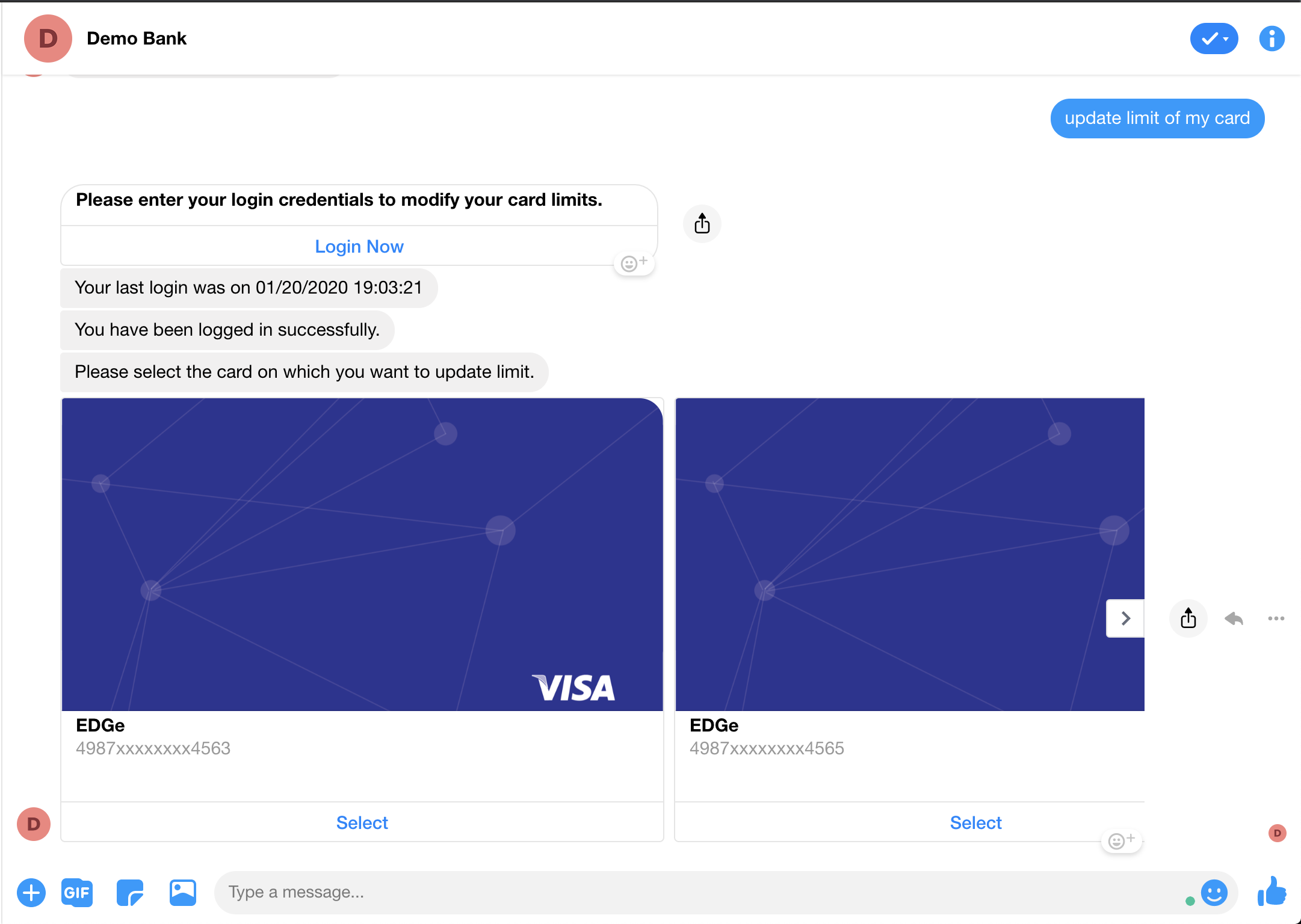

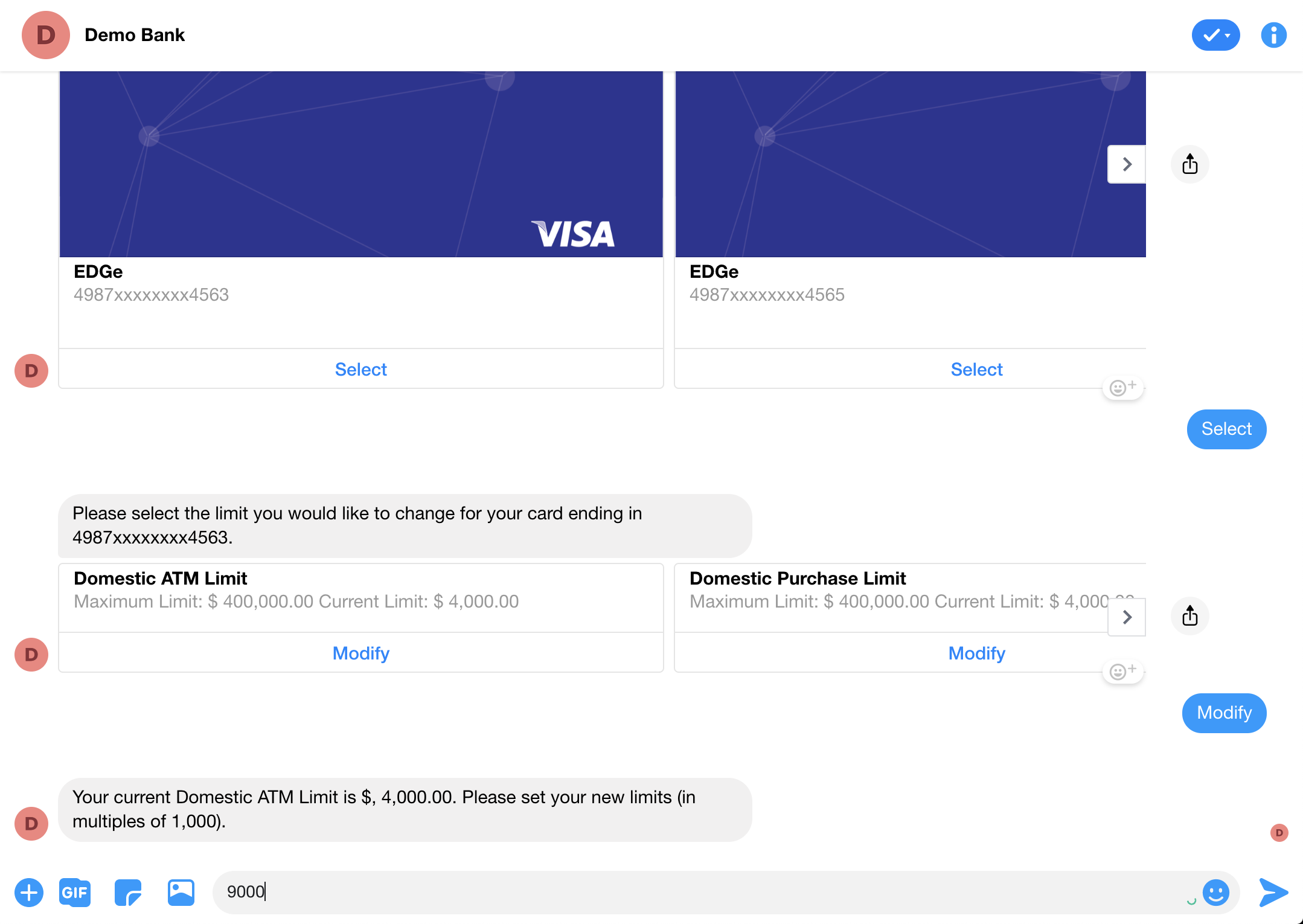

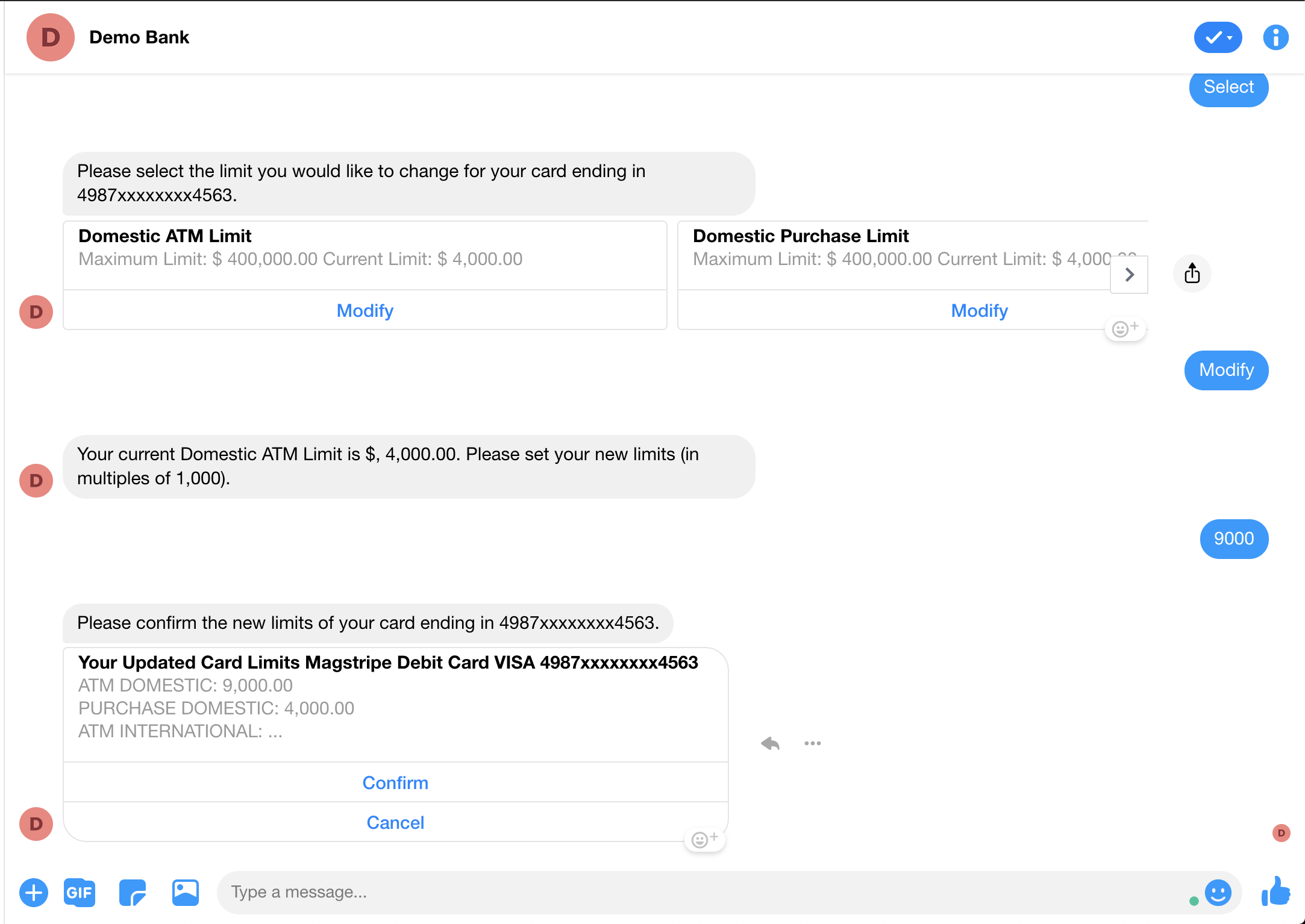

Facebook Flow -

Configurations

Generic Configurations

The Following are the generic default configurations available with setup and are applicable for all channels.

- This property defines with all products that are supported in Balance Inquiry use-case qry-accountenquiry_ACCOUNT_CATEGORIES=casa,creditcard Supported account Categories are : casa, creditcard, debitcard, loan, deposit, overdraft, forexcard

- This property defines with the account types supported for Accounts qry-accountenquiry_SUPPORTED_ACCOUNT_TYPES=checking

- Supported account types are : savings,checking

- The order of listing accounts in Balance Inquiry. ACCOUNT_CATEGORY_SORT_ORDER=casa, creditcard

- The values are to be in sync with whatever configured for qry-accountenquiry_ACCOUNT_CATEGORIES.

- Sort and list the accounts based on their balances. SORT_ACCOUNTS_BY_HIGH_BALANCE=yes

- Set it to 'no' if need to show the accounts as received from API.

- The Following are the list of product attributes that are supported as a default set of implementation. (statementbalance,minimumpayment,minpayment,outstandingbalance,currentbalance,latestbalance,duedate,expirydate,rewardpoints,rewardpoint,totalbalance,closingbalance,ledgerbalance,floatbalance,holdbalance,dueamount,accountopened,loyaltypoint,availablelimit,totallimit,minimumdue,mindue,lastpaymentamount,lastpaymentdate,lastmonthbill,lastmonthdue,basebranch,branch,branchname,branchaddress,nominee,tenure,interestrate,installmentamount,enddate,emiamount,accountopening,outstanding,rateofinterest,maturitydate,maturityamount,maturityinstruction,startdate,accumulatedinterest,renewaldate,cumulativeamount,currentmonthbill,presentamount,balance,lastbill,totaldue,minimumamount,minimumamountdue,nextpaymentamount,primaryowner,jointowner,nextpaymentdate,openingdate,emidate,nextemidate)

- Based on the requirement all the attributes can be enabled by appending to the following property. qry-accountenquiry_SUPPORTED_MODIFIERS=statementbalance,minimumpayment

- The Following property is to tell bot wrt attribute responses, whether need to be as a Template or Text response. qry-accountenquiry_RESPONSE_TYPE=TEMPLATE Supported values : TEMPLATE or TEXT

- Will the accountSummary API list all accounts and its balances or need to do a separate call to fetch balance, if separate API needs to be invoked then the following need to be set to true. IS_BALANCE_SEPARATE_API_CALL=false Supported boolean values are 'true' or 'false'

- Configured supported products are casa & creditcard, Credit Card api is giving response with card details & balances where as Current Account & Savings Account API is not with balance details and need to invoke separate API to fetch balance, in which case we will configure this property based on product. INVOKE_CASA_BALANCE_API=true

- From the received balance API response, all the attributes that need to be mapped back for display need to be configured in this property. ACCOUNT_BALANCE_PROPS_FROM_API=balance,availableBalance

- If balance API is invoked for each product, then the attributes can be configured for each of the products as LOAN_BALANCE_PROPS_FROM_API=outstandingbalance,installmentAmount And same way for other products: CREDIT_CARD,DEBIT_CARD,DEPOSIT

- Do we have multiple api for individual productType or one api to fetch all poroductType summaries IS_MULTIPLE_API_CALL_FOR_GET_ACCOUNTS=false

- If we need to call multiple APIs to fetch all the supported products, then accordingly this need to be set to True. IS_ACCOUNT_DETAILS_SEPARATE_API_CALL= false

- If details API is set to true and to invoke details API based on product, we need the set the following property to true. INVOKE_ACCOUNT_DETAILS_API=true

- other supported products are,LOAN,CREDIT_CARD,DEBIT_CARD,DEPOSIT. Replacing the product name with ACCOUNT, will be fetching details accordingly.

- For voice channels if we don't want user to select an acc to know its balance, then by by setting this value it reads the balance of an account that is set as preferred/default account. qry-accountenquiry_aa_USE_DEFAULT_ACCOUNT=yes qry-accountenquiry_gh_USE_DEFAULT_ACCOUNT=yes

- Details that need to be mapped back to Product can be specified here based on Product. ACCOUNT_DETAILS_PROPS_FROM_API=ifscCode,bankName other supported products are, LOAN, CREDIT_CARD, DEBIT_CARD, DEPOSIT. Replacing the product name with ACCOUNT, will be fetching details accordingly.

- Invoke balance api on account mismatch when user uttered like show my balance of account number 1234 (where 1234 account is not exists) Here need to show accounts without balance after selection needs to hit an api and show particular account balance after balance api called) by default it is true INVOKE_BALANCE_API_ON_MISMATCH=true

- support for different template based on modifier - say if you would like to render custom template for showing account details qry-accountenquiry_CUSTOM_TEMPLATES_FOR_MODIFIERS*=*caniuse,account-detail,card-detail

casa modifier response type, by default template

availablebalance_RESPONSE_TYPE=TEMPLATE

currentbalance_RESPONSE_TYPE=TEMPLATE

totalbalance_RESPONSE_TYPE=TEMPLATE

allbalances_RESPONSE_TYPE=TEMPLATE

accountopened_RESPONSE_TYPE=TEMPLATE

credit card modifiers response type

outstandingbalance_RESPONSE_TYPE=TEMPLATE

account-open_RESPONSE_TYPE=TEXT

creditlimit_RESPONE_TYPE=TEXT

modifiers to be applied for account categories

account modifiers

availablebalance_ACCOUNT_CATEGORIES=casa

currentbalance_ACCOUNT_CATEGORIES=casa

totalbalance_ACCOUNT_CATEGORIES=casa, creditcard

allbalances_ACCOUNT_CATEGORIES=casa, creditcard

accountopened_ACCOUNT_CATEGORIES=casa,deposit,loan

closingbalance_ACCOUNT_CATEGORIES=casa

ledgerbalance_ACCOUNT_CATEGORIES=casa

floatbalance_ACCOUNT_CATEGORIES=casa

holdbalance_ACCOUNT_CATEGORIES=casa

loyaltypoint_ACCOUNT_CATEGORIES=casa

reward_ACCOUNT_CATEGORIES=casa

cash_ACCOUNT_CATEGORIES=casa

money_ACCOUNT_CATEGORIES=casa

fund_ACCOUNT_CATEGORIES=casa

networth_ACCOUNT_CATEGORIES=casa,creditcard

worth_ACCOUNT_CATEGORIES=casa

portfolio_ACCOUNT_CATEGORIES=casa,creditcard

debt_ACCOUNT_CATEGORIES=creditcard

ifsccode_ACCOUNT_CATEGORIES=casa

basebranch_ACCOUNT_CATEGORIES=casa

branch_ACCOUNT_CATEGORIES=casa,creditcard,loan,deposit

branchname_ACCOUNT_CATEGORIES=casa,creditcard,loan,deposit

branchaddress_ACCOUNT_CATEGORIES=casa,creditcard,loan,deposit

nominee_ACCOUNT_CATEGORIES=casa,deposit

primary_ACCOUNT_CATEGORIES=casa,creditcard

overdraftledgerbalance_ACCOUNT_CATEGORIES=casa

credit card modifiers

outstandingbalance_ACCOUNT_CATEGORIES=creditcard

statementbalance_ACCOUNT_CATEGORIES=creditcard

dueamount_ACCOUNT_CATEGORIES=creditcard

minimumdue_ACCOUNT_CATEGORIES=creditcard

mindue_ACCOUNT_CATEGORIES=creditcard

minimumpayment_ACCOUNT_CATEGORIES=creditcard

minpayment_ACCOUNT_CATEGORIES=creditcard

duedate_ACCOUNT_CATEGORIES=creditcard,deposit,loan

rewardspoints_ACCOUNT_CATEGORIES=creditcard

rewardpoints_ACCOUNT_CATEGORIES=creditcard

rewardpoint_ACCOUNT_CATEGORIES=creditcard

availablelimit_ACCOUNT_CATEGORIES=creditcard

totallimit_ACCOUNT_CATEGORIES=creditcard

spendlimit_ACCOUNT_CATEGORIES=creditcard

lastpaymentdate_ACCOUNT_CATEGORIES=creditcard.loan

lastpaymentamount_ACCOUNT_CATEGORIES=creditcard,loan

didiuse_ACCOUNT_CATEGORIES=creditcard

caniuse_ACCOUNT_CATEGORIES=casa,creditcard

expirydate_ACCOUNT_CATEGORIES=creditcard,debitcard

lastmonthbill_ACCOUNT_CATEGORIES=creditcard

lastmonthdue_ACCOUNT_CATEGORIES=creditcard

minimumamountdue_ACCOUNT_CATEGORIES=creditcard

dueamount_minimumamountdue=minimumdue

minimumamountdue_dueamount=minimumdue

rewardpoints_rewardpoint=rewardpoint

loan modifiers

tenure_ACCOUNT_CATEGORIES=loan,deposit

interestrate_ACCOUNT_CATEGORIES=loan,deposit

rateofinterest_ACCOUNT_CATEGORIES=loan,deposit

howmanyinstallments_ACCOUNT_CATEGORIES=loan

installmentamount_ACCOUNT_CATEGORIES=loan

enddate_ACCOUNT_CATEGORIES=loan

emiamount_ACCOUNT_CATEGORIES=loan

emidate_ACCOUNT_CATEGORIES=loan

nextemidate_ACCOUNT_CATEGORIES=loan

loanamount_ACCOUNT_CATEGORIES=loan

principalamount_ACCOUNT_CATEGORIES=loan,deposit

outstanding_ACCOUNT_CATEGORIES=creditcard,loan

nextpaymentamount_ACCOUNT_CATEGORIES=creditcard,loan

nextpaymentdate_ACCOUNT_CATEGORIES=creditcard,loan

deposit modifiers

maturitydate_ACCOUNT_CATEGORIES=deposit

whencaniwithdraw_ACCOUNT_CATEGORIES=deposit

maturityamount_ACCOUNT_CATEGORIES=deposit

maturityinstruction_ACCOUNT_CATEGORIES=deposit

startdate_ACCOUNT_CATEGORIES=deposit

accumulatedinterest_ACCOUNT_CATEGORIES=deposit

renewaldate_ACCOUNT_CATEGORIES=deposit

cumulativeamount_ACCOUNT_CATEGORIES=deposit

openingdate_ACCOUNT_CATEGORIES=deposit,casa,loan,creditcard

modifier precedence

duedate_renewaldate=renewaldate

availablelimit_cashlimit=cashlimit

duedate_outstanding=duedate

Customisation

Integration Customisation

Checkout the RB Stub Integration Services code from the Repo for quick and easy integration. click here

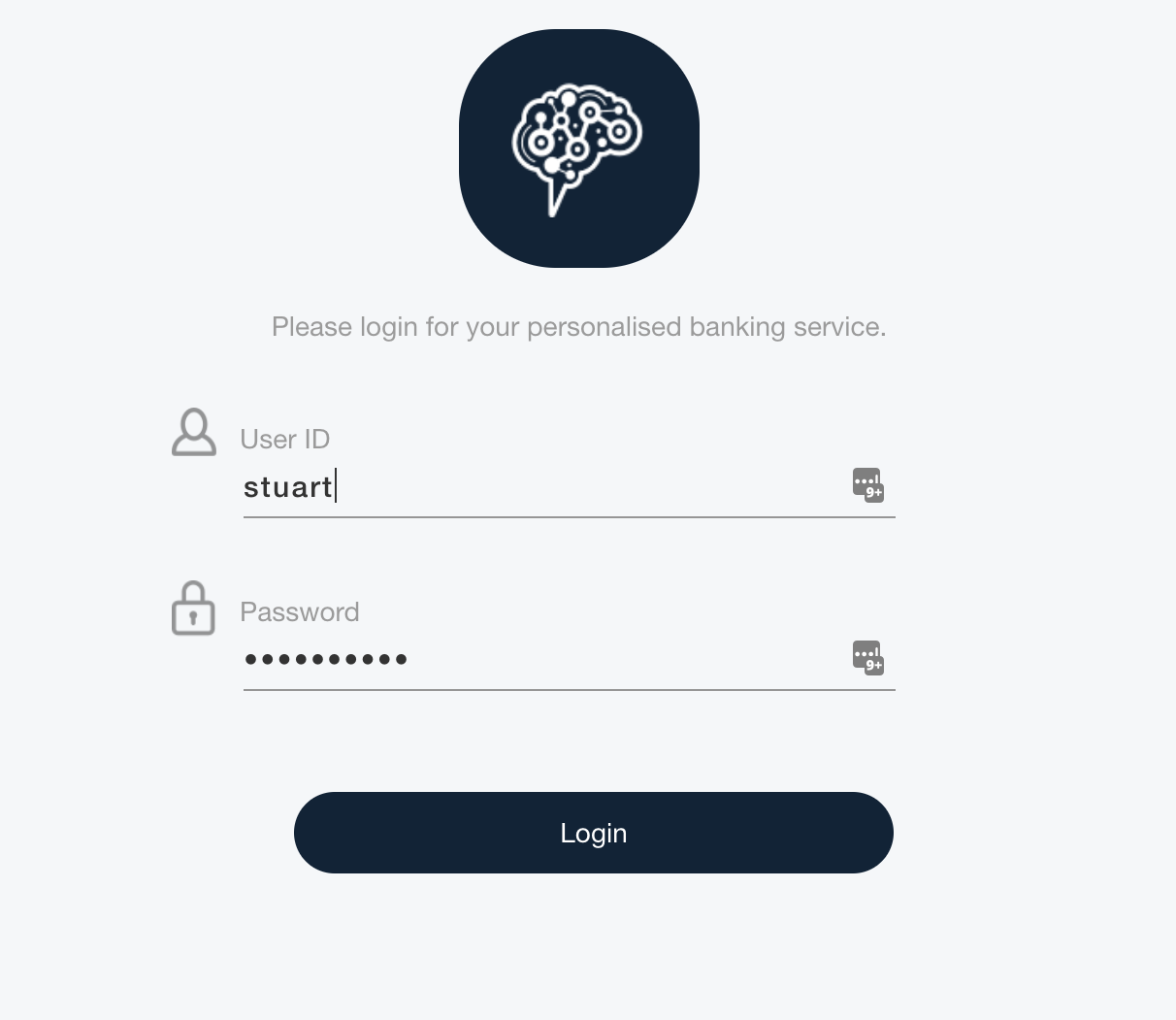

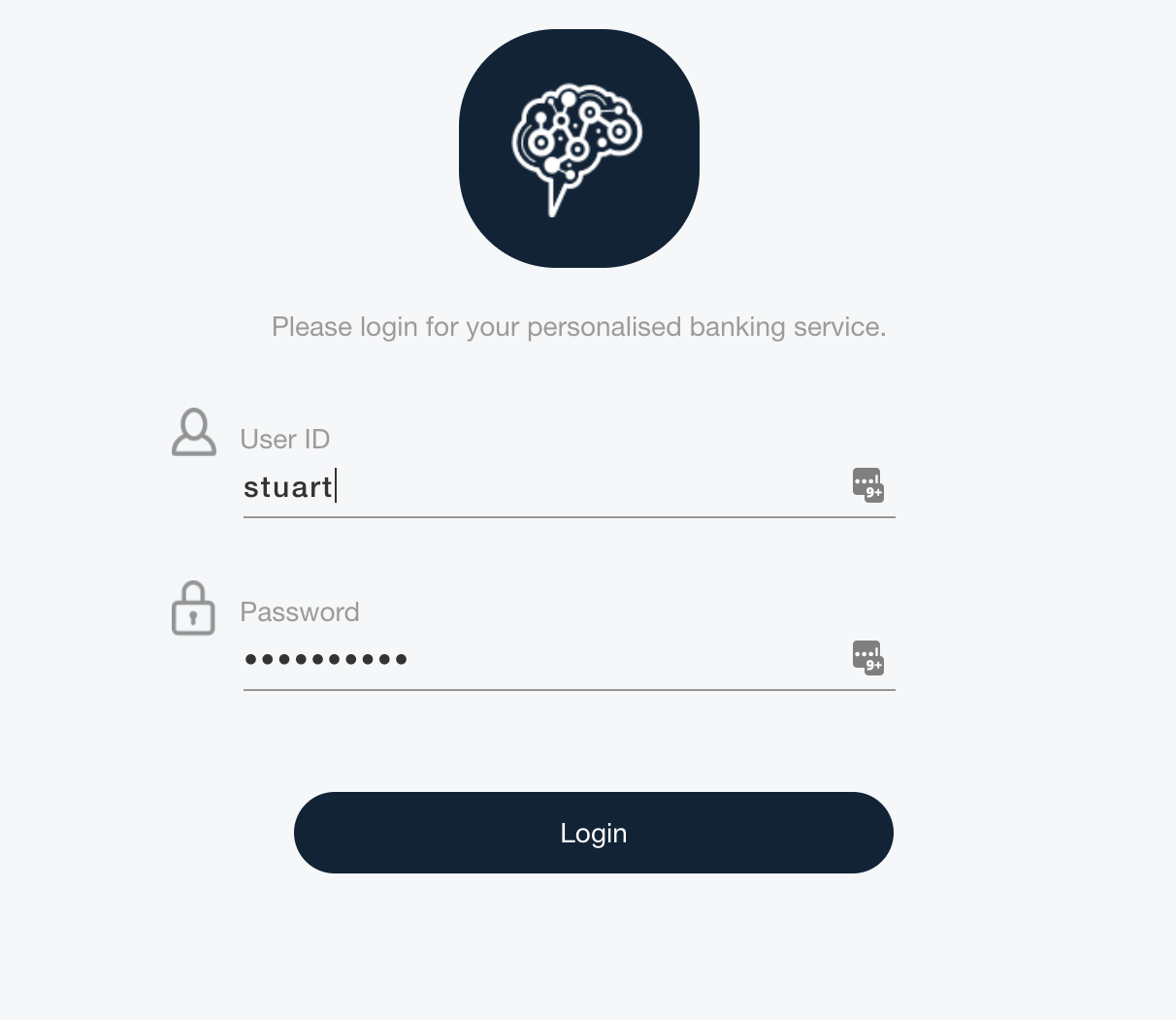

Integrate with the Bank Login API using the given code, deploy and start working.

Request / Response

Sample Request-Response in the case of one API returning accounts with balances.

Along with accounts/cards summary call itself

Request:

Request URL : http://localhost:8080/banking-integration/v1/{customerId}/accounts/{productType}

customerId - String

productType - String (casa, deposit, creditcard, debitcard, loan)

Response:

Status : 200

Meaning: OK

Description: OK

Schema :

{

"accounts": \[

{

"accountId": "string",

"accountName": "string",

"accountNumber": "string",

"balance": {

"amount": 0,

"availableBalance": 0,

"currencyCode": "string",

"currentBalance": 0

},

"bankName": "string",

"branchAddress": "string",

"branchId": "string",

"branchName": "string",

"category": "string",

"displayAccountNumber": "string",

"lastStatementBalance": 0,

"lastStatementDate": "string",

"openingDate": "string",

"product": "string",

"productCode": "string",

"status": "ACTIVE",

"type": "SAVINGS"

}

],

"result": {

"message": "string",

"messageCode": "string",

"status": 0

}

}

Separate call for Balance

If need to do a separate API call to fetch balance for account list received in above call.

Request:

Request URL : http://localhost:8080/banking-integration/v1/{customerId}/accounts/{productType}/{accountId}/balance

customerId - String

productType - String (casa, deposit, creditcard, debitcard, loan)

Response:

Status : 200

Meaning: OK

Description: OK

Schema :

{

"accountSelected": {

"accountId": "string",

"balance":

{

"amount": 0,

"availableBalance": 0,

"currentBalance": 0,

"monthlyAverageBalance": 0,

"currencyCode": "string"

}

},

"result": {

"message": "string",

"messageCode": "string",

"status": 0

}

}

Separate API to fetch Details

Request:

Request URL: http://localhost:8080/banking-integration/v1/{customerId}/accounts/{productType}/{accountId}

customerId - String

accountId - String

productType - String (casa, deposit, creditcard, debitcard, loan)

Response:

Status : 200

Meaning: OK

Description: OK

Schema :

{

"accountSelected": {

"accountId": "string",

"balance":

{

"amount": 0,

"availableBalance": 0,

"currentBalance": 0,

"monthlyAverageBalance": 0,

"currencyCode": "string"

}

},

"result": {

"message": "string",

"messageCode": "string",

"status": 0

}

}

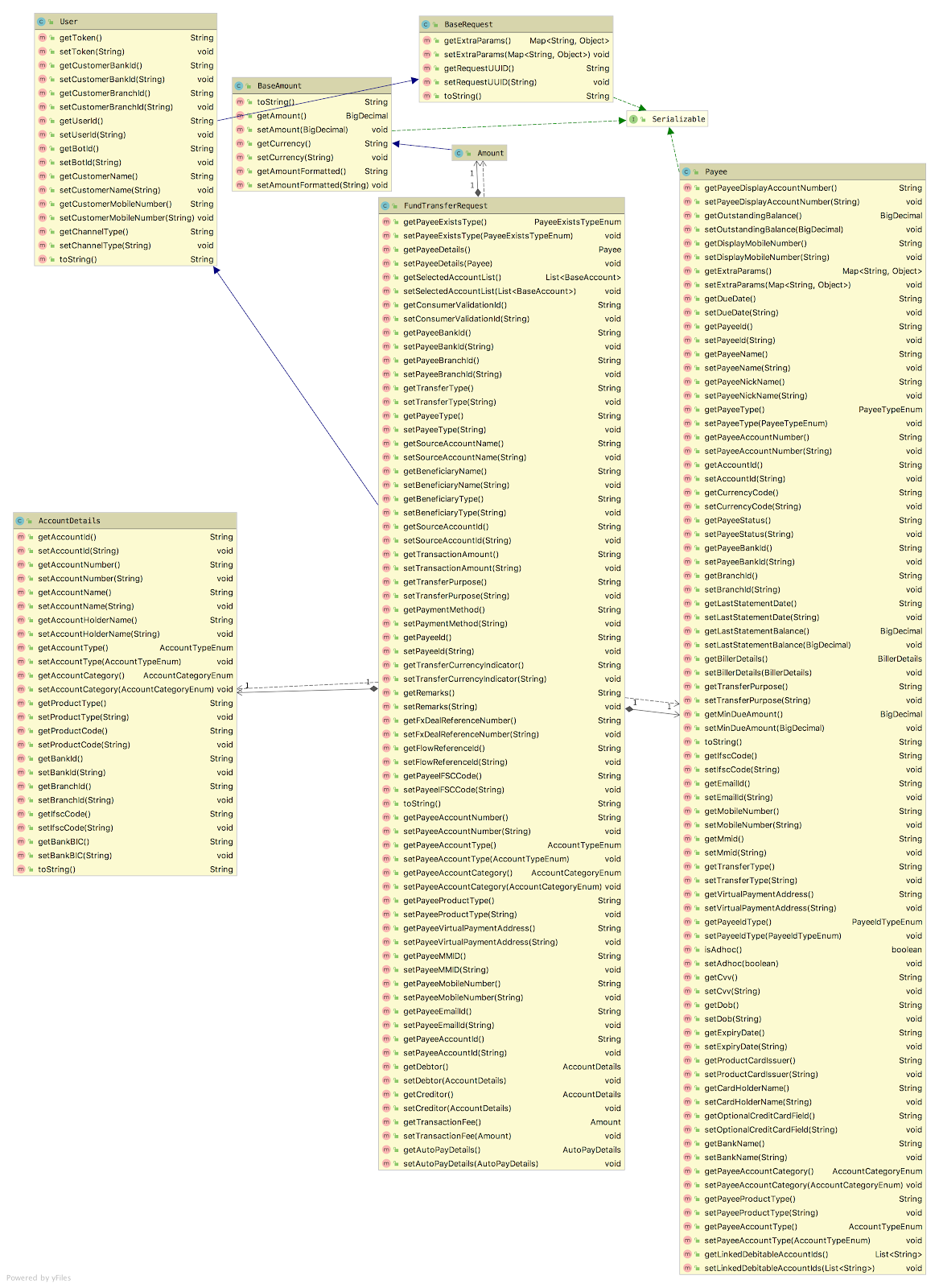

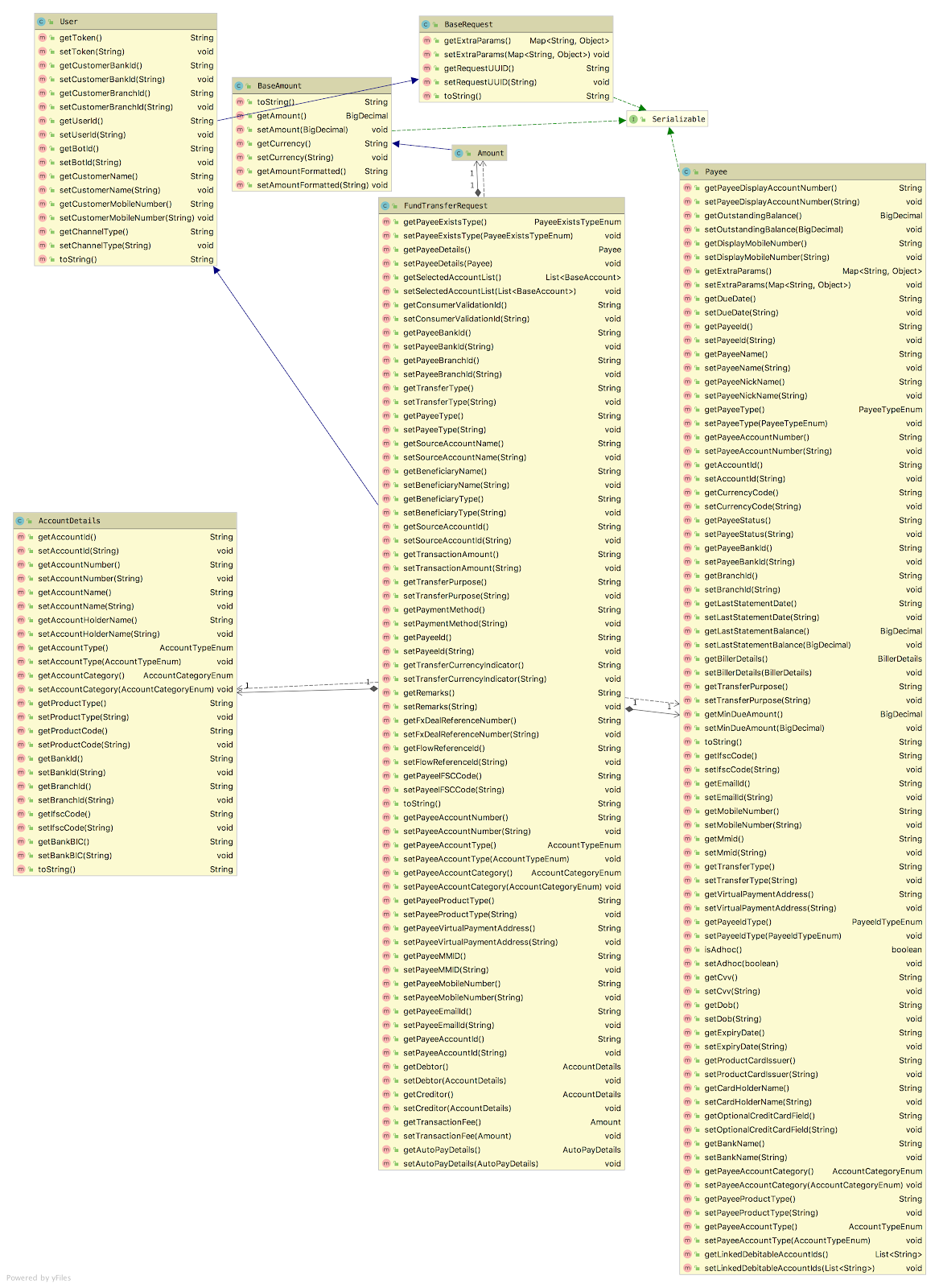

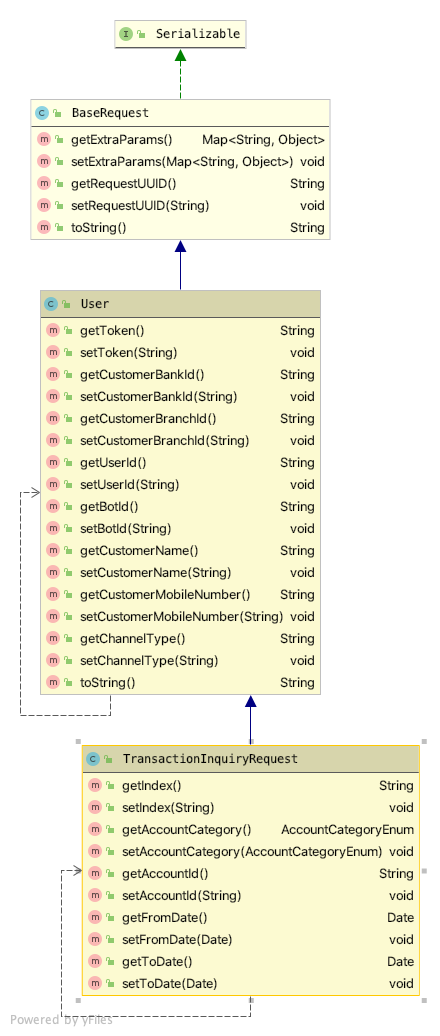

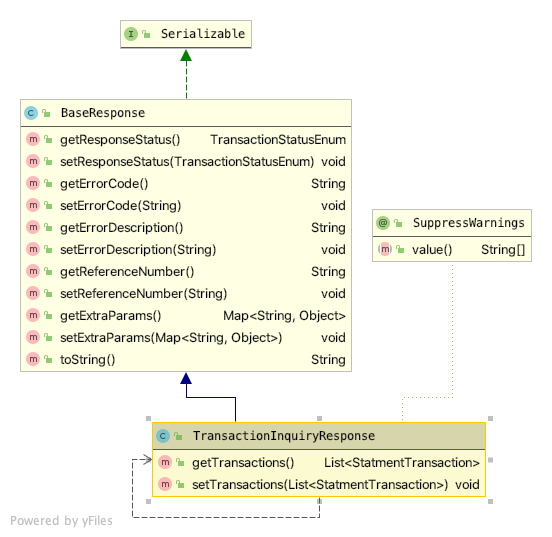

Following are the Balance Request-Response objects using which one can integrate with product with own integration coding. By pointing the following RB property value to integration camel route id for supported productTypes.

ACCOUNT_ROUTE_URI=direct:demobank.stub.getAccounts (Default value for Current Account & Savings Account)

CREDIT_CARD_ROUTE_URI=direct:demobank.stub.getCreditCards

DEBIT_CARD_ROUTE_URI=direct:demobank.stub.getDebitCards

DEPOSIT_ROUTE_URI=direct:demobank.stub.getDeposits

LOAN_ROUTE_URI=direct:demobank.stub.getLoans

FOREX_CARD_ROUTE_URI=direct:demobank.stub.getForexCards

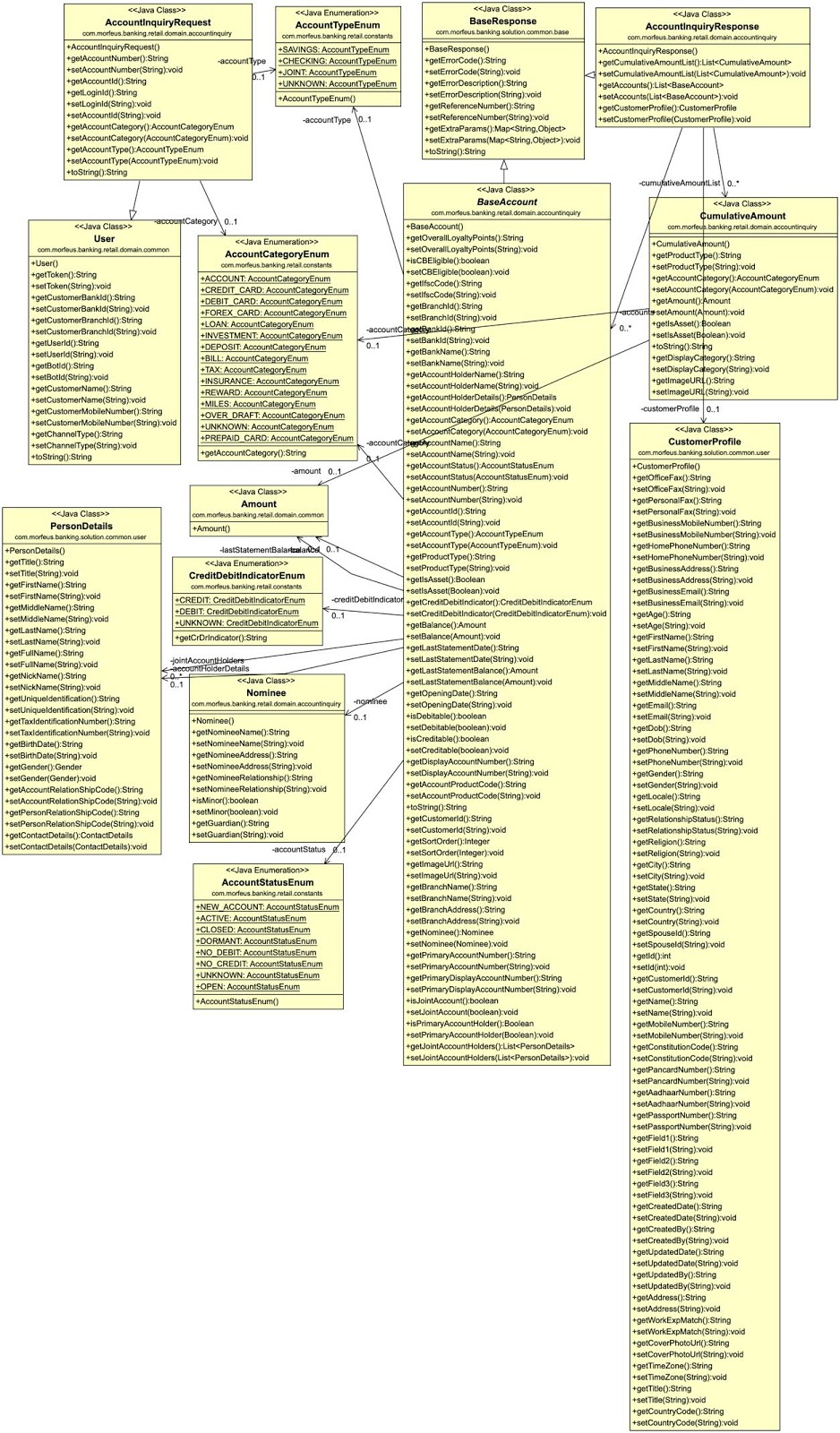

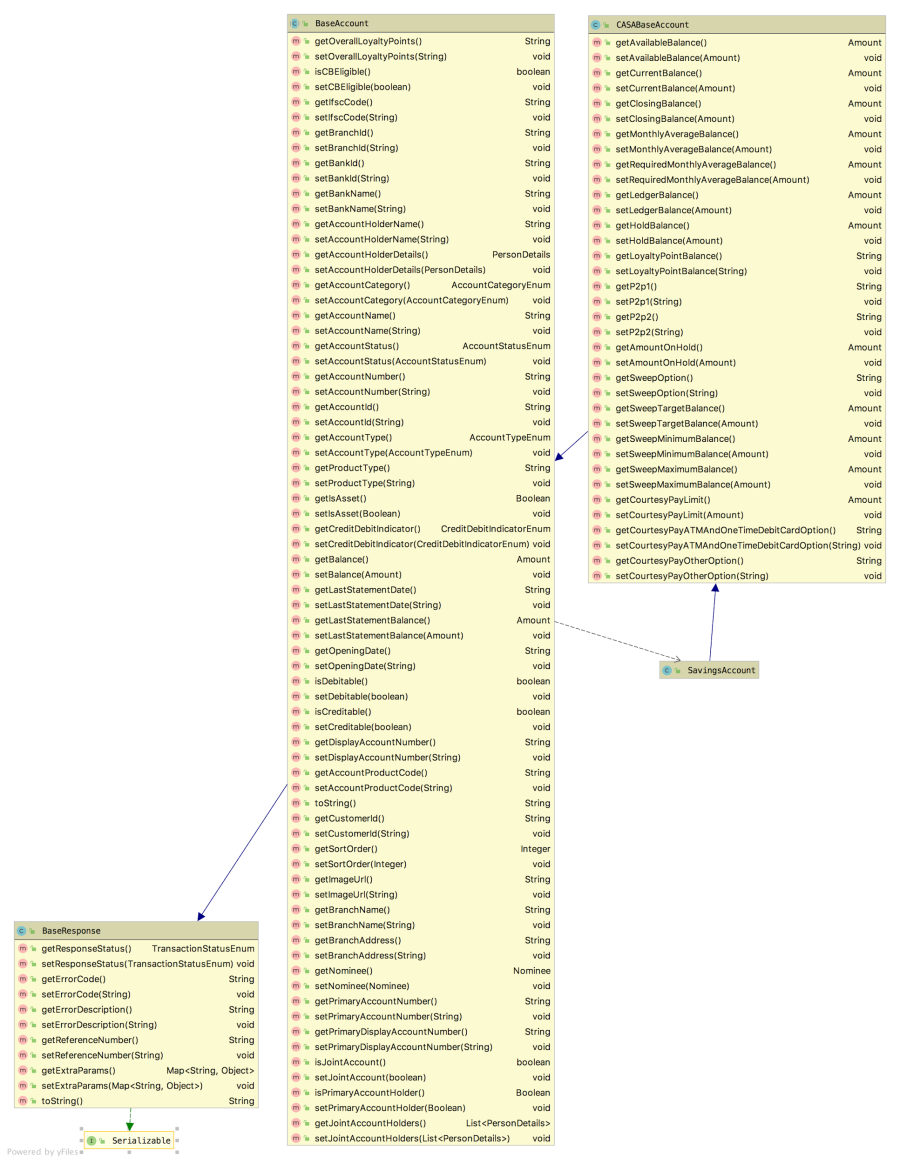

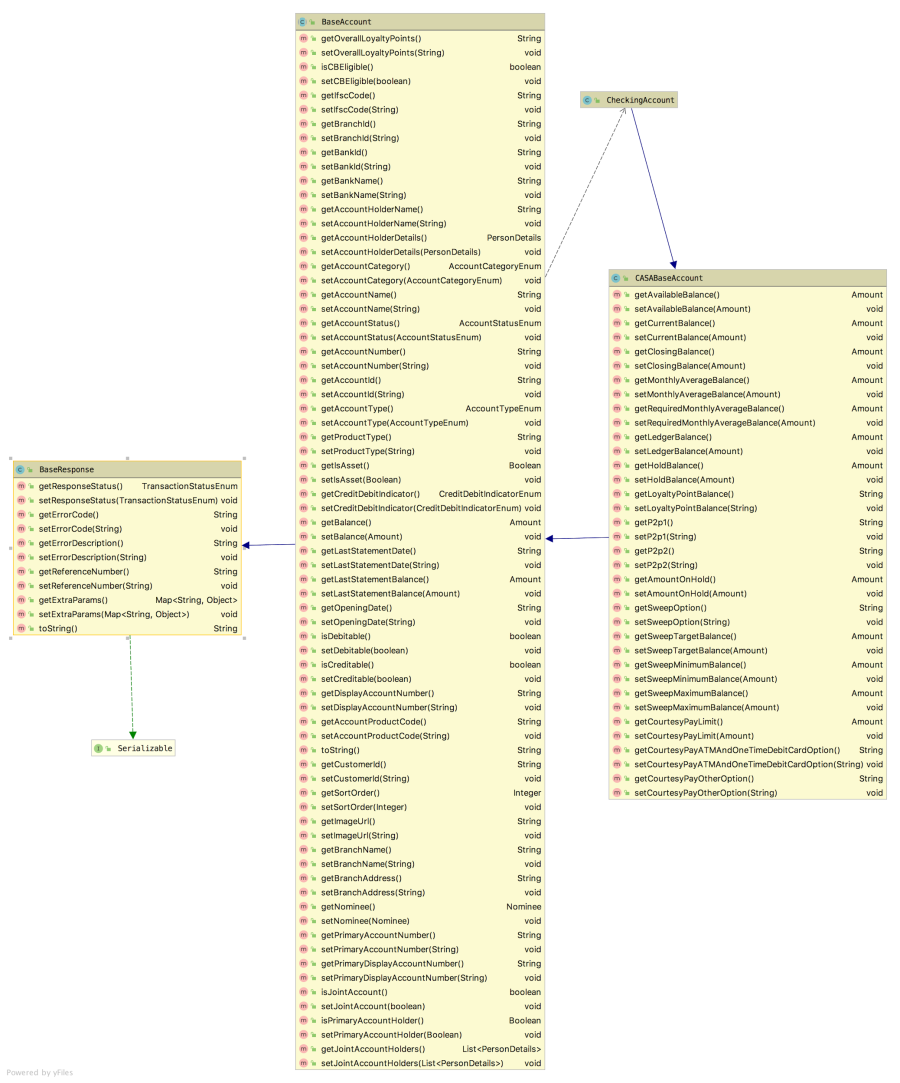

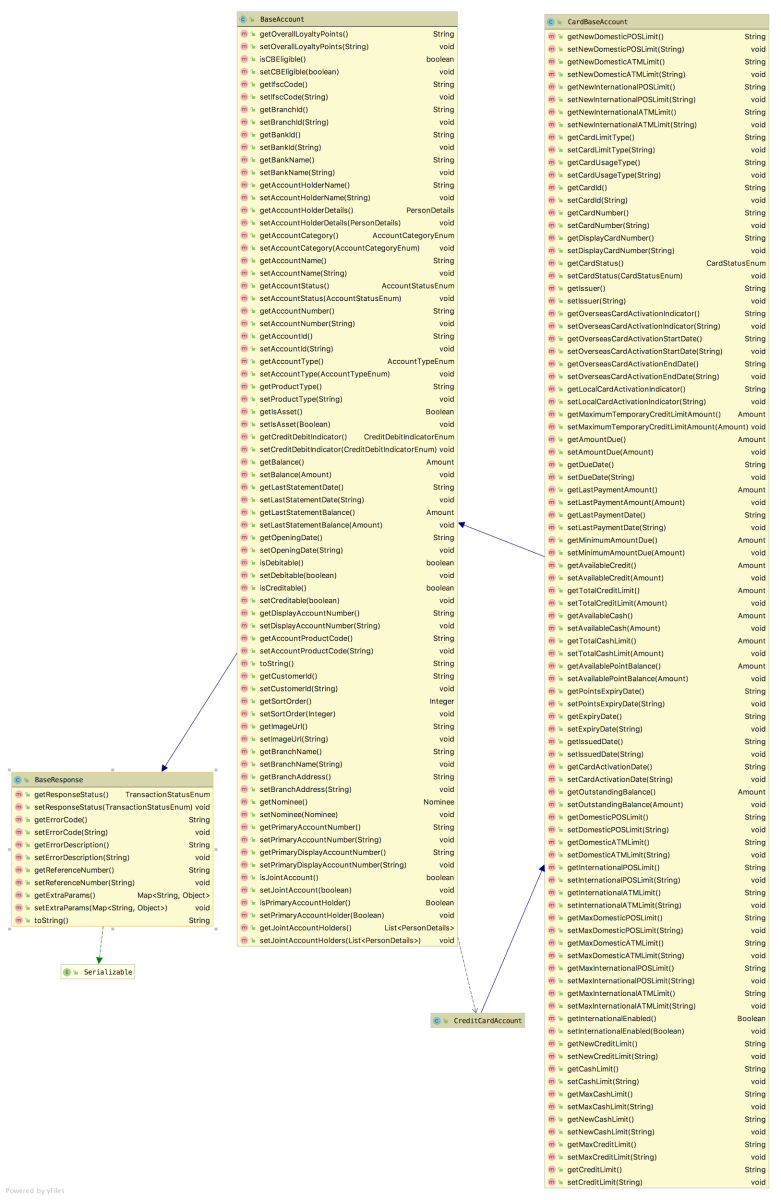

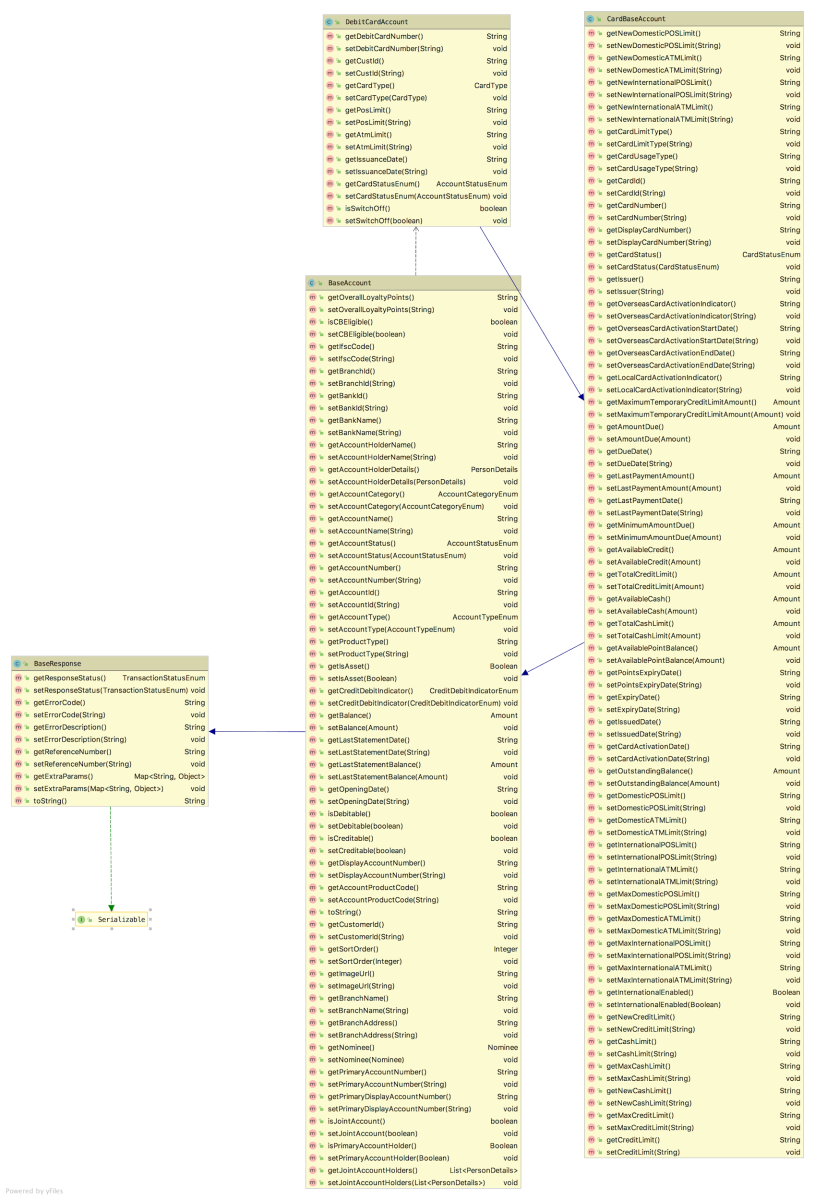

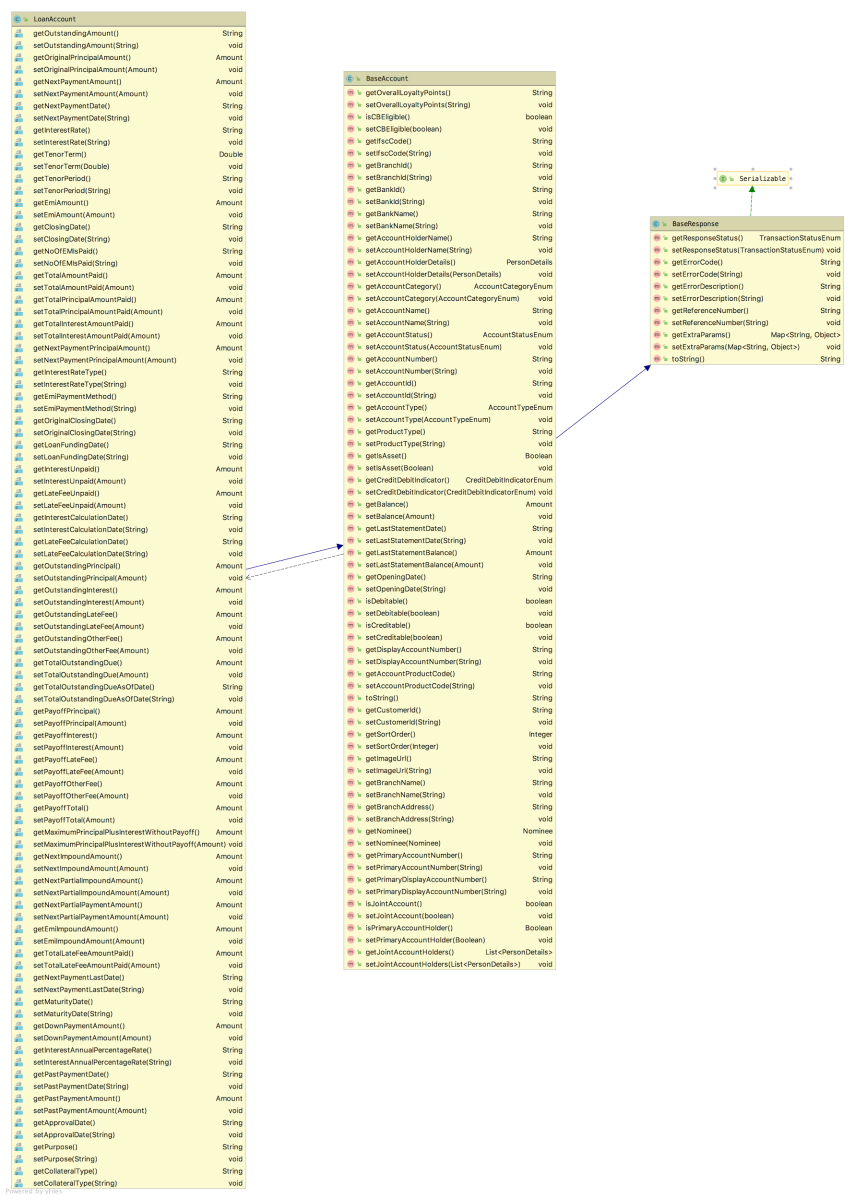

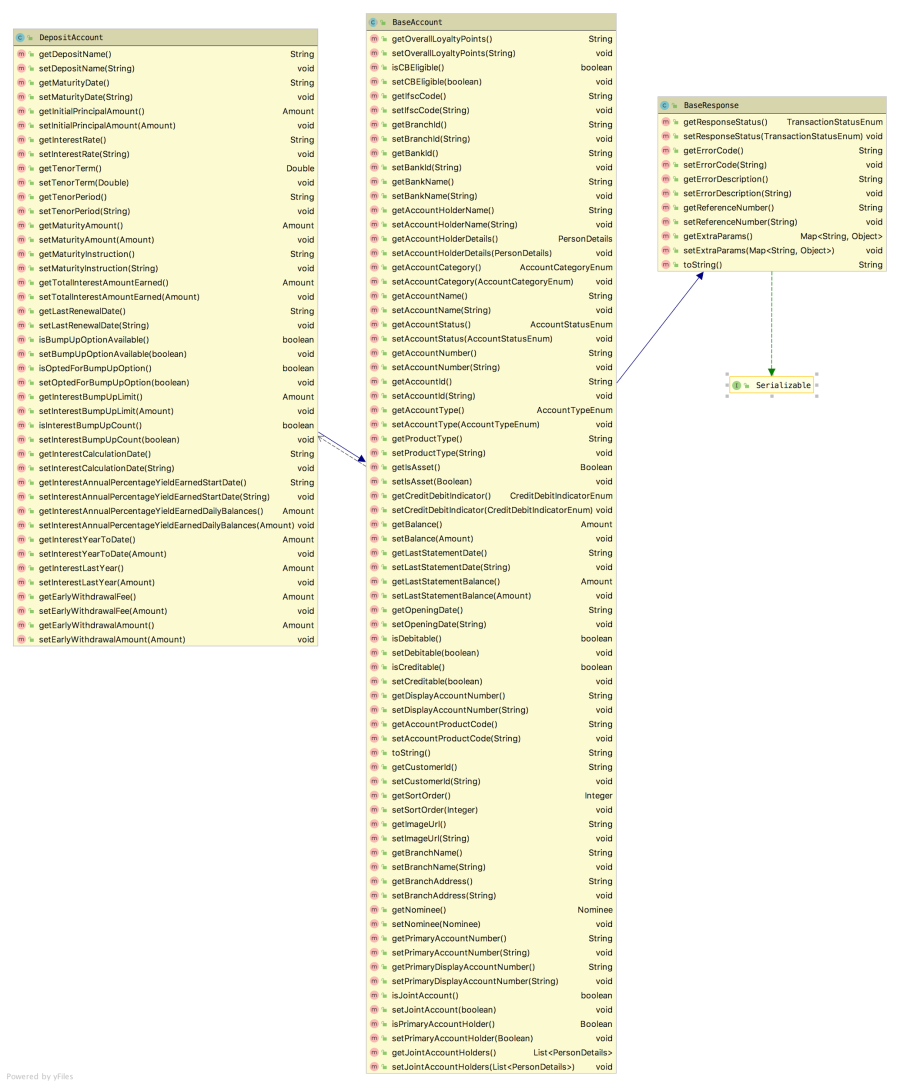

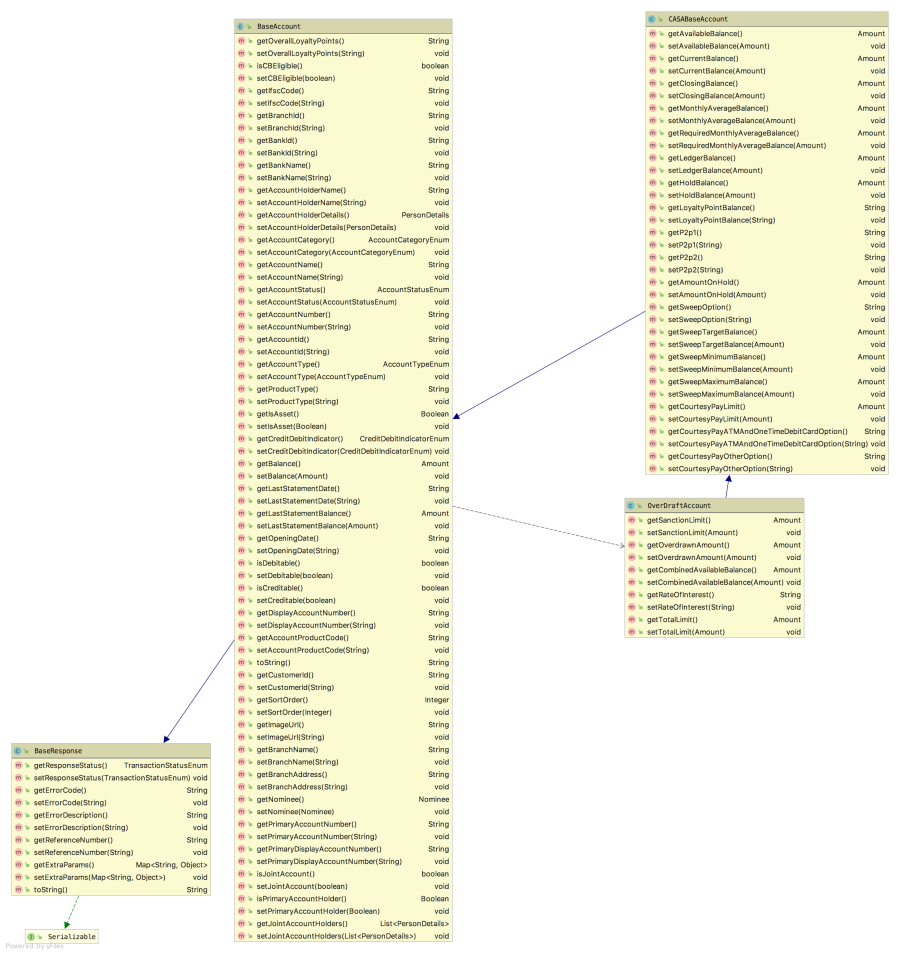

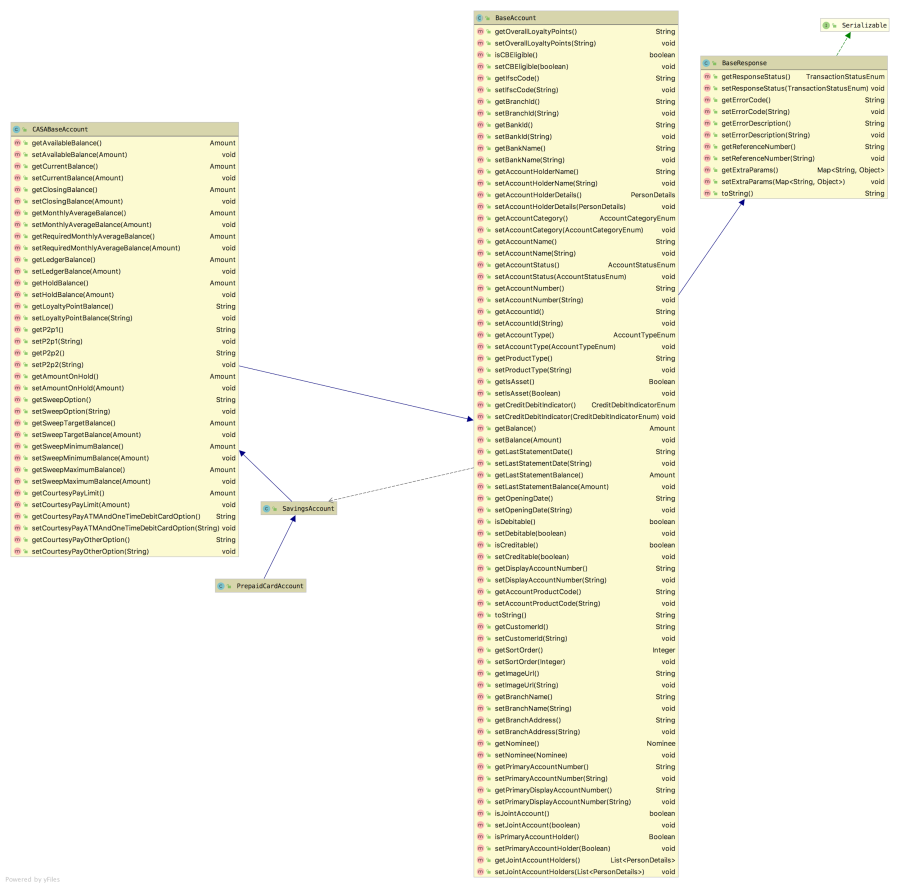

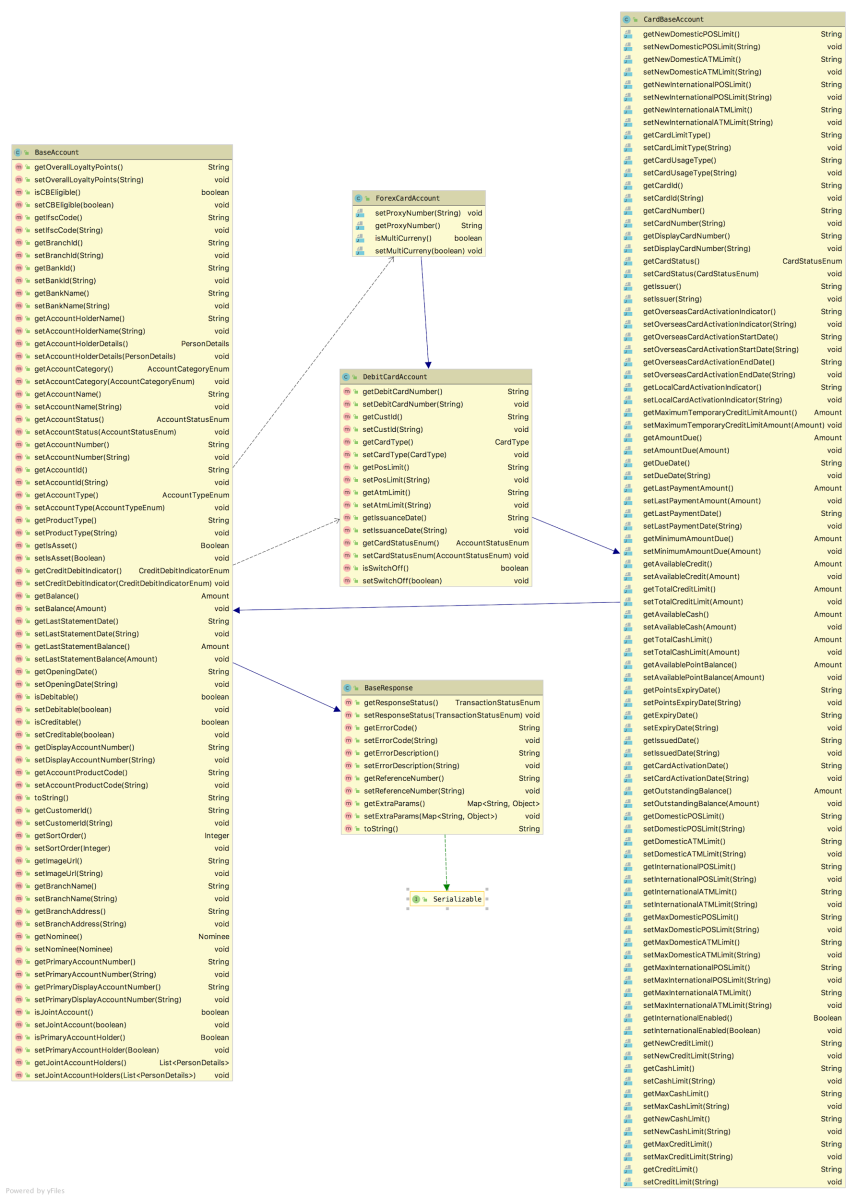

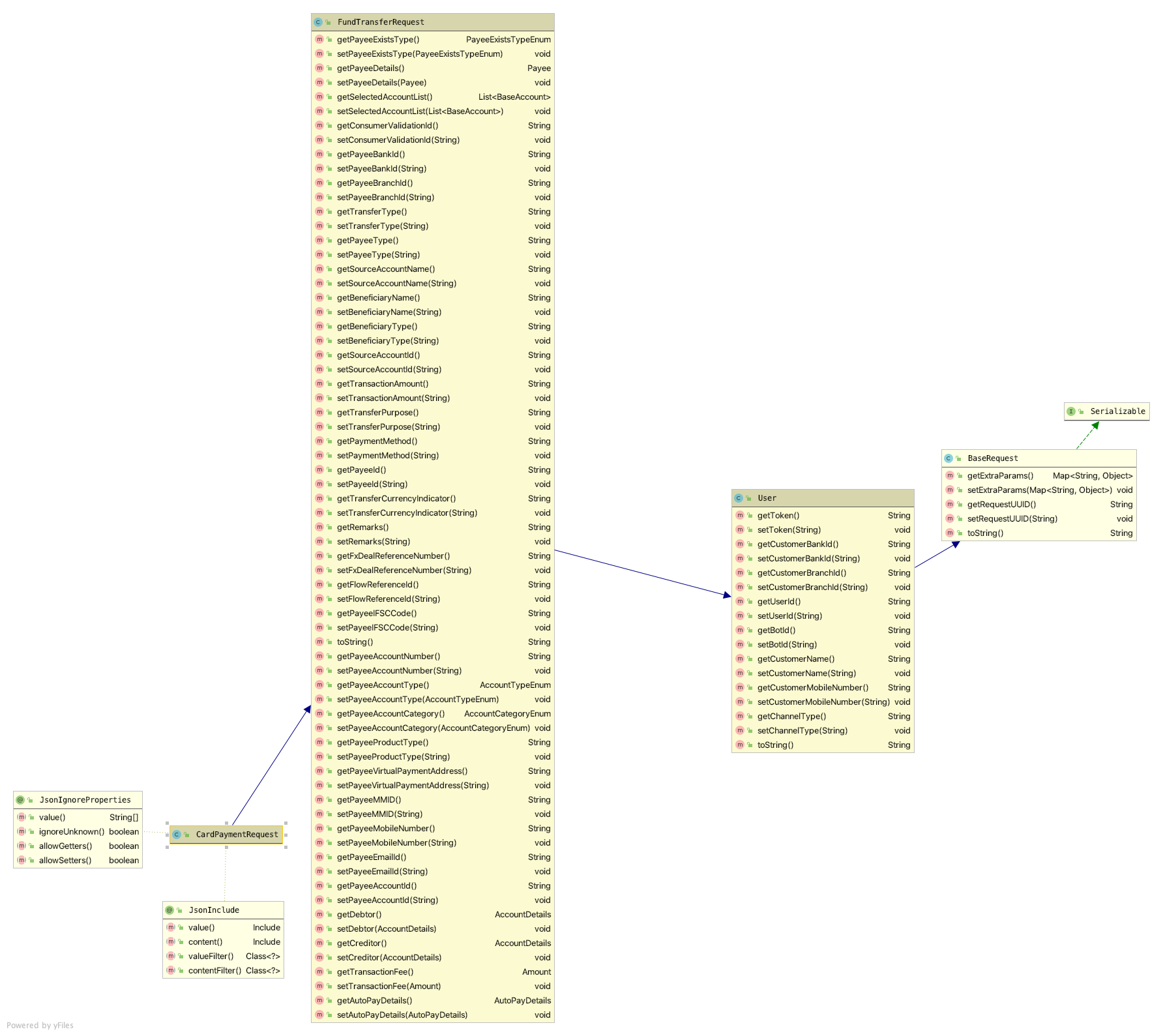

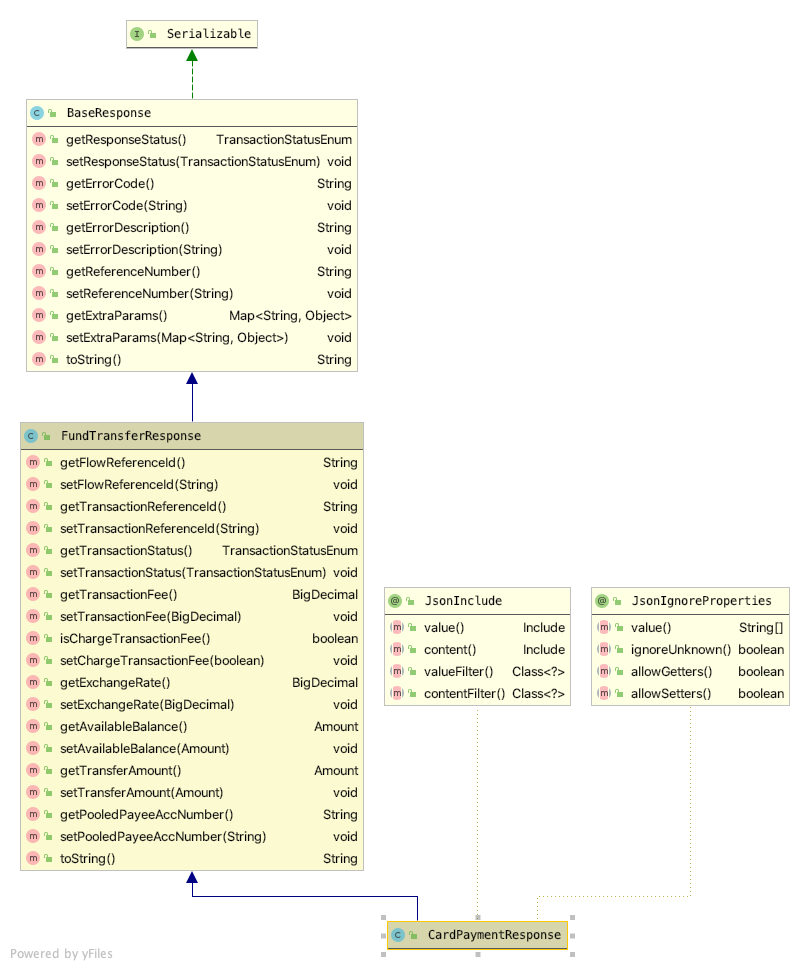

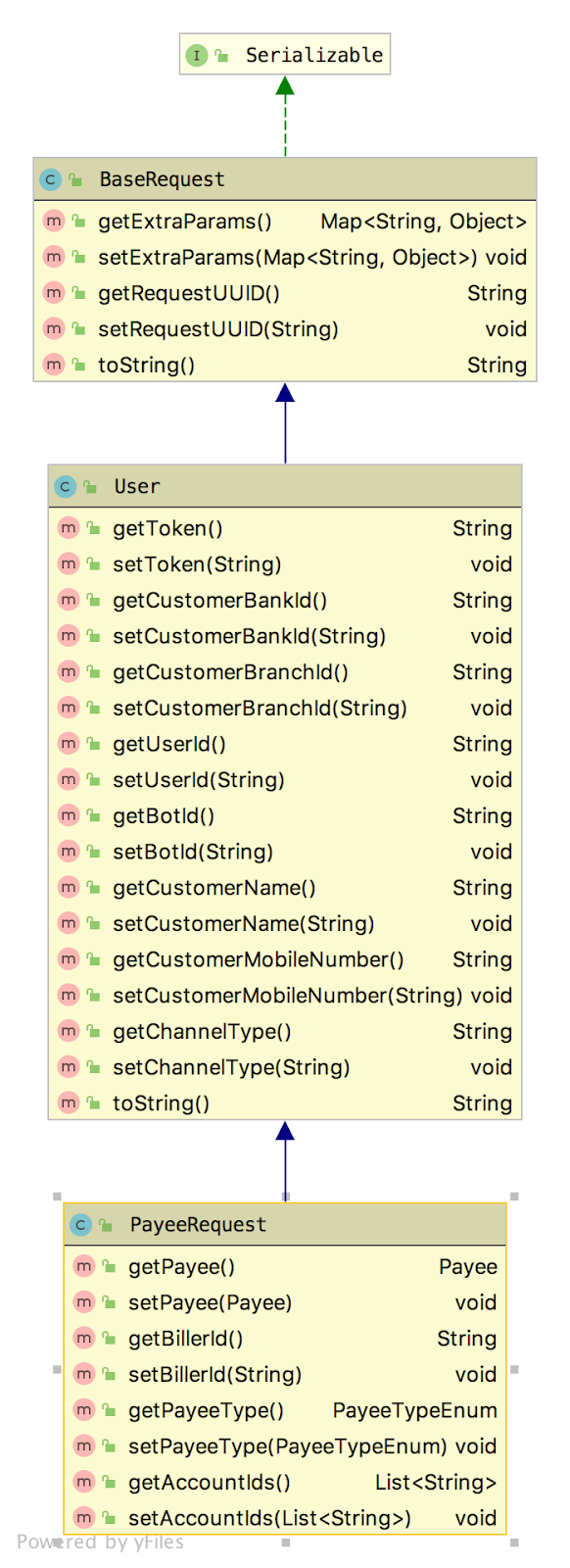

Class Diagrams

Account Inquiry Request

Fig 1 Savings Account

Fig 2 Checking Account

Fig 3 Credit Card

Fig 4 Debit Card

Fig 5 Loan Account

Fig 6 Deposit Account

Fig 7 OverDraft Account

Fig 8 Prepaid Card

Fig 9 Forex Card

Response Customisation

Generic

- The properties needs to be formatted properly so that on response visible on templates should be in proper like 100000 -> 1,10,000

ACCOUNT_AMOUNT_PROPS_TO_BE_FORMATTED=balance,availableBalance

Product Images:

Images can be displayed differently for each product in template.

We configure images to be shown on templates as described below

Example: -

Accounts Specific Images: qry-accountenquiry_VISA_IMAGE_URL={S3_DOMAIN_NAME}/visa_card_2x.png

SAVINGS_IMAGE_URL={S3_DOMAIN_NAME}/savings_account_2x.png

CHECKING_IMAGE_URL={S3_DOMAIN_NAME}/current_account_2x.png

DEPOSIT_IMAGE_URL={S3_DOMAIN_NAME}/deposit_account_2x.png

LOAN_IMAGE_URL={S3_DOMAIN_NAME}/loan_account_2x.png

SAVINGS_SINGLE_IMAGE_URL={S3_DOMAIN_NAME}/savings_account_2x.png

CHECKING_SINGLE_IMAGE_URL={S3_DOMAIN_NAME}/current_account_2x.png

DEPOSIT_SINGLE_IMAGE_URL={S3_DOMAIN_NAME}/deposit_account_2x.png

LOAN_SINGLE_IMAGE_URL={S3_DOMAIN_NAME}/loan_account_2x.png

Card Specific Images:

qry-accountenquiry_MASTER_IMAGE_URL={S3_DOMAIN_NAME}/master_card_2x.png

qry-accountenquiry_AMEX_IMAGE_URL={S3_DOMAIN_NAME}/default_card_2x.png

qry-accountenquiry_DINERS_IMAGE_URL={S3_DOMAIN_NAME}/default_card_2x.png

qry-accountenquiry_MASTER_SINGLE_IMAGE_URL={S3_DOMAIN_NAME}/master_card_2x.png

qry-accountenquiry_AMEX_SINGLE_IMAGE_URL={S3_DOMAIN_NAME}/default_card_2x.png

qry-accountenquiry_DINERS_SINGLE_IMAGE_URL={S3_DOMAIN_NAME}/default_card_2x.png

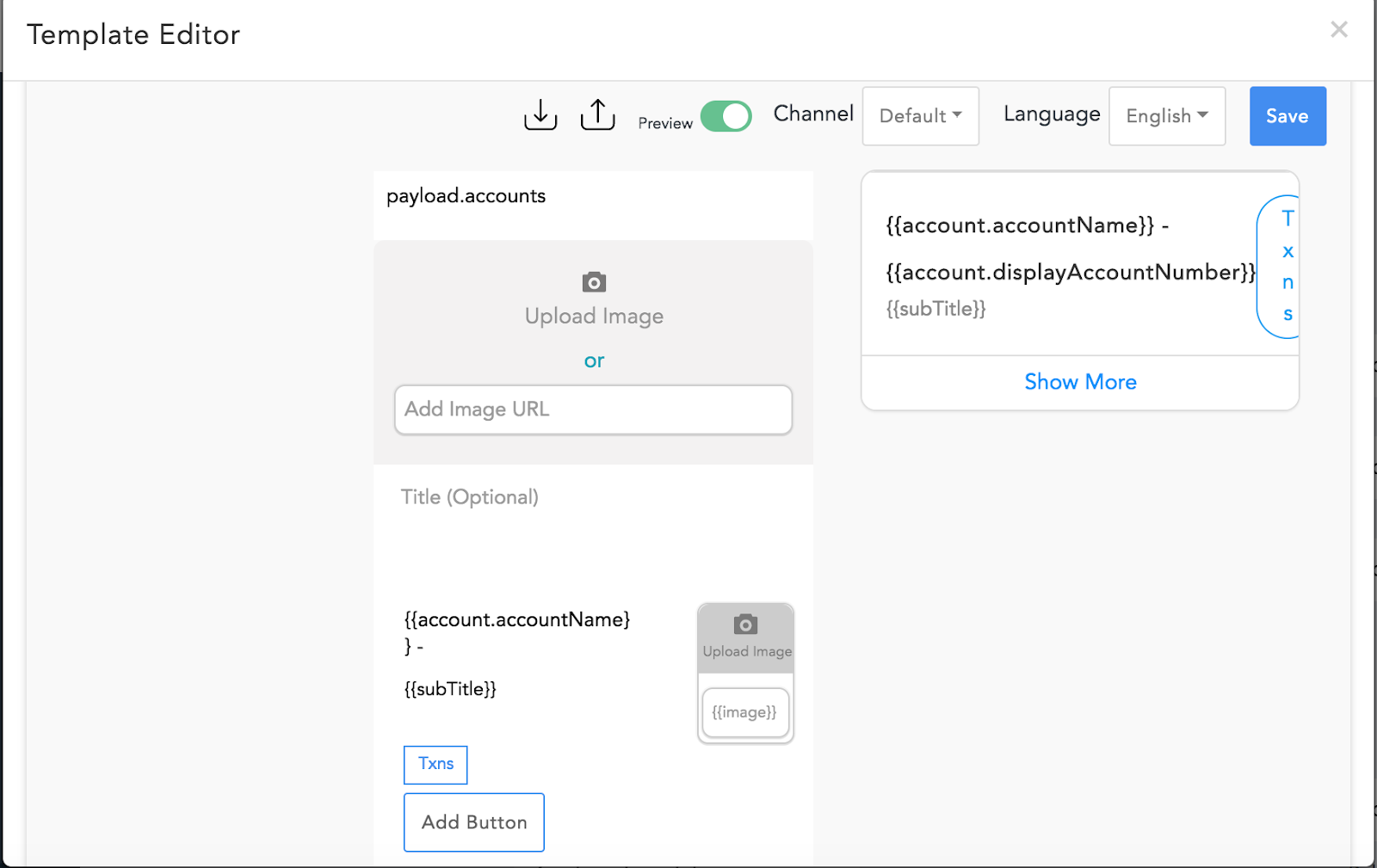

We can customise response on template using template editor as shown here

Messages:-

Kindly refer messages for this use case on admin by selecting respective category ( like Balance Inquiry, Balance Common, Common) as shown here

Templates:-

Kindly refer Templates for this use case on admin by selecting a category (like Balance Inquiry, Balance Common, Common) as shown here

you can make templates as carousel as we support by default list by using templateEditor

template Id's:-

BalanceViewSingleAccount -> If accounts size is equals to one and which we need show for confirmationneed to validate for all flow like a confirmation rather than selecting an account on both mismatch and normal case

BalanceViewWithGetDetails -> If accounts less than or equals to number of accounts to be displayed

AccountsListWithShowMoreWithGetDetails -> If accounts more than number of accounts to be displayed

BalanceViewWithGetDetails -> After clicking show more button on mismatch and in normal as well

If account mismatch happen on utterance level

Say user uttered like show nominee for acc no 2015 where 9015 is not exists

qry-accountenquiry_ACCT_SELECT_TEMPLATE_ID=BalInqAcctSelection

If accounts more than number of accounts to be displayed when mismatch happen on utterance level

qry-accountenquiry_ACCT_SELECT_WITH_SHOW_MORE_TEMPLATE_ID=BalInqAcctSelection

Hooks or Fulfilments:-

Kindly refer Hooks or Fulfilments for name(Balance_Inquiry) use case on admin as guided on here.

Customization of Image Properties:-

To customise images. Kindly refere here

Activate Card

Overview

| Attribute | Description |

|---|---|

| Use case name | Activate card |

| Type | Service request |

| Intent | txn-cardsettings |

| Banking products supported | Cards |

| Channels supported | Web, Mobile, FB messenger, Alexa |

| Login | Yes |

| 2FA | Yes |

| Integrated API availability | NA |

| Stub data availability | Yes |

Features

Summary

User can request for activation of a new or blocked card

If the card is in inactive or blocked status it will be activated.

Detailed

User can request for activating a debit or credit card in their possession.

Typically users will be required to activate their new or re-issued cards before they can use.

Some financial institutions also allow to unblock/activate a card that was blocked temporarily

Flow CX

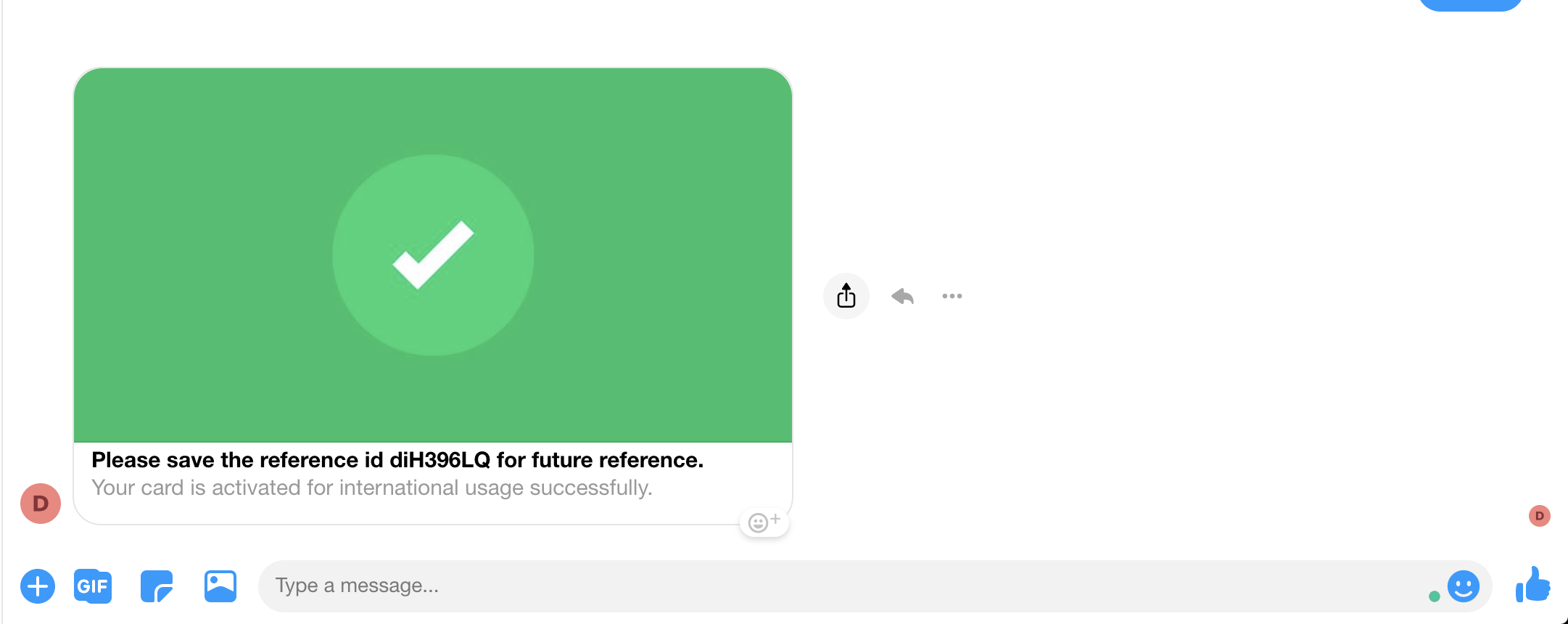

List of Cards -> Confirm Activation of Cards -> Enter OTP -> Status of Card Activation.

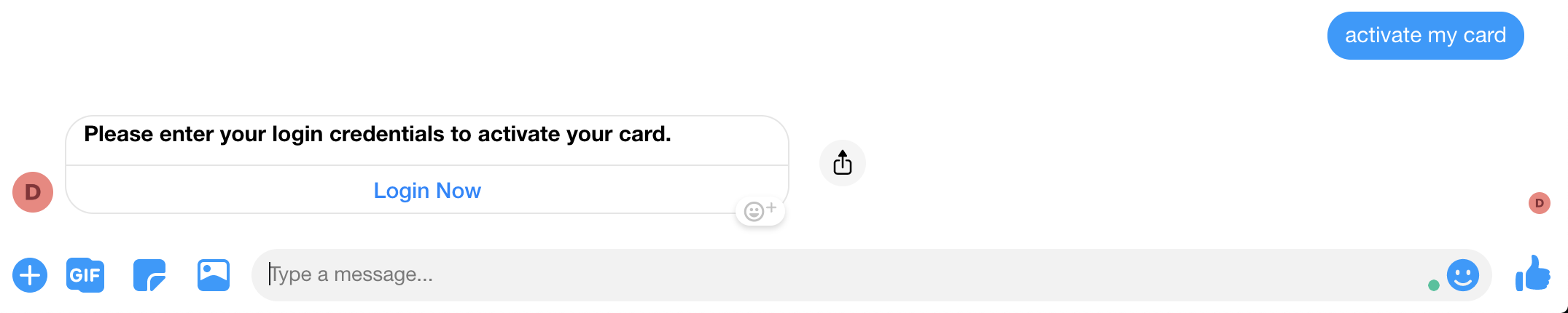

Sample CX for default flow

Default Flow - List of Cards -> Confirm Activation of Cards -> Enter OTP -> Status of Card Activation.

Note: This can be flowchart / GIF or screenshot to represent OOTB flow

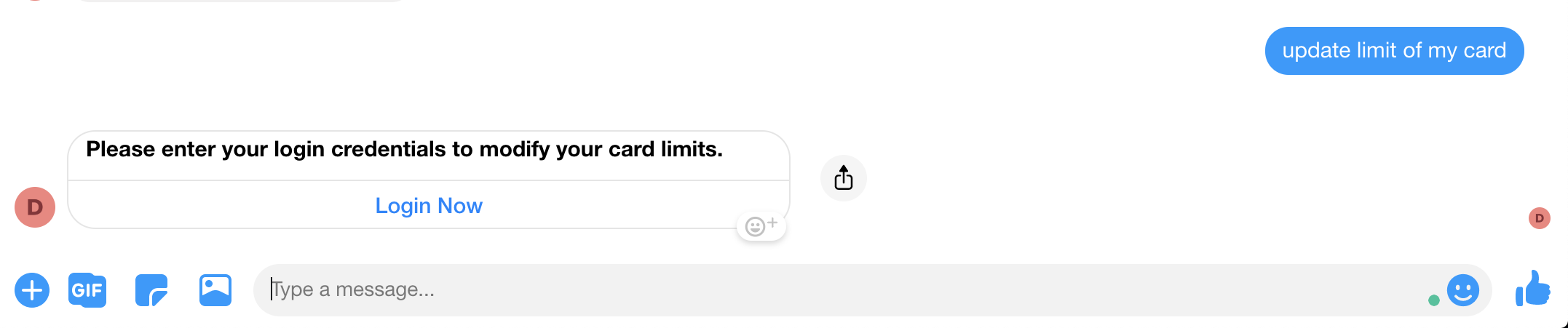

Facebook Flow -

Sample utterances that work as per the flow

- Activate my card

- Activate my card ending with 1234 (valid card number).

- Activate my visa card (only 1 visa card).

- Activate my card ending with 0000(invalid card number).

- Activate my master card (more than 1 card exists).

Configuration

Generic Configuration

- Different product categories supported in Activate Card, as configured the supported categories are Credit Card, Debit Card and Forex Card. Ex:- If ‘Prepaid Card’ need to be supported, the same need to appended as ‘prepaidcard’

- cardactivation_ACCOUNT_CATEGORIES=creditcard,debitcard,forexcard

- List all cards based on the supported card status, the default value is ‘Issued’ to list only Issued cards. Other supported Statuses are ‘Inactive’, ‘Active’, ’Closed’.

- txn-cardsettings_cardactivation_SUPPORTED_STATUS=ISSUED

- No. of cards to show on the list. The default carousel view is supported, can be changed to list by updated the template. The template details are detailed below.

- cardactivation_NO_OF_ITEMS_TO_SHOW_IN_LIST=10

Customisation

Integration Customisation

Pre-Requirement:-To fetch the API of credit and debit cards list, refer to the Balance Inquiry.

API for Activate Card Status

Request

Request URL: - http://one-api.active.ai/banking-integration/v1/{customerId}/cards/{cardNumber}/activation/confirm

customerId- String cardNumber- String

Schema:

{

"accessToken": "string",

"address": "string",

"cardDetails": {

"accountId": "string",

"accountName": "string",

"activationDate": "string",

"amountDue": 0,

"availableCash": 0,

"availableCreditLimit": 0,

"bankName": "string",

"branchAddress": "string",

"branchId": "string",

"branchName": "string",

"cardHolderName": "string",

"cardIssuer": "VISA",

"cardName": "string",

"cardNumber": "string",

"cardStatus": "ISSUED",

"cardType": "CREDIT_CARD",

"cashLimit": "string",

"closingBalance": 0,

"creditLimit": 0,

"currencyCode": "string",

"displayCardNumber": "string",

"domesticATMLimit": "string",

"domesticPOSLimit": "string",

"expiryDate": "string",

"internationalATMLimit": "string",

"internationalEnabled": true,

"internationalPOSLimit": "string",

"isInternationalEnabled": true,

"lastStatementBalance": 0,

"lastStatementDate": "string",

"maxCashLimit": "string",

"maxCreditLimit": "string",

"maxDomesticATMLimit": "string",

"maxDomesticPOSLimit": "string",

"maxInternationalATMLimit": "string",

"maxInternationalPOSLimit": "string",

"minimumPayment": 0,

"openingBalance": 0,

"outStandingAmount": 0,

"oversearCardActivated": true,

"overseasCardActivated": true,

"paymentDueDate": "string",

"permanentCreditLimit": 0,

"productCode": "string",

"productType": "string",

"temporaryCreditLimit": 0

},

"customerId": "string",

"customerName": "string",

"emailId": "string",

"mobileNumber": "string"

}

Response:

Status : 200

Meaning: OK

Description: OK

Schema:

{

"result": {

"message": "string",

"messageCode": "string",

"status": 0

},

"status": "SUCCESS",

"referenceId": "string"

}

Service API to integrate with Bank API

| Package | Class Name | Method Name | Details |

|---|---|---|---|

| services | CardsService | getActivationCardResponseEntity() | You can call your API inside this method. |

| domain-->request | ActivationCardRequest | Request Class | |

| domain-->response | ActivationCardResponse | Response Class | |

| mapper-->response | ActivationCardResponseMapper | Map API response to this mapper class | |

| model | Card | Fields, Getter/Setter methods |

Following are the types to customize the integration for the Activate Card

- Pre requirement- Cards(Debit/Credit Card) APIs should already be integrated.

Writing custom service and invoking in the camel route:-

- You can directly call your API from the integration camel by following the below steps.

- Go to that route id.

- Check for the API URL and change it by your API URL and map the response accordingly.

- Check for property and route to fetch card activation status ACTIVATION_CARD_ROUTE_URI=direct:get.activation.card.response.

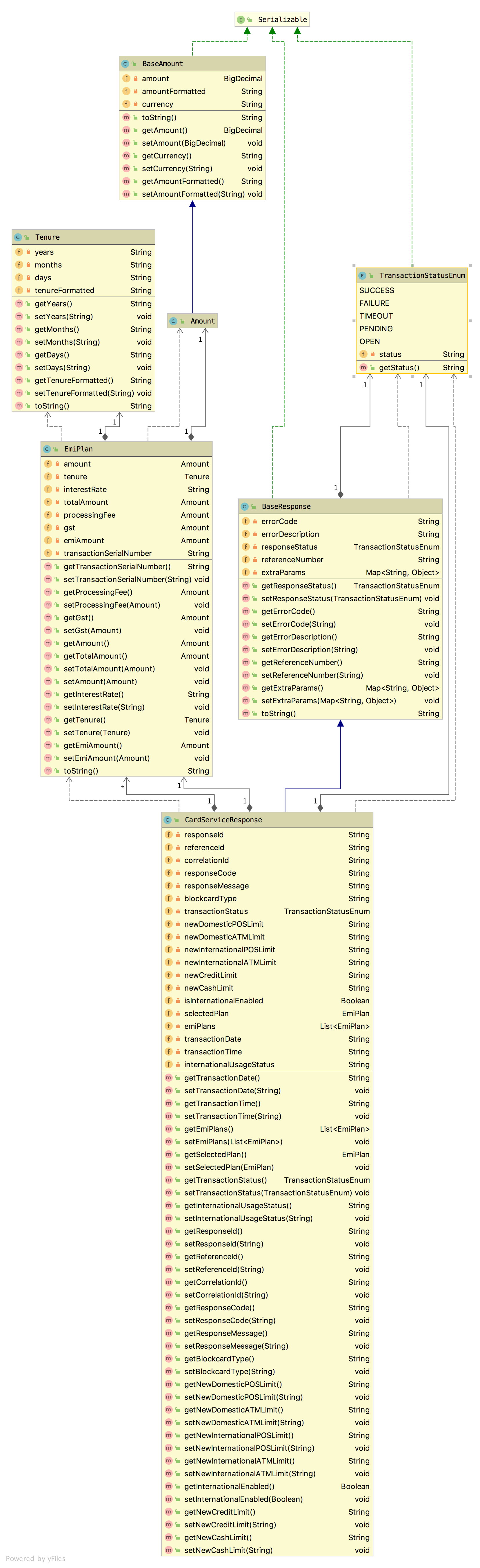

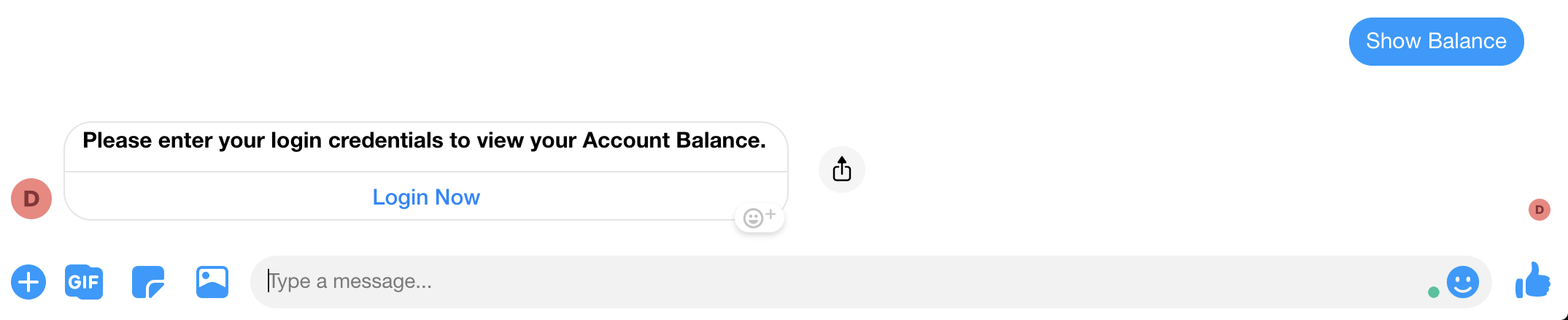

Class Diagram for Card Service Request and Card Service Response

Request Object:- Figure 1.1 describes the class diagram for CardServiceRequest Object of RB with fields and dependencies.

Response Object:- Figure 1.2 describes the class diagram for CardServiceResponse Object of RB With fields and dependencies.

Figure 1.1

Figure 1.1

Figure 1.2

Figure 1.2

Using Workflow webhook

- You can directly call your API using a workflow webhook and customize your response.

Response Customisation

Messages

- Kindly refer messages for this use case on admin by selecting respective category (Card Activation). ### Templates

- Kindly refer Templates for this use case on admin by selecting a category (Card Activation). Following are the Template Properties:-

Default card list templates are carousel to change it to list use template editor

- When all cards list to be shown and list size<4. Default is carousel template

- cardactivation_ALL_ACCOUNTS_TEMPLATE_ID=CardActivationAllAccounts

- When all cards list to be shown as list and list size>4 and show more is enabled.

- cardactivation_ACCOUNTS_WITH_SHOW_MORE_TEMPLATE_ID=CardActivationAccountsWithShowMore

- When all cards in the list need to be displayed for selection, after clicking show more button.

- cardactivation_ACCOUNTS_SHOW_MORE_REQ_TEMPLATE_ID=CardActivationAccountsWithShowMore

- When the list contains only one card. Default is a card template

- cardactivation_SINGLE_ACCOUNT_TEMPLATE_ID=CardActivationAcctSelection

- Shows a list of cards in case of a card number mismatch scenario. The default is a carousel.

- cardactivation_ACCT_SELECT_TEMPLATE_ID=CardActivationAccountMismatch

- When all cards list to be shown as list and list size>4 and show more is enabled.

- cardactivation_ACCT_SELECT_WITH_SHOW_MORE_TEMPLATE_ID=CardActivationAccountsWithShowMore

Hooks or Fulfilments

- Kindly refer Hooks or Fulfilments for name(Card Activation) use case on admin as guided on here.

Customization of Image Properties:-

Images of Cards for Cards List. Kindly refere here

Assets and Liabilities Inquiry

Coming Soon...

ATM Locator

Coming Soon...

Balance Inquiry

Overview

| Use case name | Balance Inquiry |

| Type | Inquiry |

| Intent | qry-balanceenquiry |

| Entities |

|

| Banking products supported | Savings, Checking (current), Loans, Deposits, Cards |

| Channels supported | Web, Mobile, FB messenger, Alexa |

| Login | Yes |

| 2FA | NA |

| Integrated API availability | Yes (Finastra & Corelation) |

| Integrations done | NA |

| Stub data availability | Yes |

Features

Summary

The user will be able to check the balance held in various products of the bank.

It will be possible to check the summary based on product type and also drill down to individual account details.

Alternatively, users can directly specify the account number to check balance details for a specific account relationship.

Detailed

User can view the balance details across their relationships with the financial institution.

User can mention a specific account or get the details by specifying a category (like loans, credit cards).

User can also view balances that they 'owe' (Liabilities) vs that they 'own' (Assets) i.e. their portfolio view.

- User can select a specific account, loan, card etc after expanding the category or portfolio view.

- The consolidated balance based on above grouping will be displayed.

User can retrieve balance details for an account by specifying partial details that identify one or more accounts

- ...account ending with '2678'

- ...certificate of deposits

- … 'Platinum' credit card or 'Premier' checking account

User can request for different types of balances applicable for that relationship

- ...outstanding amount on my credit card

- …minimum amount due on my credit card

- ...available balance on my savings account

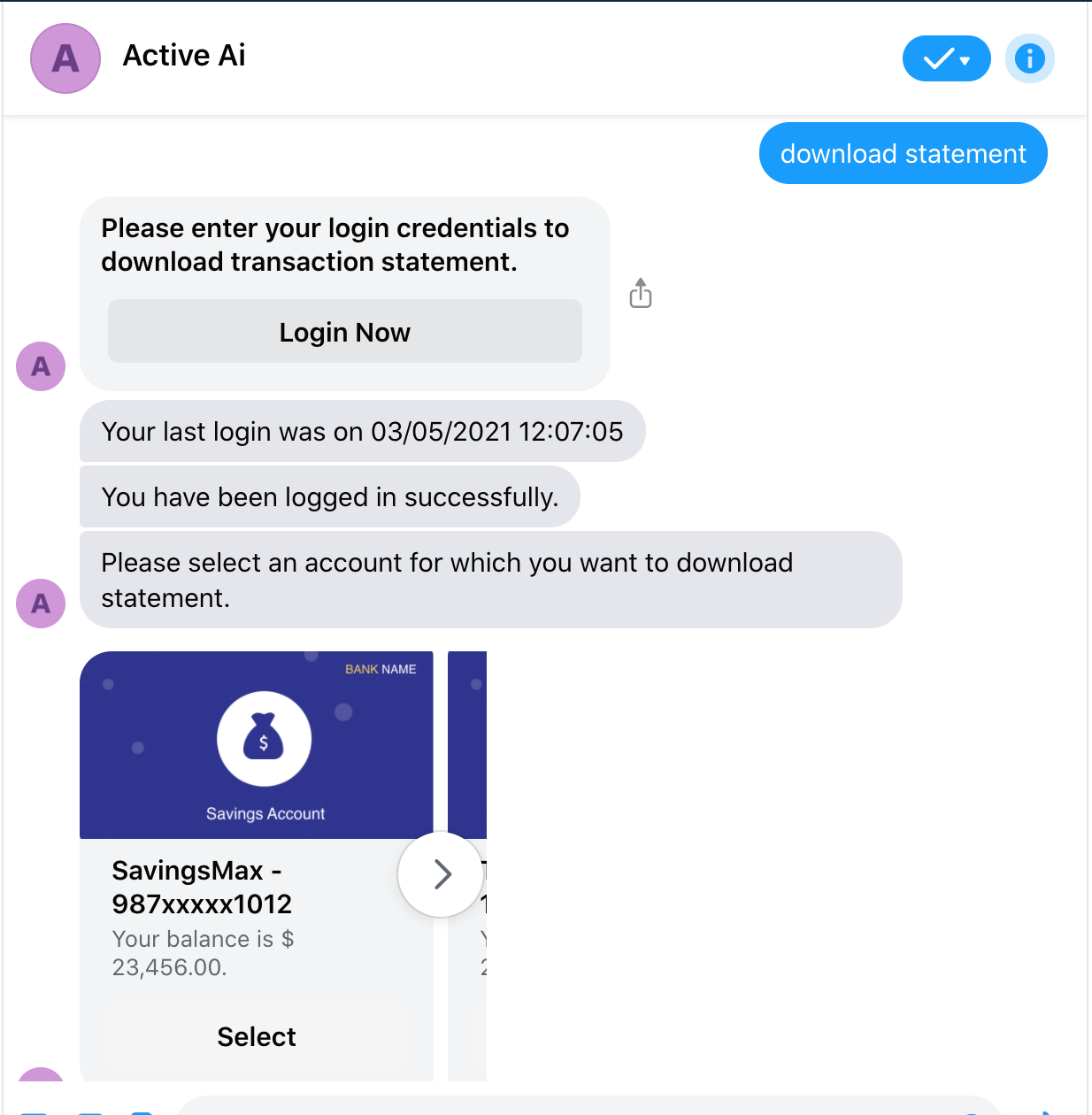

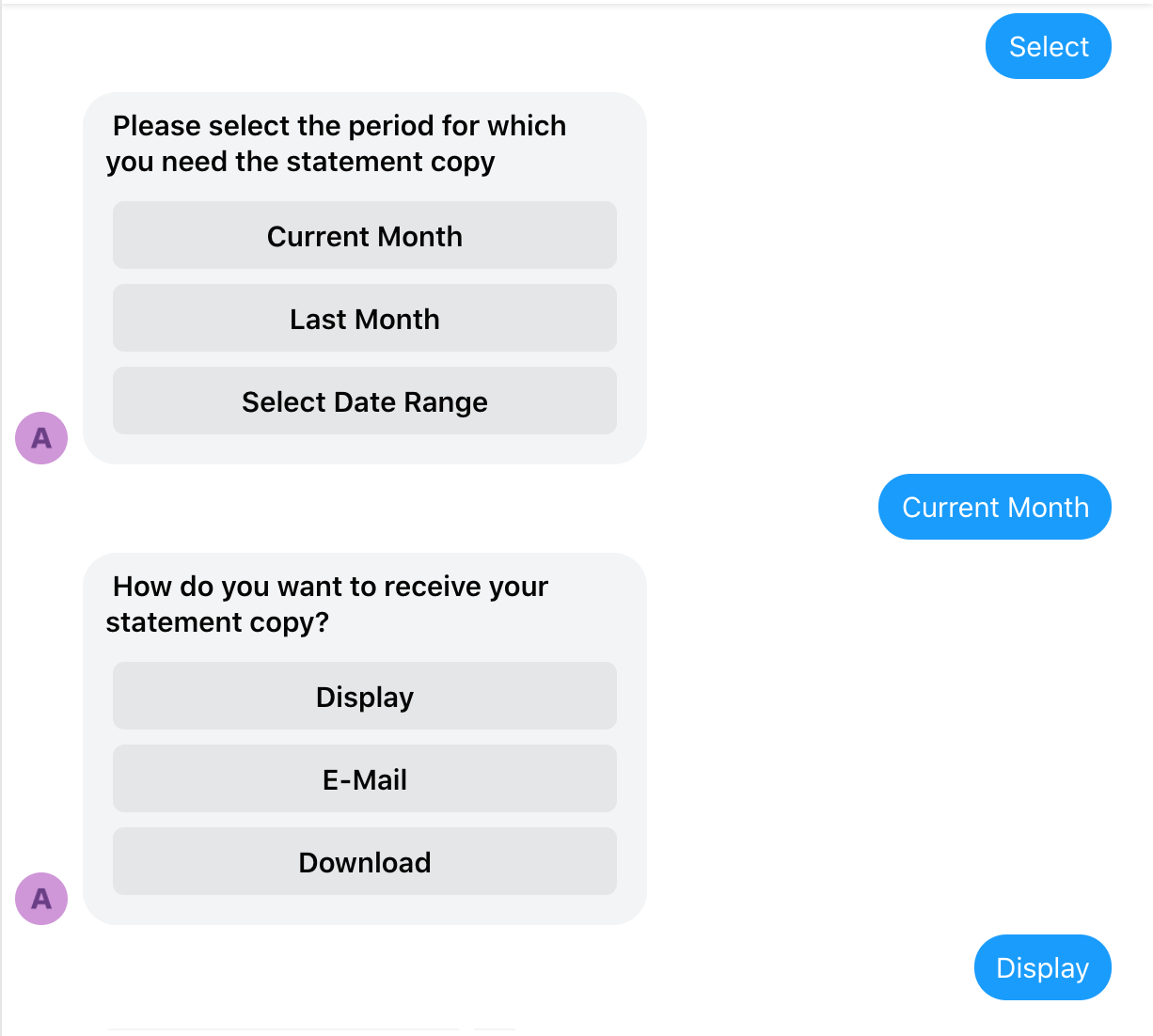

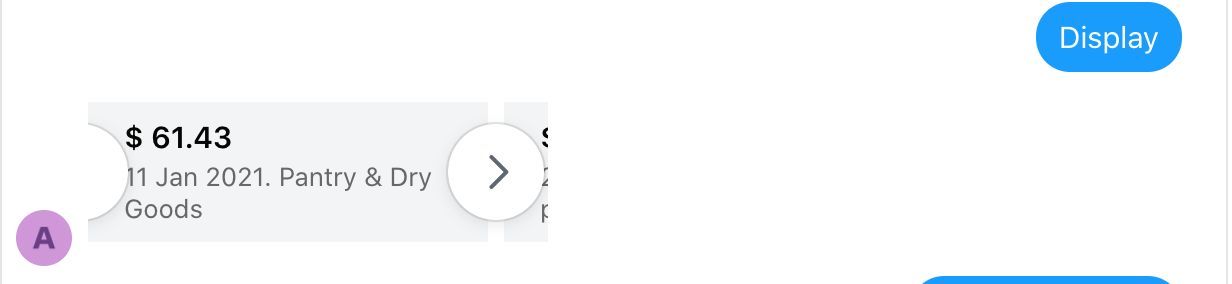

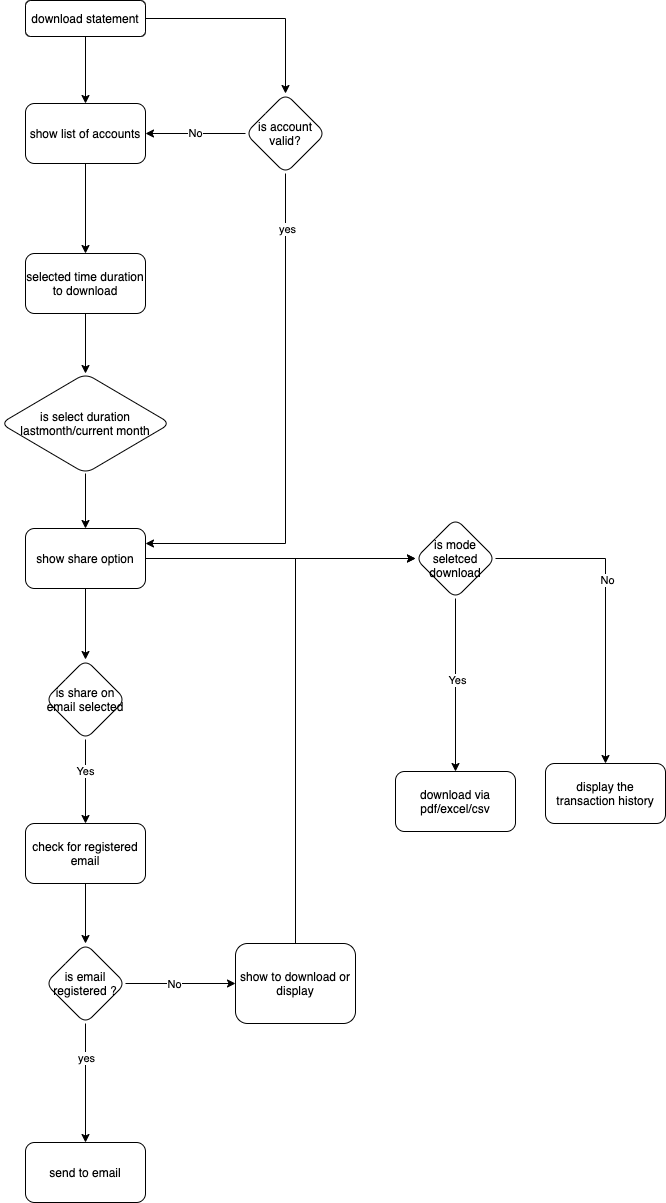

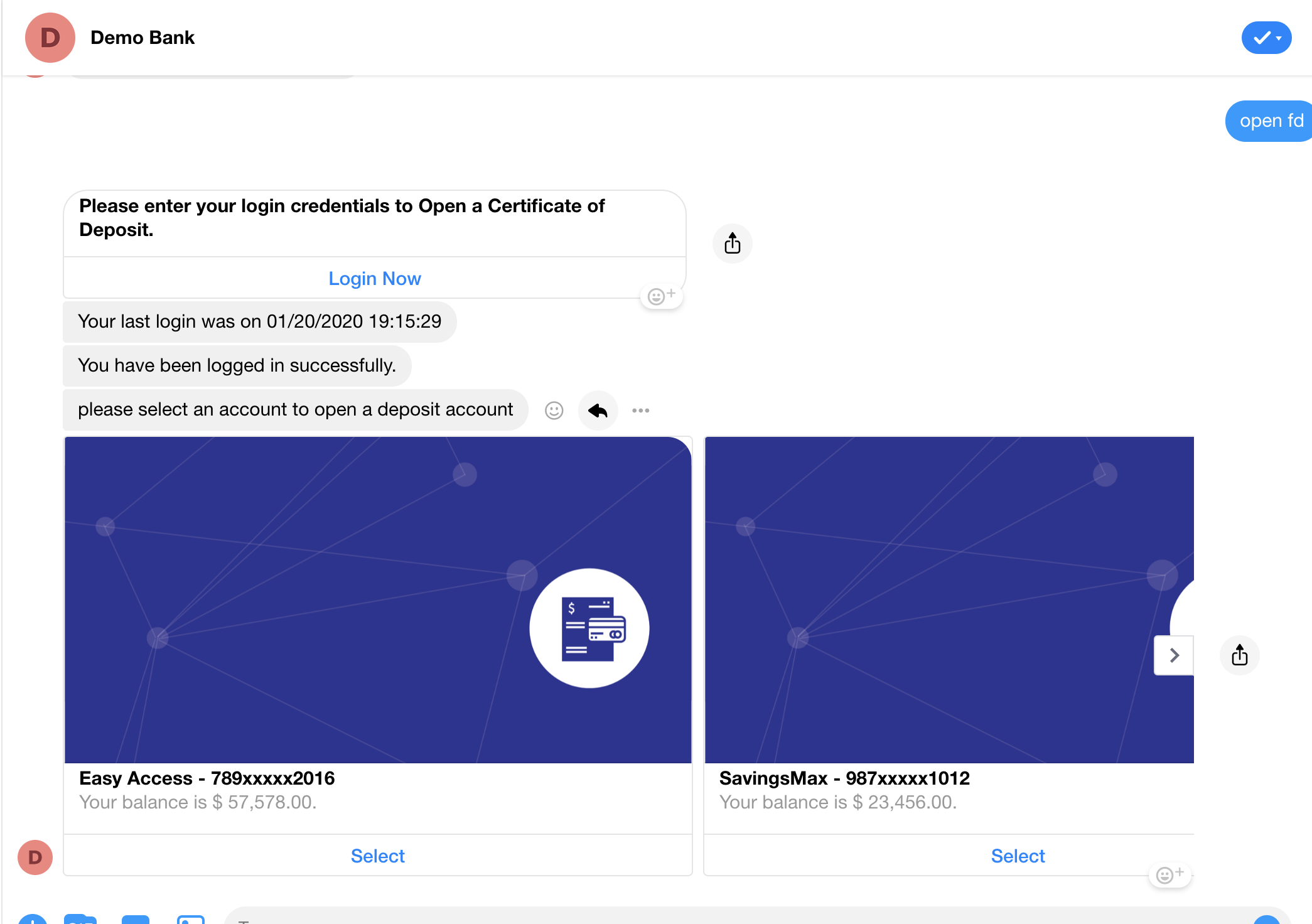

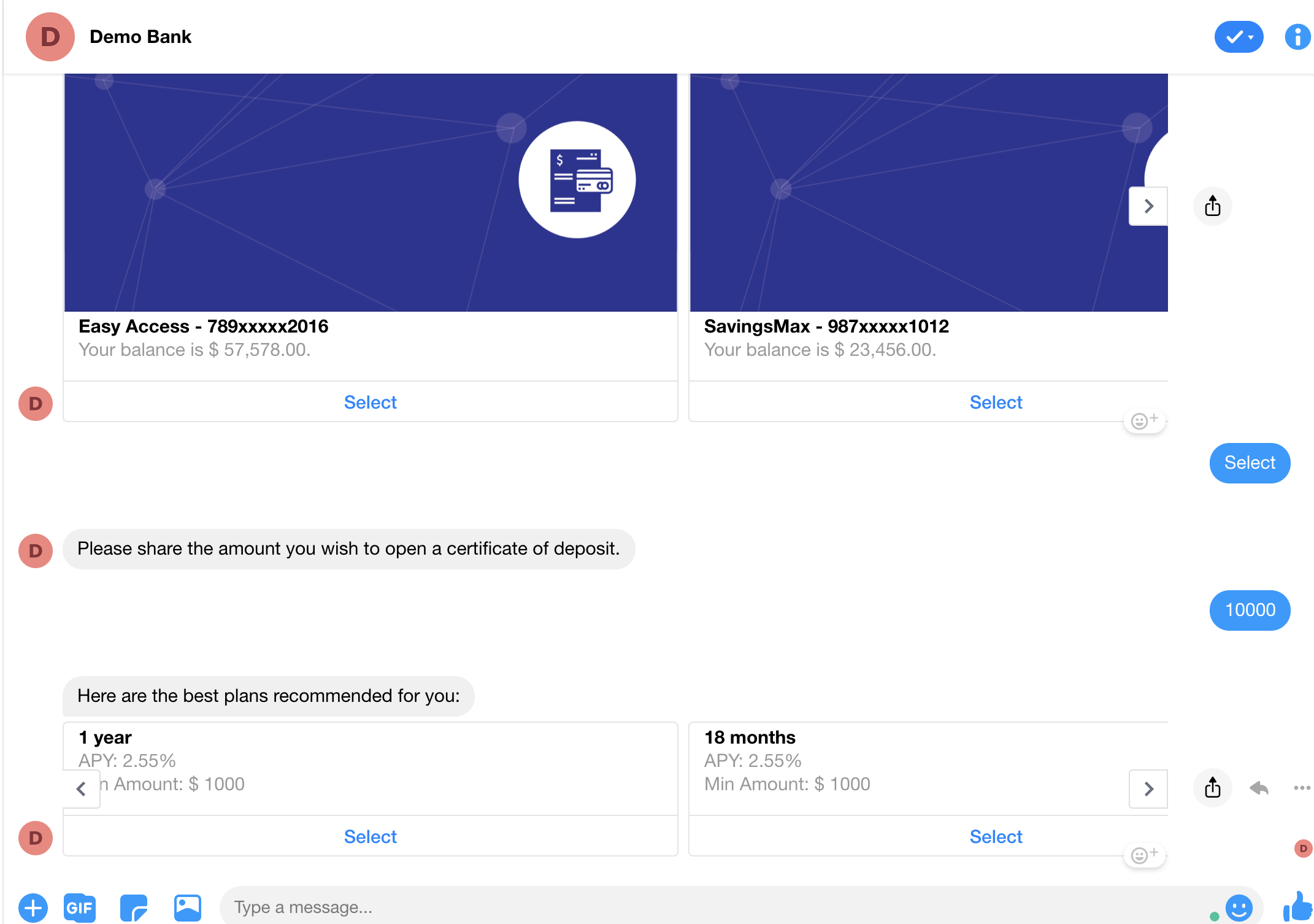

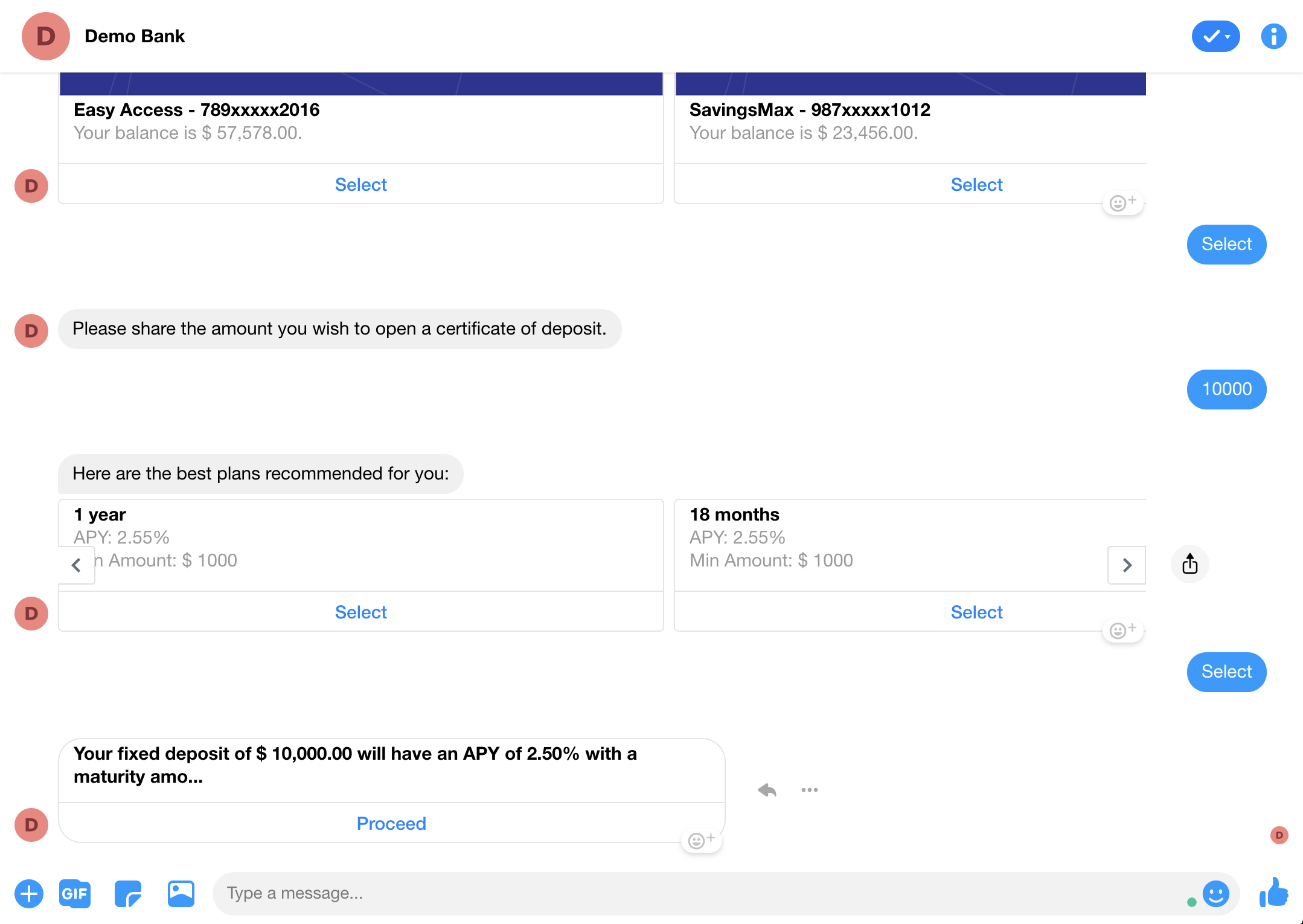

Flow CX

Note: This can be flowchart / GIF or screenshot to represent OOTB flow

Facebook Flow -

Flow Templates

Template 1: (Default)

Show as Categorised → Select a Category → List of accounts → Select an Account → View Details → View Transactions

- Applicable/Suggested when more than 1 product category is required.

Template 2:

Show as Categorised → Select a Category → List of accounts → View Transactions

- Applicable/Suggested when more than 1 product category is required.

Template 3:

Show list of accounts → Select an account → Show details → View Transactions

Template 4:

Show list of accounts → Select an account → View Transactions

Configurations

Generic Configurations

Following are the generic default configurations available with setup and are applicable for all channels.

- This property defines with all products that are supported in Balance Inquiry use-case

qry-balanceenquiry_ACCOUNT_CATEGORIES

Supported account Categories are : casa, creditcard, debitcard, loan, deposit, overdraft, forexcard

This property defines with the account types supported for Accounts

qry-balanceenquiry_SUPPORTED_ACCOUNT_TYPES=checking

Supported account types are : savings,checking

The order of listing accounts in Balance Inquiry.

ACCOUNT_CATEGORY_SORT_ORDER=casa, creditcard

The values are to be in sync with whatever configured for qry-balanceenquiry_ACCOUNT_CATEGORIES.

Sort and list the accounts based on their balances.

SORT_ACCOUNTS_BY_HIGH_BALANCE=yes

Set it to 'no' if need to show the accounts as received from API.

Following are the list of product attributes that are supported as a default set of implementation.

(statementbalance,minimumpayment,minpayment,outstandingbalance,currentbalance,latestbalance,duedate,expirydate,rewardpoints,rewardpoint,totalbalance,closingbalance,ledgerbalance,floatbalance,holdbalance,dueamount,accountopened,loyaltypoint,availablelimit,totallimit,minimumdue,mindue,lastpaymentamount,lastpaymentdate,lastmonthbill,lastmonthdue,basebranch,branch,branchname,branchaddress,nominee,tenure,interestrate,installmentamount,enddate,emiamount,accountopening,outstanding,rateofinterest,maturitydate,maturityamount,maturityinstruction,startdate,accumulatedinterest,renewaldate,cumulativeamount,currentmonthbill,presentamount,balance,lastbill,totaldue,minimumamount,minimumamountdue,nextpaymentamount,primaryowner,jointowner,nextpaymentdate,openingdate,emidate,nextemidate)

- Based on the requirement all the attributes can be enabled by appending to the following property.

qry-balanceenquiry_SUPPORTED_MODIFIERS=statementbalance,minimumpayment

- Following property is to tell bot wrt attribute responses, whether need to be as a Template or Text response.

qry-balanceenquiry_RESPONSE_TYPE=TEMPLATE

Supported values : TEMPLATE or TEXT

Will the accountSummary API list all accounts and its balances or need to do a separate call to fetch balance, if separate API need to be invoked then the following need to be set to true.

IS_BALANCE_SEPARATE_API_CALL=false

Supported boolean values are 'true' or 'false'

Configured supported products are casa & creditcard, Credit Card api is giving response with card details & balances where as Current Account & Savings Account API is not with balance details and need to invoke separate API to fetch balance, in which case we will configure this property based on product.

INVOKE_CASA_BALANCE_API=true

- From the received balance API response, all the attributes that need to be mapped back for display need to be configured in this property.

ACCOUNT_BALANCE_PROPS_FROM_API=balance,availableBalance

If balance API is invoked for each product, then the attributes can be configured for each of the products as LOAN_BALANCE_PROPS_FROM_API=outstandingbalance,installmentAmount

And same way for other products: CREDIT_CARD,DEBIT_CARD,DEPOSIT

Do we have multiple api for individual productType or one api to fetch all poroductType summaries

IS_MULTIPLE_API_CALL_FOR_GET_ACCOUNTS=false

- If we need to call multiple APIs to fetch all the supported products, then accordingly this need to be set to True.

IS_ACCOUNT_DETAILS_SEPARATE_API_CALL= false

- If details API is set to true and to invoke details API based on product, we need the set the following property to true.

INVOKE_ACCOUNT_DETAILS_API=true

other supported products are,LOAN,CREDIT_CARD,DEBIT_CARD,DEPOSIT. Replacing the product name with ACCOUNT, will be fetching details accordingly.

For voice channels if we don't want user to select an acc to know its balance, then by by setting this value it reads the balance of an account that is set as preferred/default account.

qry-balanceenquiry_aa_USE_DEFAULT_ACCOUNT=yes

qry-balanceenquiry_gh_USE_DEFAULT_ACCOUNT=yes

- Details that need to be mapped back to Product can be specified here based on Product.

ACCOUNT_DETAILS_PROPS_FROM_API=ifscCode,bankName

other supported products are,LOAN,CREDIT_CARD,DEBIT_CARD,DEPOSIT. Replacing the product name with ACCOUNT, will be fetching details accordingly.

Invoke balance api on account mismatch

when user uttered like show my balance of account number 1234 (where 1234 account is not exists)

Here need to show accounts without balance after selection needs to hit an api and show particular account balance after balance api called) by default it is true

INVOKE_BALANCE_API_ON_MISMATCH=true

Template Configurations

Template 1

Show as Categorised → Select a Category → List of accounts → Select an Account → View Details → View Transactions

| Config ID | Configuration | Details |

|---|---|---|

| C1 | show balance based 1) Category 2) Account | Category to get categorised as Accounts /Cards/Loans/Deposits etc, use this config to enable this DEFAULT_BALANCE_VIEW=balance_by_category * Account - to display individual account details |

| C2 | Is cumulative balance is returned from bank API? | Yes(default), No |

| C3 | qry-balanceenquiry_INVOKE_ACCOUNT_DETAILS_API=true | This value is set to 'true' to fetch details of the selected account. |

Template 2

Show as Categorised → Select a Category → List of accounts → View Transactions

| Config ID | Configuration | Details |

|---|---|---|

| C1 | show balance based 1) Category 2) Account | 1) Category -to get categorised as Accounts /Cards/Loans/Deposits etc, use this config to enable this DEFAULT_BALANCE_VIEW=balance_by_category 2) Account - to display individual account details |

| C2 | Is cumulative balance is returned from bank API? | Yes(default),No |

| C3 | Do you want to display account with high balance as the order within each category? | Yes(default),No |

| C4 | qry-balanceenquiry_ALL_ACCOUNTS_TEMPLATE_ID=AllAccountsListForTrxn qry-balanceenquiry_ACCOUNTS_SHOW_MORE_REQ_TEMPLATE_ID=AllAccountsListForTrxn qry-balanceenquiry_SINGLE_ACCOUNT_TEMPLATE_ID=BalanceViewSingleAccountForTrxn qry-balanceenquiry_ACCT_SELECT_TEMPLATE_ID=BalInqAcctSelectionForTrxn qry-balanceenquiry_ACCT_SELECT_WITH_SHOW_MORE_TEMPLATE_ID=BalInqAcctSelectionForTrxn qry-balanceenquiry_ACCOUNTS_WITH_SHOW_MORE_TEMPLATE_ID=AccountsListWithShowMoreForTrxn | Update these configurations either in domainrulemstr or rb property file |

Template 3

Show list of accounts → Select an account → View details → View Transactions

| Config ID | Configuration | Details |

|---|---|---|

| C1 | show balance based 1) Account | Account - to display individual account details DEFAULT_BALANCE_VIEW=drilldown To get list of accounts in first step itself |

| C2 | Is cumulative balance is returned from bank API? | Yes(default), No |

Template 4

Show list of accounts → Select an account → View Transactions

|Config ID|Configuration| Details| |---|---|---| |C1|show balance based 1) Category 2) Account| 1) Category -to get categorised as Accounts /Cards/Loans/Deposits etc, use this config to enable this DEFAULT_BALANCE_VIEW=balance_by_category 2) Account - to display individual account details | | C2| Is cumulative balance is returned from bank API? | Yes(default),No| |C3|Do you want to display account with high balance as the order within each category?|Yes(default),No| |C4|qry-balanceenquiry_ALL_ACCOUNTS_TEMPLATE_ID=AllAccountsListForTrxn qry-balanceenquiry_ACCOUNTS_SHOW_MORE_REQ_TEMPLATE_ID=AllAccountsListForTrxn qry-balanceenquiry_SINGLE_ACCOUNT_TEMPLATE_ID=BalanceViewSingleAccountForTrxn qry-balanceenquiry_ACCT_SELECT_TEMPLATE_ID=BalInqAcctSelectionForTrxn qry-balanceenquiry_ACCT_SELECT_WITH_SHOW_MORE_TEMPLATE_ID=BalInqAcctSelectionForTrxn qry-balanceenquiry_ACCOUNTS_WITH_SHOW_MORE_TEMPLATE_ID=AccountsListWithShowMoreForTrxn |Update these configurations either in domainrulemstr or rb property file

Customisation

Integration Customisation

- Checkout the RB Stub Integration Services code from the Repo for quick and easy integration. click here Integrate with the Bank Login API using the given code, deploy and starts working.

Request / Response

Sample Request-Response in the case of one API returning accounts with balances.

Along with accounts/cards summary call itself

Request:

Request URL : http://localhost:8080/banking-integration/v1/{customerId}/accounts/{productType}

customerId - String

productType - String (casa, deposit, creditcard, debitcard, loan)

Response :

Status : 200

Meaning: OK

Description: OK

Schema:

{

"accounts":[

{

"accountId":"string",

"accountName":"string",

"accountNumber":"string",

"accountType":"SAVINGS",

"balance":{

"amount":0,

"availableBalance":0,

"currencyCode":"string",

"currentBalance":0,

"monthlyAverageBalance":0

},

"bankName":"string",

"branchAddress":"string",

"branchId":"string",

"branchName":"string",

"displayAccountNumber":"string",

"ifscCode":"string",

"lastStatementBalance":0,

"lastStatementDate":"string",

"leavesCount":"string",

"openingDate":"string",

"product":"Fixed Deposit",

"productCode":"string",

"referenceId":"string",

"status":"NEW_ACCOUNT",

"transactionStatus":"SUCCESS"

}

],

"result":{

"message":"string",

"messageCode":"string",

"status":0

}

}

Separate call for Balance

If need to do a separate API call to fetch balance for account list received in above call.

Request:

Request URL: http://one-api.active.ai/banking-integration/v1/{customerId}/accounts/{productType}/{accountId}/balance

customerId - String

productType - String (casa, deposit, creditcard, debitcard, loan)

Response:

Status : 200

Meaning: OK

Description: OK

Schema:

{

"accountSelected":{

"accountId":"string",

"accountName":"string",

"accountNumber":"string",

"accountType":"SAVINGS",

"balance":{

"amount":0,

"availableBalance":0,

"currencyCode":"string",

"currentBalance":0,

"monthlyAverageBalance":0

},

"bankName":"string",

"branchAddress":"string",

"branchId":"string",

"branchName":"string",

"displayAccountNumber":"string",

"ifscCode":"string",

"lastStatementBalance":0,

"lastStatementDate":"string",

"leavesCount":"string",

"openingDate":"string",

"product":"Fixed Deposit",

"productCode":"string",

"referenceId":"string",

"status":"NEW_ACCOUNT",

"transactionStatus":"SUCCESS"

},

"result":{

"message":"string",

"messageCode":"string",

"status":0

}

}

Separate API to fetch Details

Request:

Request URL: http://one-api.active.ai/banking-integration/v1/{customerId}/accounts/{productType}/{accountId}

customerId - String

accountId - String

productType - String (casa, deposit, creditcard, debitcard, loan)

Response:

Status : 200

Meaning: OK

Description: OK

Schema:

{

"accountDetails":{

"accountId":"string",

"accountName":"string",

"accountNumber":"string",

"accountType":"SAVINGS",

"balance":{

"amount":0,

"availableBalance":0,

"currencyCode":"string",

"currentBalance":0,

"monthlyAverageBalance":0

},

"bankName":"string",

"branchAddress":"string",

"branchId":"string",

"branchName":"string",

"displayAccountNumber":"string",

"ifscCode":"string",

"lastStatementBalance":0,

"lastStatementDate":"string",

"leavesCount":"string",

"openingDate":"string",

"product":"Fixed Deposit",

"productCode":"string",

"referenceId":"string",

"status":"NEW_ACCOUNT",

"transactionStatus":"SUCCESS"

},

"result":{

"message":"string",

"messageCode":"string",

"status":0

}

}

- Following are the Balance Request-Response objects using which one can integrate with product with own integration coding. By pointing the following RB property value to integration camel route id for supported productTypes.

Route to fetch Current Account & Savings Account accounts ACCOUNT_ROUTE_URI=direct:demobank.stub.getAccounts (Default value for Current Account & Savings Account)

Route to fetch Credit cards CREDIT_CARD_ROUTE_URI=direct:demobank.stub.getCreditCards

Route to fetch Debit cards DEBIT_CARD_ROUTE_URI=direct:demobank.stub.getDebitCards

Route to fetch Deposit accounts DEPOSIT_ROUTE_URI=direct:demobank.stub.getDeposits

Route to fetch Loan accounts LOAN_ROUTE_URI=direct:demobank.stub.getLoans

Route to fetch Forex cards FOREX_CARD_ROUTE_URI=direct:demobank.stub.getForexCards

Class Diagrams

For class Diagrams click here

Response Customisation

The properties needs to be formatted properly so that on response visible on templates should be in proper like 100000 -> 1,10,000

ACCOUNT_AMOUNT_PROPS_TO_BE_FORMATTED=balance,availableBalance

You can customise flows as you required on given above three templates

For Template 2 and Template 3

When all accounts to be shown as list and list size<4. Default is list template, to change to carousel template, click here for template editor qry-balanceenquiry_ALL_ACCOUNTS_TEMPLATE_ID=AllAccountsList

When all accounts in the list should be displayed, after clicking show more button qry-balanceenquiry_ACCOUNTS_SHOW_MORE_REQ_TEMPLATE_ID=AllAccountsList

When list contains only one account. Default is card template qry-balanceenquiry_SINGLE_ACCOUNT_TEMPLATE_ID=BalanceViewSingleAccount

To enable/disable show more qry-balanceenquiry_IS_ACCOUNT_SHOW_MORE_SUPPORTED=yes

Shows list of accounts in case of account number mismatch scenario qry-balanceenquiry_ACCT_SELECT_TEMPLATE_ID=BalInqAcctSelection

Shows list of accounts in case of account number mismatch scenario, list size>4 and show more is enabled. qry-balanceenquiry_ACCT_SELECT_WITH_SHOW_MORE_TEMPLATE_ID=BalInqAcctSelection

When all accounts to be shown as a list with account details and list size>4 and show more is enabled. Default is list template qry-balanceenquiry_ACCOUNTS_WITH_SHOW_MORE_TEMPLATE_ID=AccountsListWithShowMoreWithGetDetails

For Template 1 and Template 4

When all accounts to be shown as a list, list size<4. Default is list template qry-balanceenquiry_ALL_ACCOUNTS_TEMPLATE_ID=AllAccountsListForTrxn

When all accounts to be shown as list after clicking show more button qry-balanceenquiry_ACCOUNTS_SHOW_MORE_REQ_TEMPLATE_ID=AllAccountsListForTrxn

When list contains only one account. Default is card template qry-balanceenquiry_SINGLE_ACCOUNT_TEMPLATE_ID=BalanceViewSingleAccountForTrxn

Shows list of accounts in case of account number mismatch scenario qry-balanceenquiry_ACCT_SELECT_TEMPLATE_ID=BalInqAcctSelectionForTrxn

Shows list of accounts in case of account number mismatch scenario when show more is clicked qry-balanceenquiry_ACCT_SELECT_WITH_SHOW_MORE_TEMPLATE_ID=BalInqAcctSelectionForTrxn

When all accounts to be shown as a list, list size>4 and show more is enabled. Default is list template qry-balanceenquiry_ACCOUNTS_WITH_SHOW_MORE_TEMPLATE_ID=AccountsListWithShowMoreForTrxn

Product Images:

Images can be displayed differently for each product in template.

We configure images to be shown on templates as described below

Example: - qry-balanceenquiry_VISA_IMAGE_URL={S3_DOMAIN_NAME}/visa_card_2x.png

Account Specific Images:

SAVINGS_IMAGE_URL={S3_DOMAIN_NAME}/savings_account_2x.png CHECKING_IMAGE_URL={S3_DOMAIN_NAME}/current_account_2x.png DEPOSIT_IMAGE_URL={S3_DOMAIN_NAME}/deposit_account_2x.png LOAN_IMAGE_URL={S3_DOMAIN_NAME}/loan_account_2x.png SAVINGS_SINGLE_IMAGE_URL={S3_DOMAIN_NAME}/savings_account_2x.png CHECKING_SINGLE_IMAGE_URL={S3_DOMAIN_NAME}/current_account_2x.png DEPOSIT_SINGLE_IMAGE_URL={S3_DOMAIN_NAME}/deposit_account_2x.png LOAN_SINGLE_IMAGE_URL={S3_DOMAIN_NAME}/loan_account_2x.png

Card Specific Images:

qry-balanceenquiry_MASTER_IMAGE_URL={S3_DOMAIN_NAME}/master_card_2x.png qry-balanceenquiry_AMEX_IMAGE_URL={S3_DOMAIN_NAME}/default_card_2x.png qry-balanceenquiry_DINERS_IMAGE_URL={S3_DOMAIN_NAME}/default_card_2x.png qry-balanceenquiry_MASTER_SINGLE_IMAGE_URL={S3_DOMAIN_NAME}/master_card_2x.png qry-balanceenquiry_AMEX_SINGLE_IMAGE_URL={S3_DOMAIN_NAME}/default_card_2x.png qry-balanceenquiry_DINERS_SINGLE_IMAGE_URL={S3_DOMAIN_NAME}/default_card_2x.png

We can customise response on template using template editor as shown here

Messages

Kindly refer messages for this use case on admin by selecting respective category ( like Balance Inquiry,Balance Common,Common) as shown here

Templates

Kindly refer Templates for this use case on admin by selecting a category (like Balance Inquiry,Balance Common,Common) as shown here

Hooks or Fulfilment's:

Kindly refer Hooks or Fulfilment's for name(Balance_Inquiry) use case on admin as guided on here.

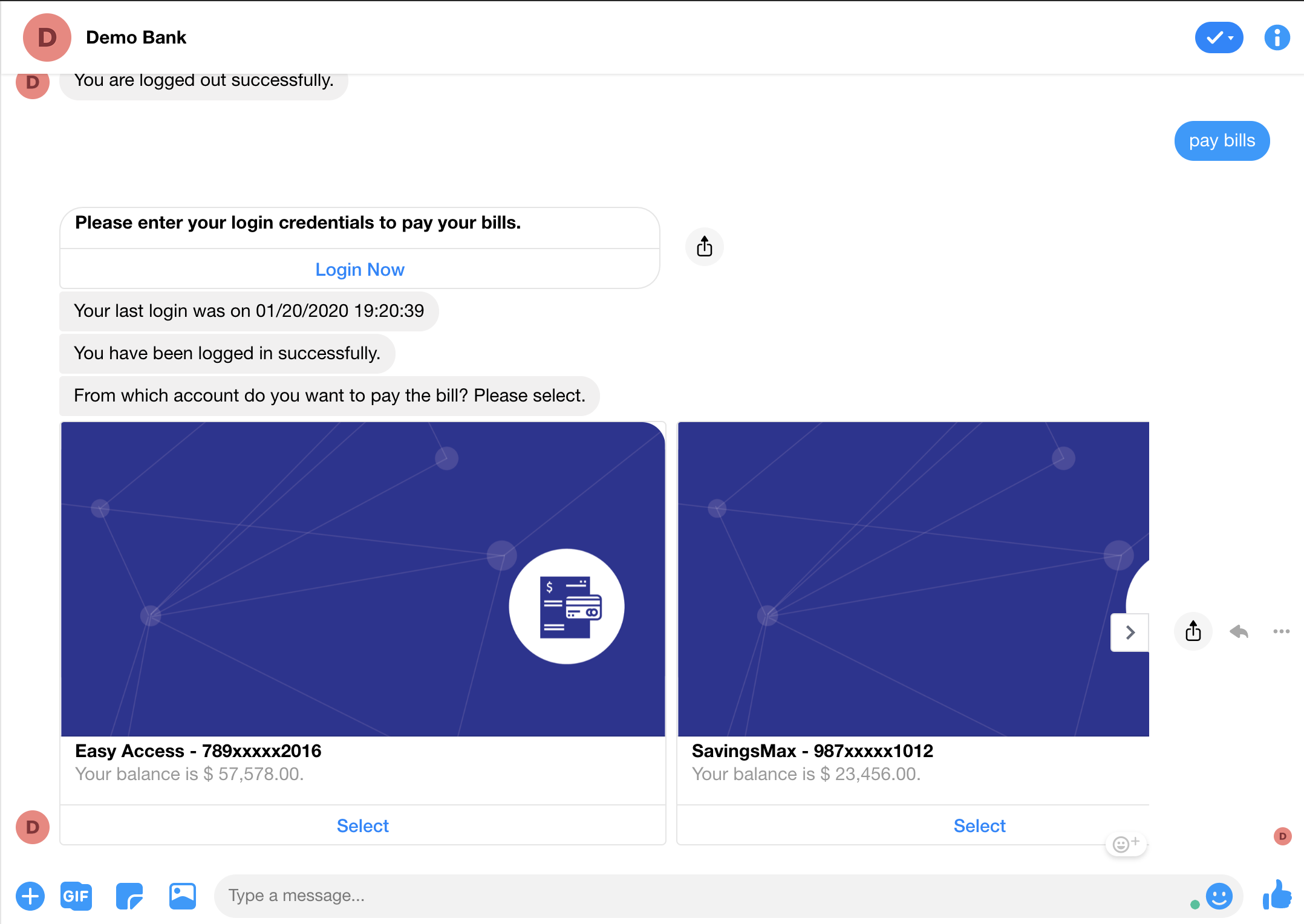

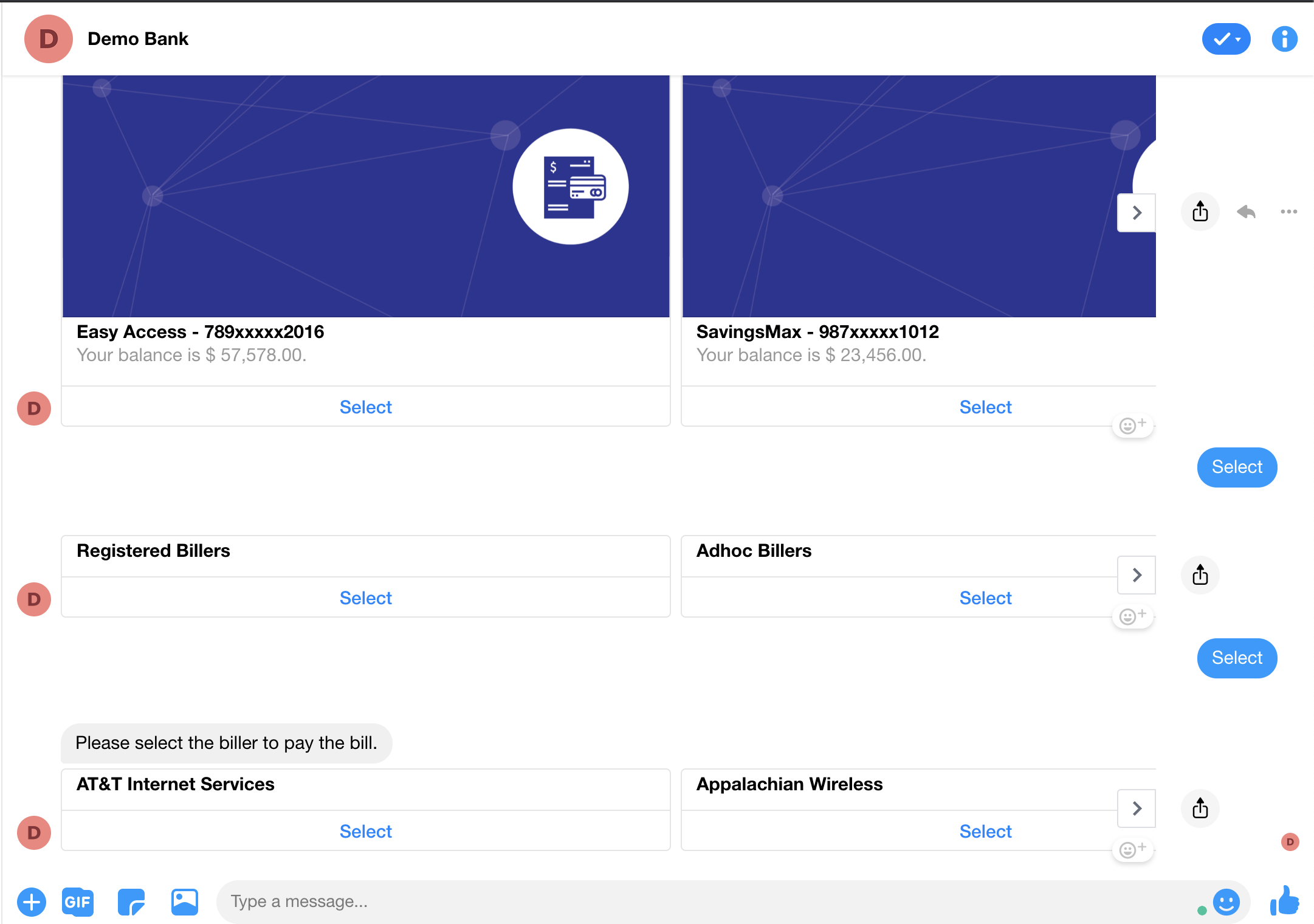

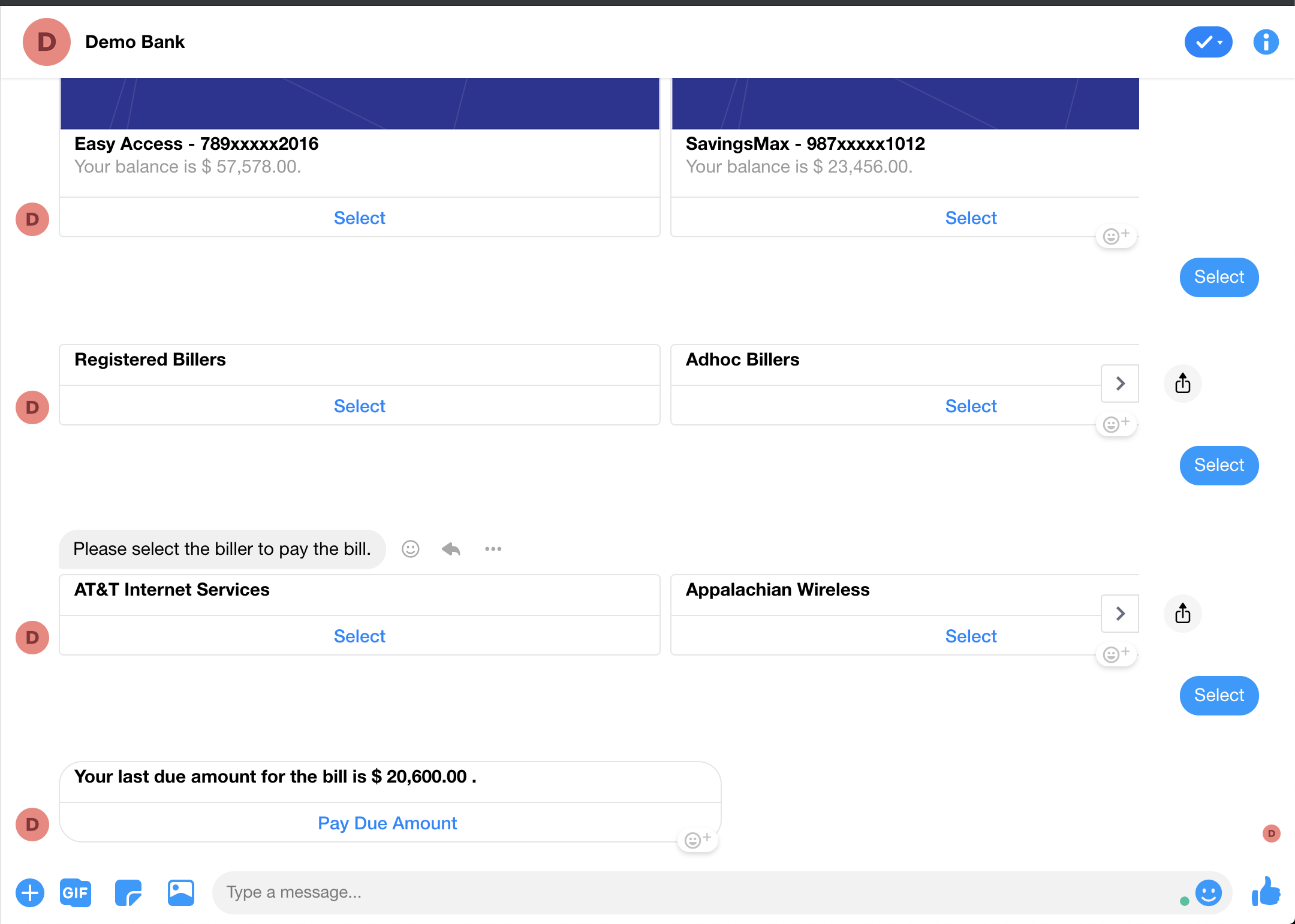

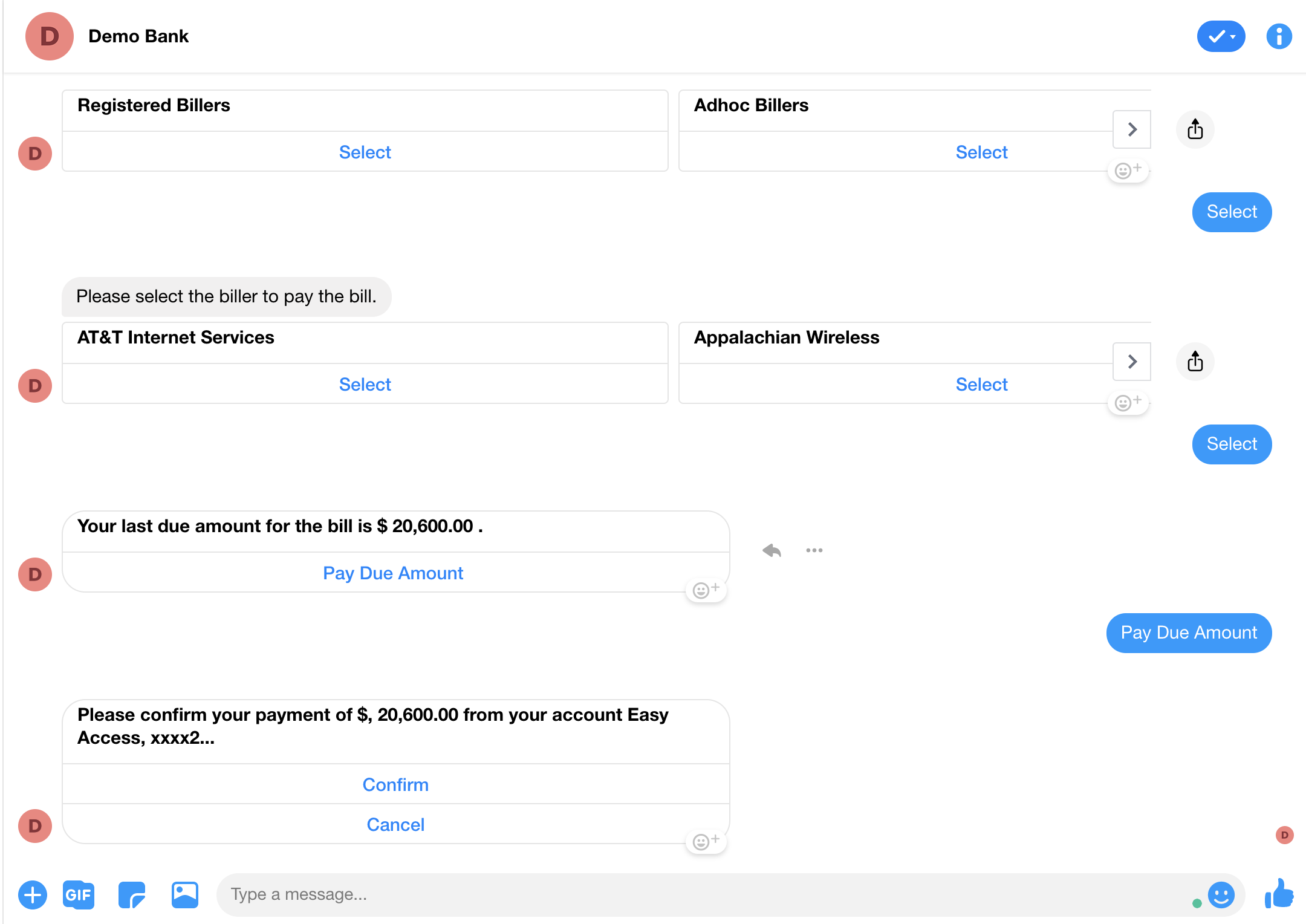

Bill Payment

Overview

| Use case name | Bill payment |

| Type | Transaction |

| Intent | txn-moneymovement |

| Entities |

|

| Banking products supported | Operative accounts, credit card |

| Channels supported | Web, Mobile, FB messenger, Alexa |

| Login | Yes |

| 2FA | Yes |

| API availability | Yes |

| Integrations done | NA |

| Stub data availability | Yes |

Features

Summary

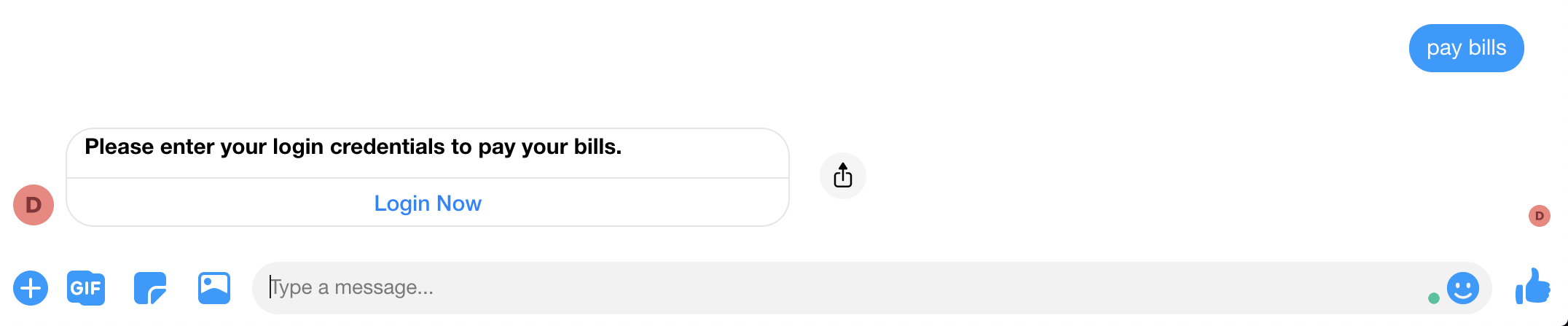

Users can make bill payments for various types of bills including credit cards.

Bills of registered billers and credit cards can be paid.

Detailed

Users can express interest in paying their bills.

System will check for previous records and suggest preferred account from which bill needs to be paid.

Users can choose any other account of their choice, if not going with the suggested account.

Once account selection is done, system will provide options to choose between credit card and other registered billers

We are supporting pay bills for different Billers

Registered

- Other Billers(Default) Pay bills for registered ones like Electricity bills, mobile bills, gas bills

- Credit Card Payment(Default)

Non-Registered Billers

- Other Billers(need to configure)

- Credit Card Payment(need to configure)

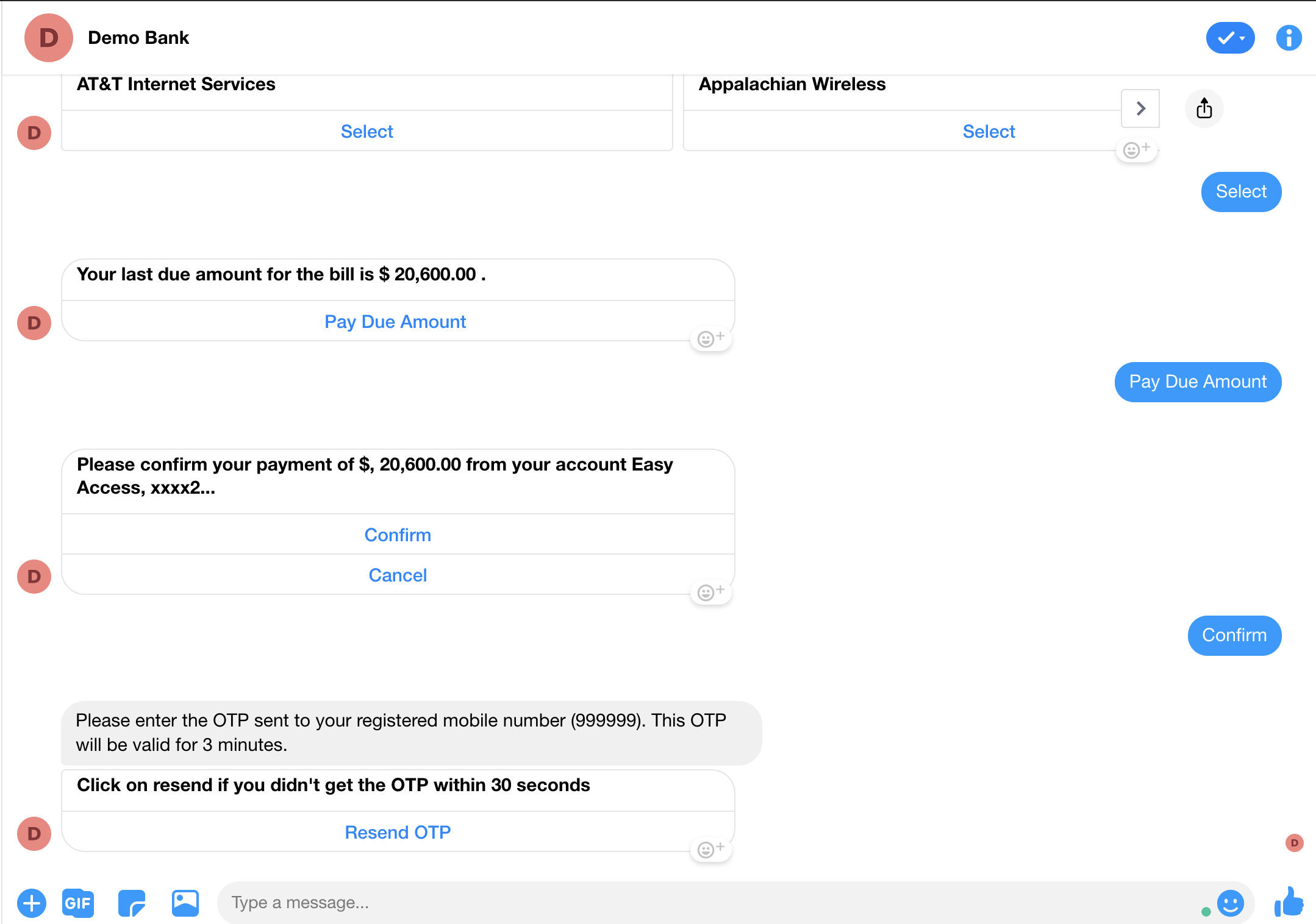

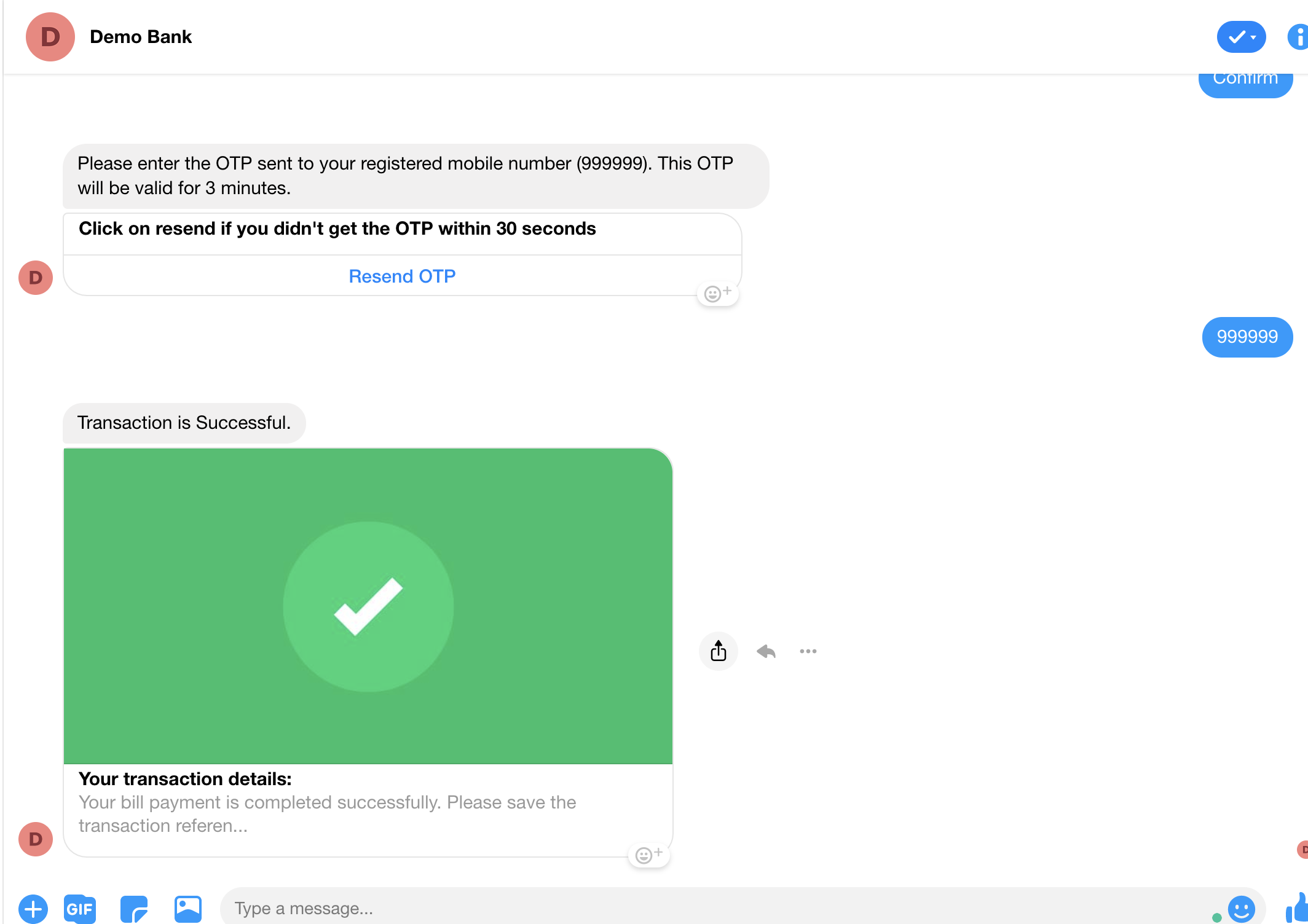

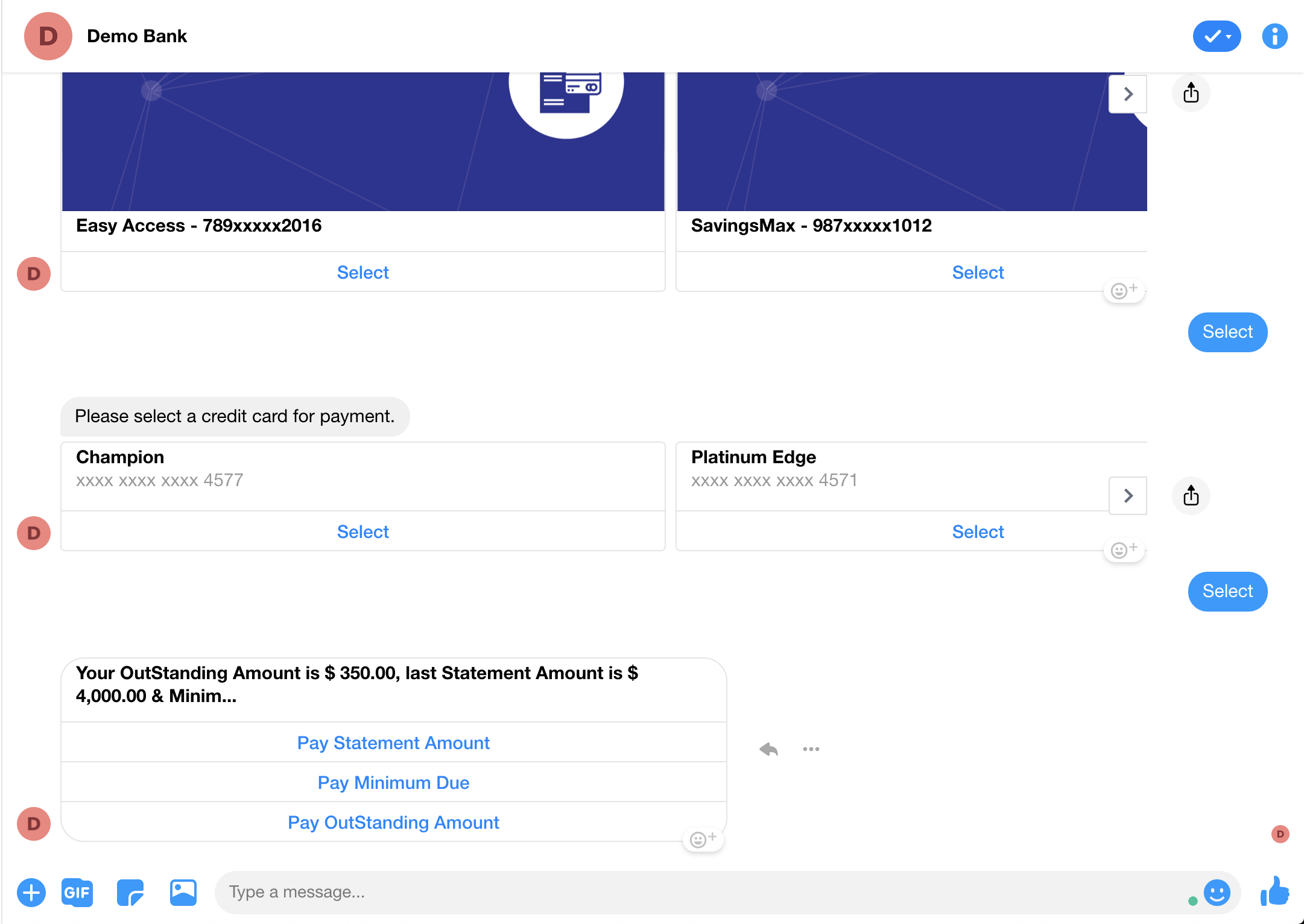

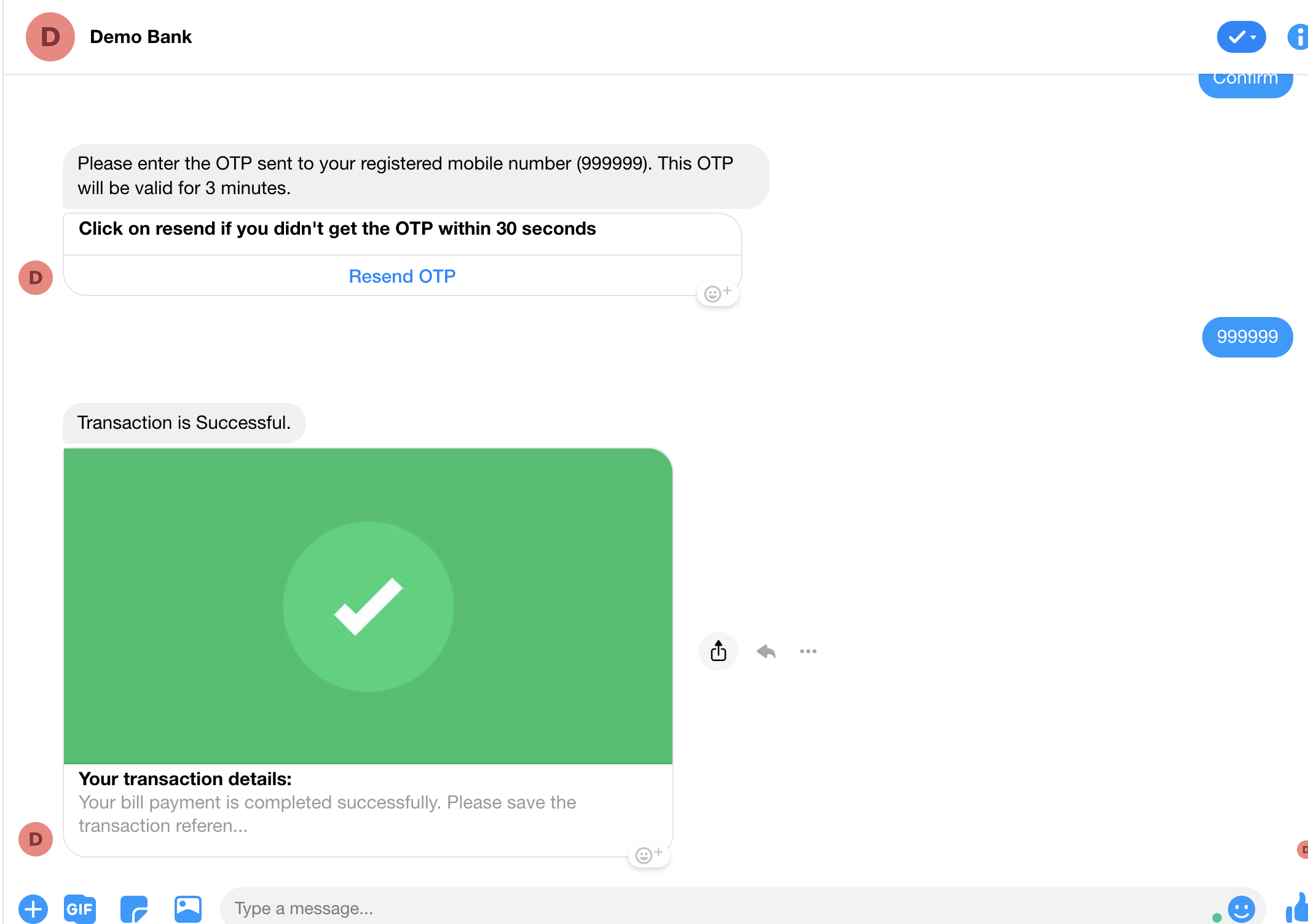

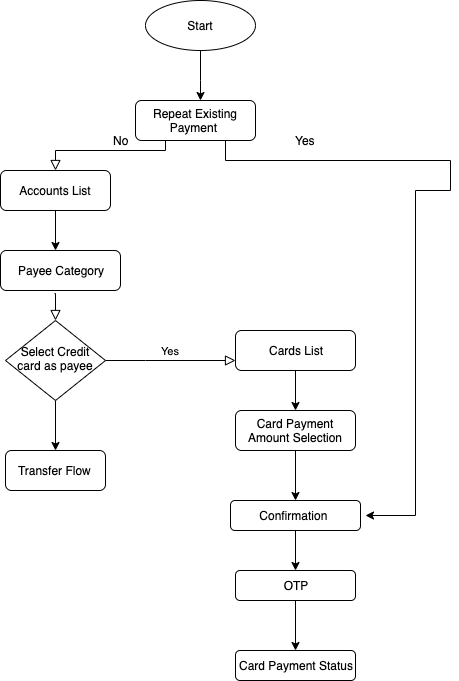

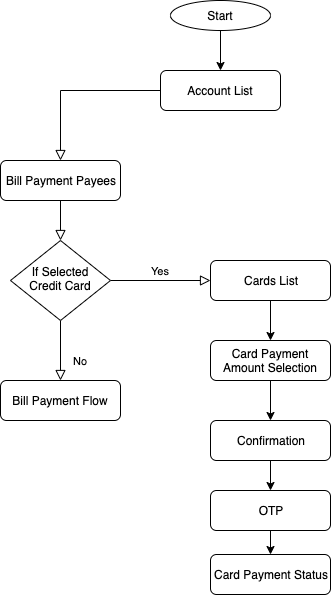

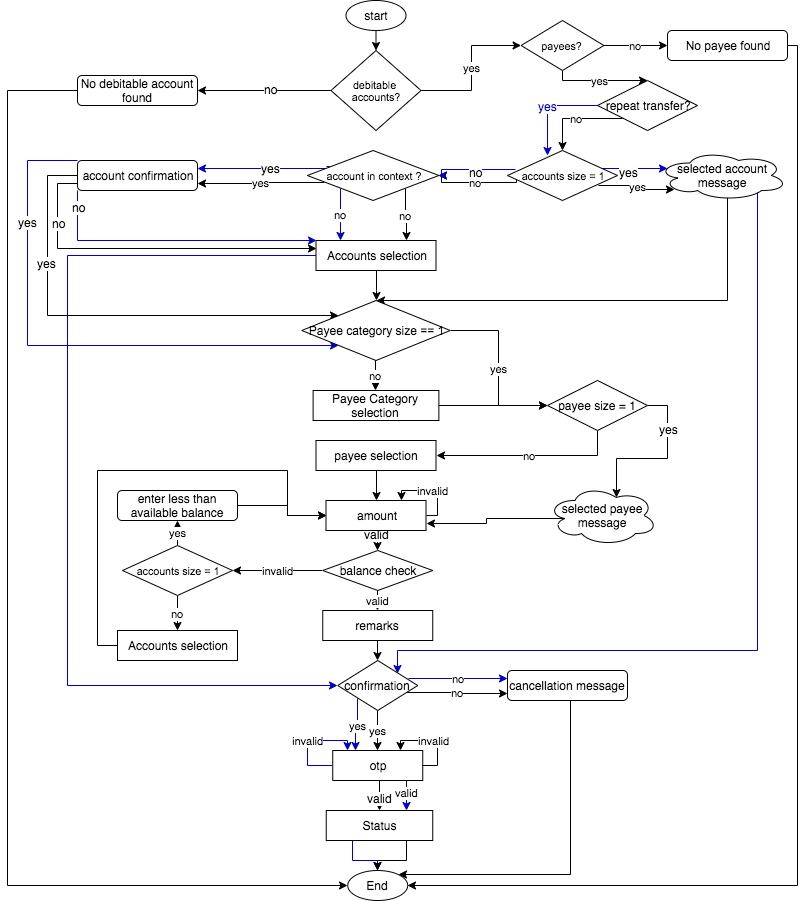

Flow CX

Note: This can be flowchart / GIF or screenshot to represent OOTB flow

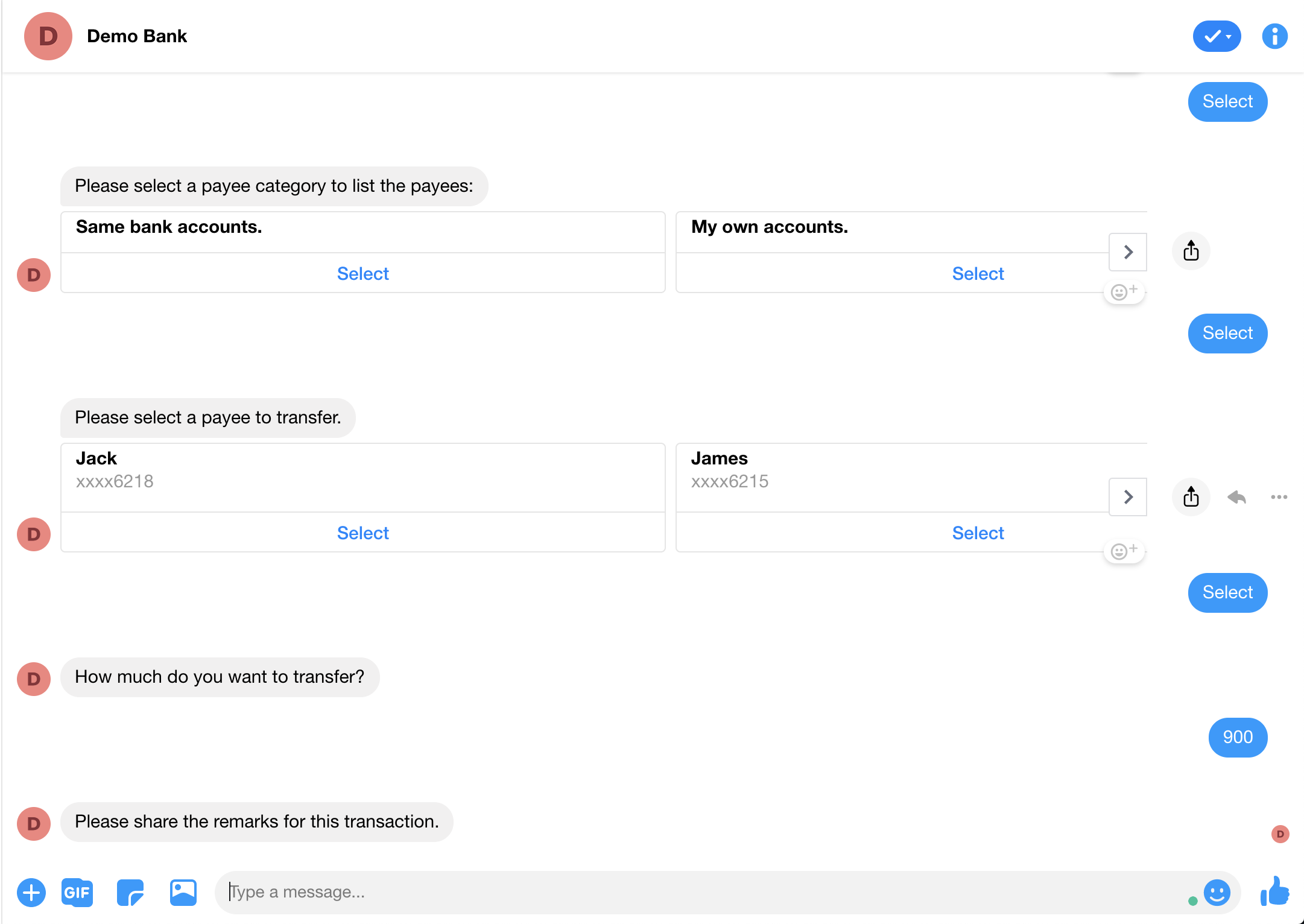

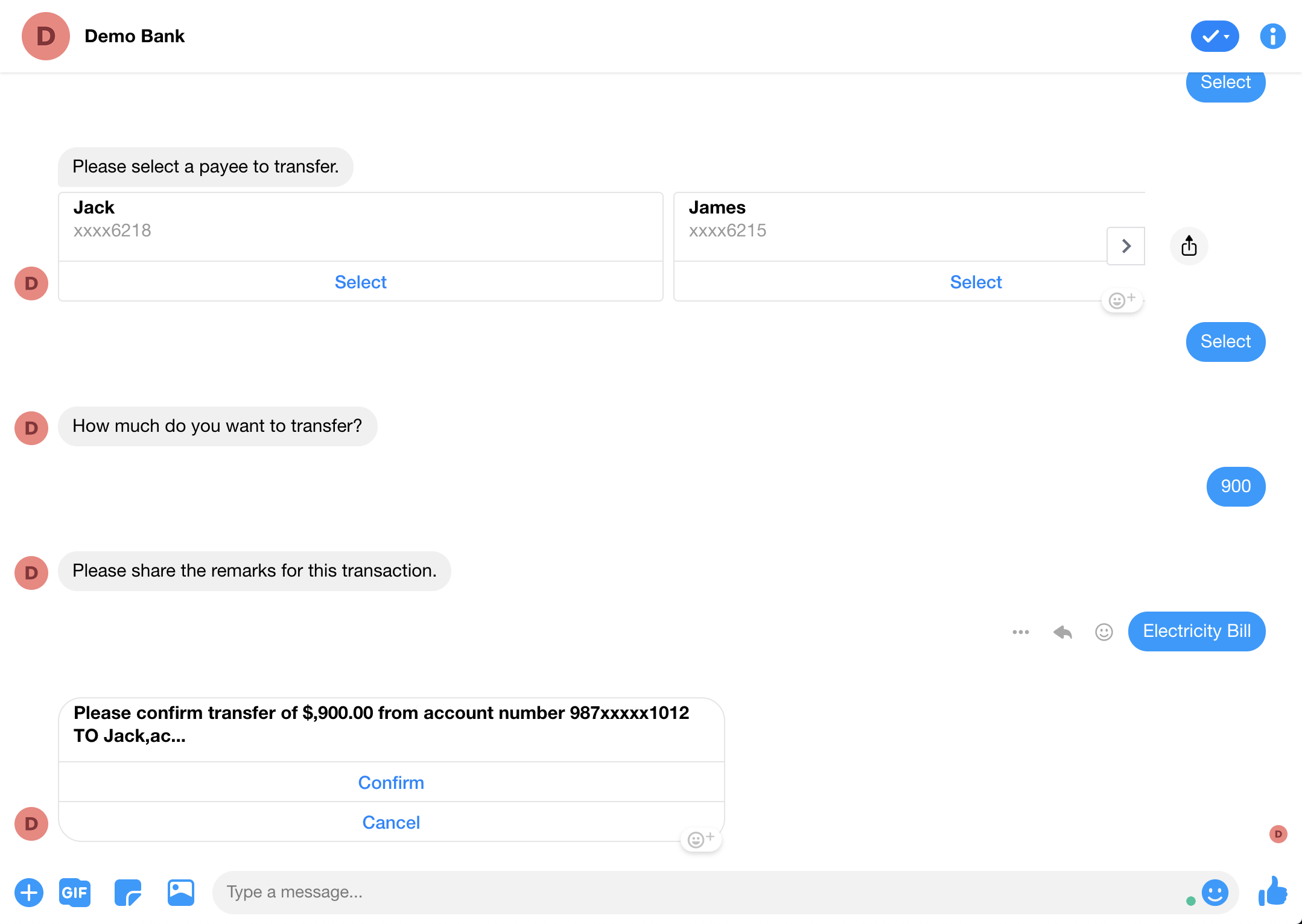

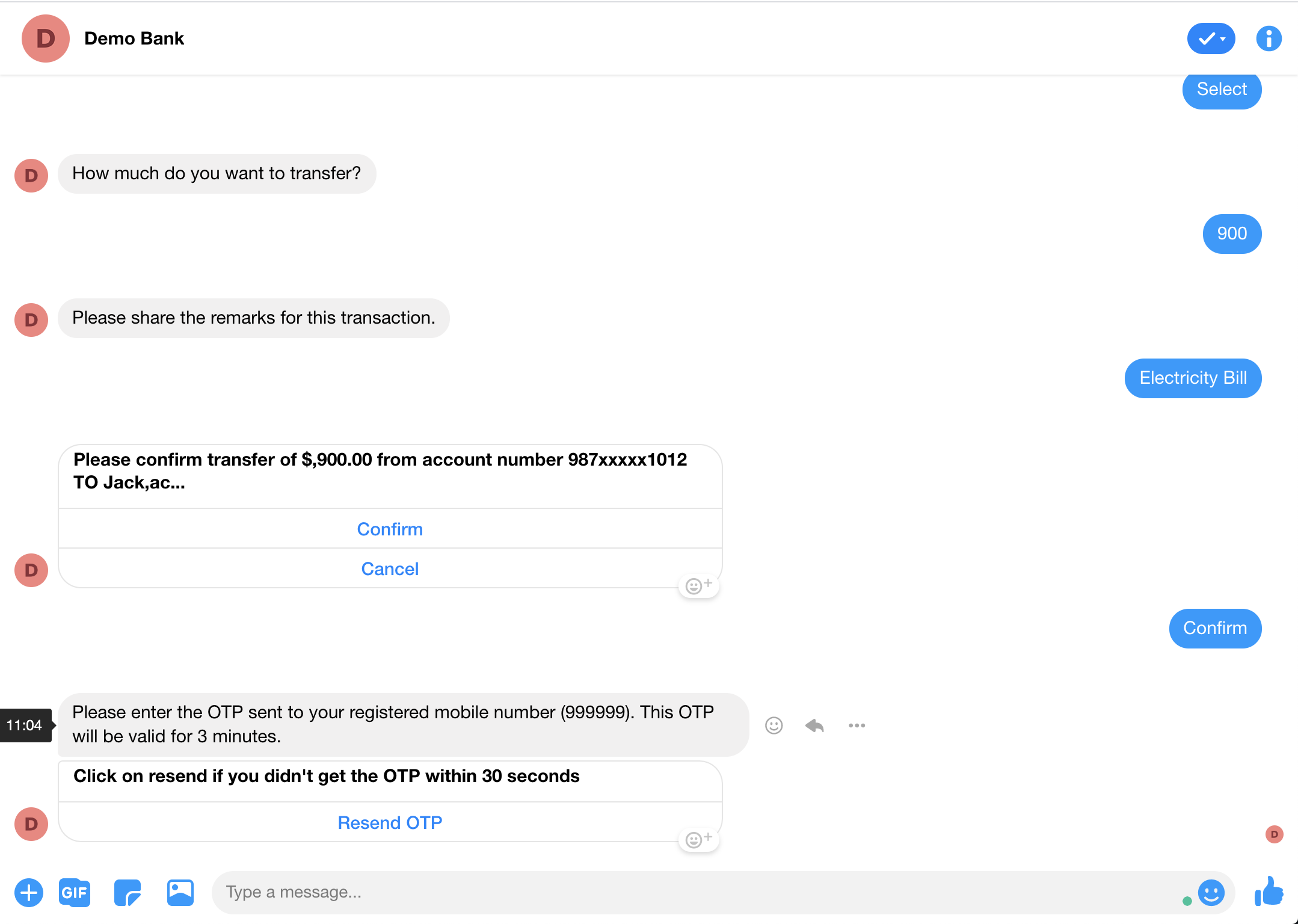

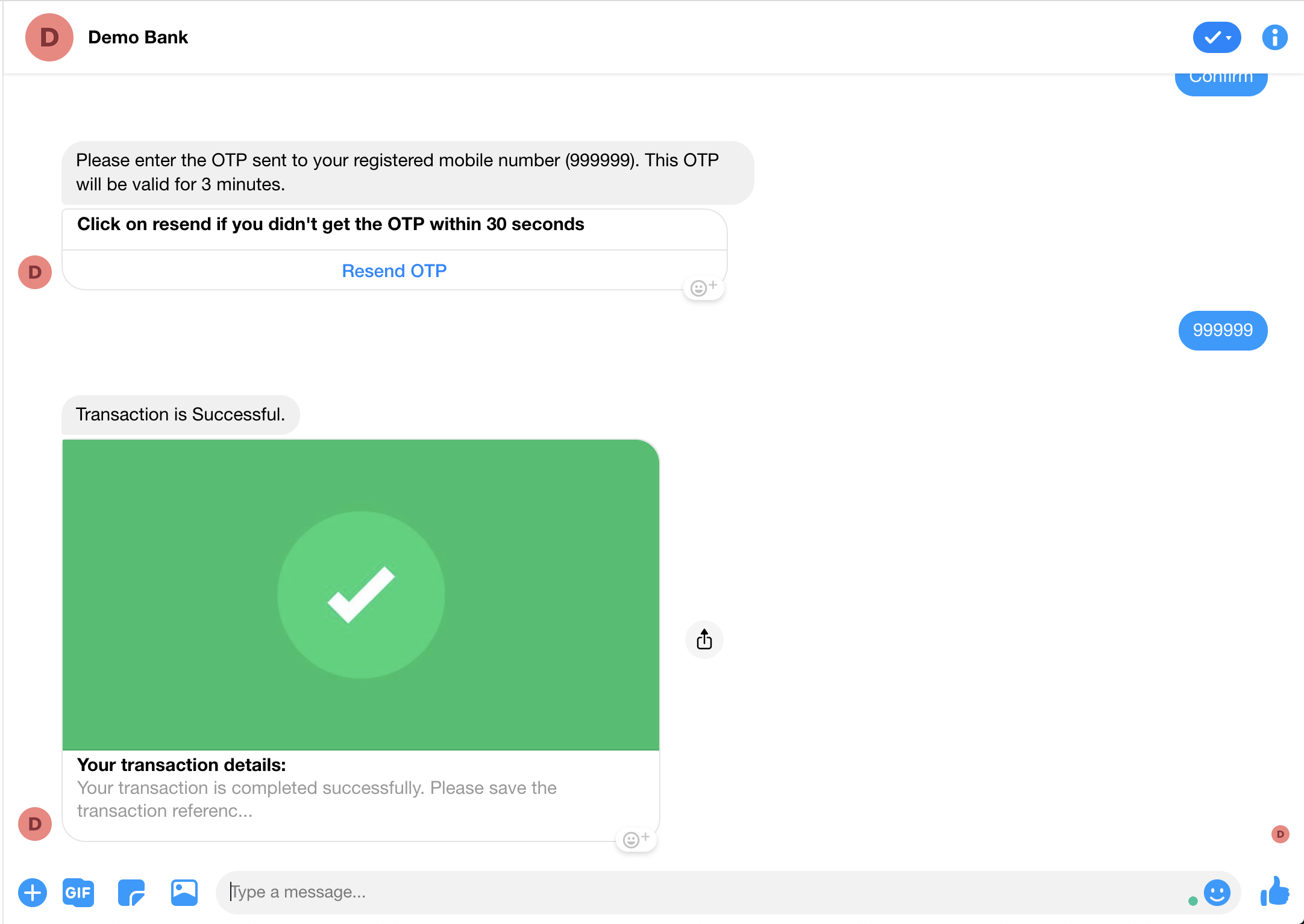

Facebook Flow -

Sample utterances that work as per the flow

- Pay bill

- Pay Water Bill

Configurations

Business Rules

Specifies the maximum bill payments done per day per user Daily Transaction Count

Specifies the cumulative maximum funds transferred via bill payments per day per user Daily Transaction Limit (Amount)

Specifies the maximum amount for a bill payment transaction Maximum Transaction Limit (Amount)

Specifies the interval between each bill payment transaction per session Minimum Interval between Transactions (mins)

Specifies the minimum amount for a bill payment transaction Minimum Transaction Limit (Amount)

Configuration

Specifies whether you want to pay bill for registered billers or adhoc billers or both Biller Type

Consumer Number

Specifies the validation regex for valid consumer reference numbers Consumer Number Validation Pattern

Specifies the maximum length of consumer number Maximum Consumer Reference Number Length

Specifies the minimum length of consumer reference number Minimum Consumer Reference Number Length

Generic Configuration

You can provide supported account Categories here which were shown to be as debitable accounts(casa, creditcard, debitcard)

billpayment_ACCOUNT_CATEGORIES=casa

Remarks need for bill payment?

TRANSFER_IS_REMARKS_REQUIRED_BILL_PAYMENT=no

To support one time payment for the billers

BILL_PAYMENT_IS_ADHOC_SUPPORTED=no

To support the enabling autopay for billers

IS_AUTO_PAY_BILLER_ENABLED=false

Is amount api is available to fetch due amount for the biller

IS_ADHOC_BILLPAYMENT_BILLDESK_AMOUNT_API_ENABLED=false

IS_BILLER_PRESENCE_ENABLED=false

Time offset for bill due date reminder

BILL_DUEDATE_REMINDER_OFFSET=4

Supported payees for bill payment

billpayment_SUPPORTED_PAYEE_CATEGORIES=CREDIT_CARD,BILL_PAYMENT

sort the biller list based on biller name by default

IS_BILLER_LIST_SORT_ON_BILLER_NAME=yes

*Kindly refer basic generic configurations here

Integration configs

For one time credit card payment you can fetch amount in this route

ADHOC_CC_FETCH_BILL_AMOUNT_URI=direct:rb.demobank.stub.creditcard.fetch.billamount

Final call for bill payment will be done here

BILL_PAYMENT_CONFIRM_URI=direct:rb.demobank.stub.bill.payment.confirm.api

Route where need to integrate for enabling autopay for the specific biller final api call

AUTO_PAY_BILLER_URI=direct:rb.demobank.stub.billers

To fetch registered biller from api

GET-REGISTERED-BILLERS=direct:rb.demobank.stub.registered.billers

Fetch one time payment biller category from api

GET_BILLER_CATEGORIES_URI=direct:rb.demobank.stub.get.biller.categories.from.file

Fetch one time payment billers from api

GET_BILLERS_URI=direct:rb.demobank.stub.get.billers.from.file

To fetch amount to be paid for the biller

GET_BILL_AMOUNT_URI=direct:rb.demobank.stub.get.bill.amount

Remarks

Remarks need to be ask for bill payment

IS_BP_REMARKS_REQUIRED=no

Need to ask to skip remarks on quick reply

BP_QUICK_REPLY_REQUIRED=yes

Transaction Status(Final Api call)

If the confirm API is two steps, like first preprocess and then call confirm by default RB set this as true

IS_BILL_PAYMENT_TWO_STEPS=true

Customization

Integration customization

Integration can be done in so many ways 1. Microservices provided by RB(Banking-Integration) * Here only default flows can be integrated * Explanation for basic details were given here 2. Using camel routes of RB itself * Here need to understand Request and response of each RB domain objects

Using camel routes of RB itself

As described in the above configurations need to create specific routes from the RB exposed routes, will suggest don't change any base routes without any notice to the product team

- Keep RB base properties separate and what you need to override those were separate file, which in turn helps to upgrade version quickly

- Even don't change all resources provided from RB keep your separate resource management package, later you can import your override resource on top of the base.

- Below is the list of RB properties needs to be altered to point it to your own integration camel-

Fetches bill payment status BILL_PAYMENT_CONFIRM_URI=direct:rb.demobank.stub.bill.payment.confirm.api

Fetches registered billers for bill payment GET-REGISTERED-BILLERS=direct:rb.demobank.stub.registered.billers

Fetches bill payment due amount GET_BILL_AMOUNT_URI=direct:rb.demobank.stub.get.bill.amount

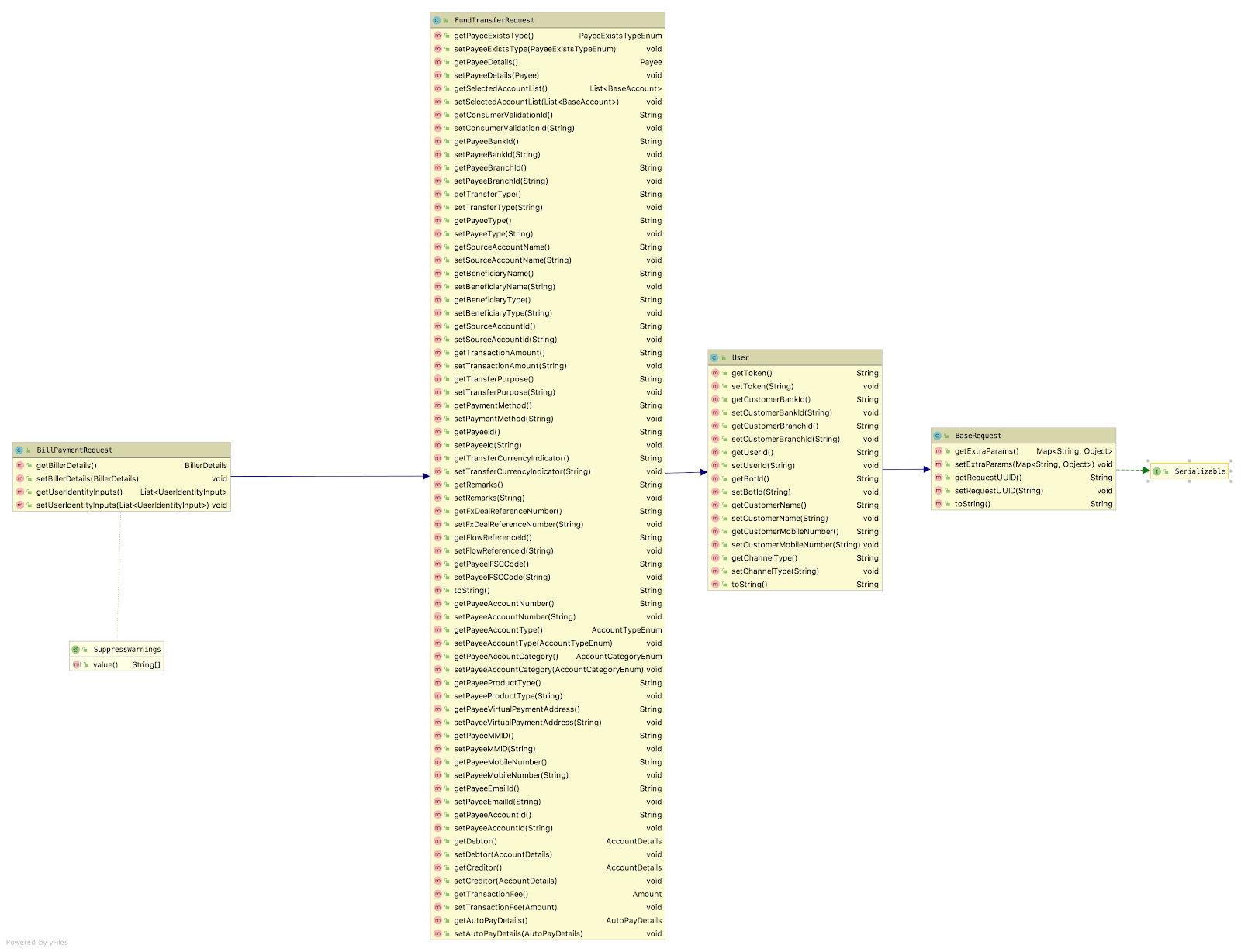

Bill Payment Status API

Request Object:- Figure 1.1 describes the class diagram for BillPaymentRequest Object of RB

Where that contains getters and setters

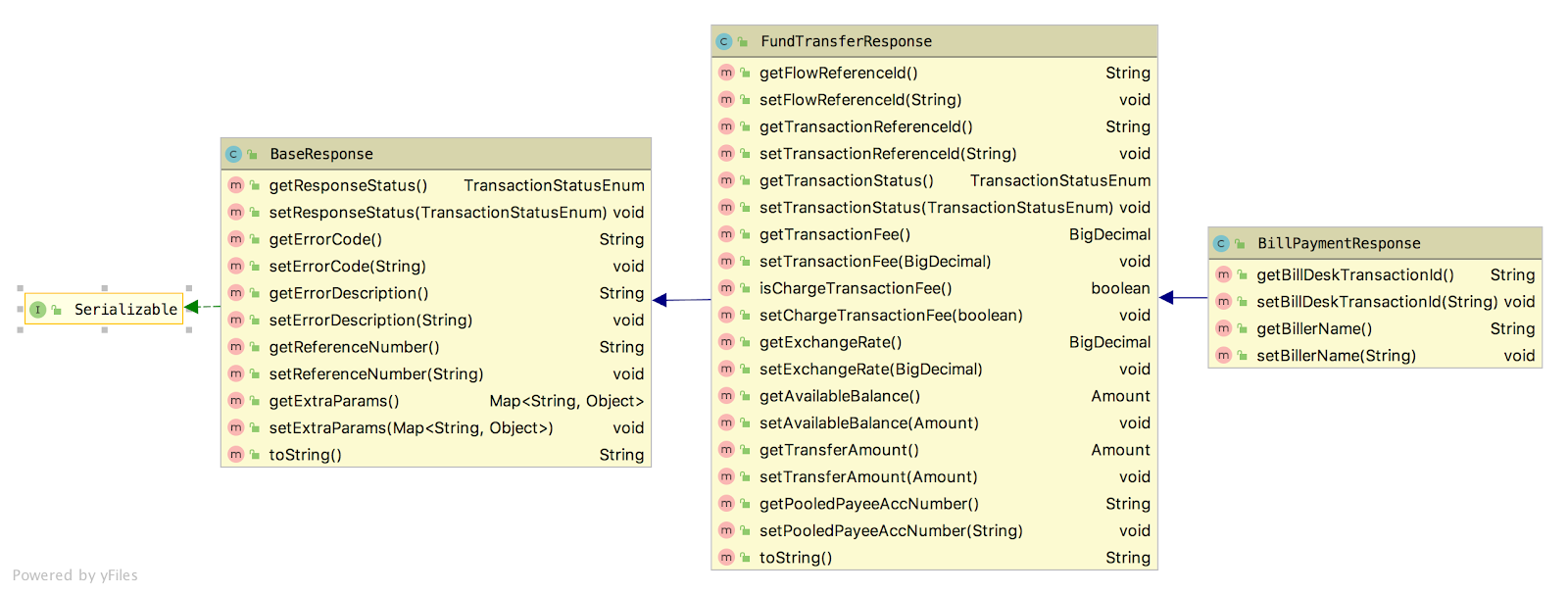

Response Object:- Figure 1.2 describes class diagram for BillPaymentResponse Object of RB With getters and setters

Fig 1.1 BillPaymentRequest

Fig 1.1 BillPaymentRequest

Fig 1.2 BillPaymentResponse

Fig 1.2 BillPaymentResponse

Due Amount API

Request Object:- Figure 1.3 describes class diagram for BillPaymentRequest Object of RB

Where that contains getters and setters

Response Object:- Figure 1.4 describes class diagram for Payee Object of RB With getters and setters

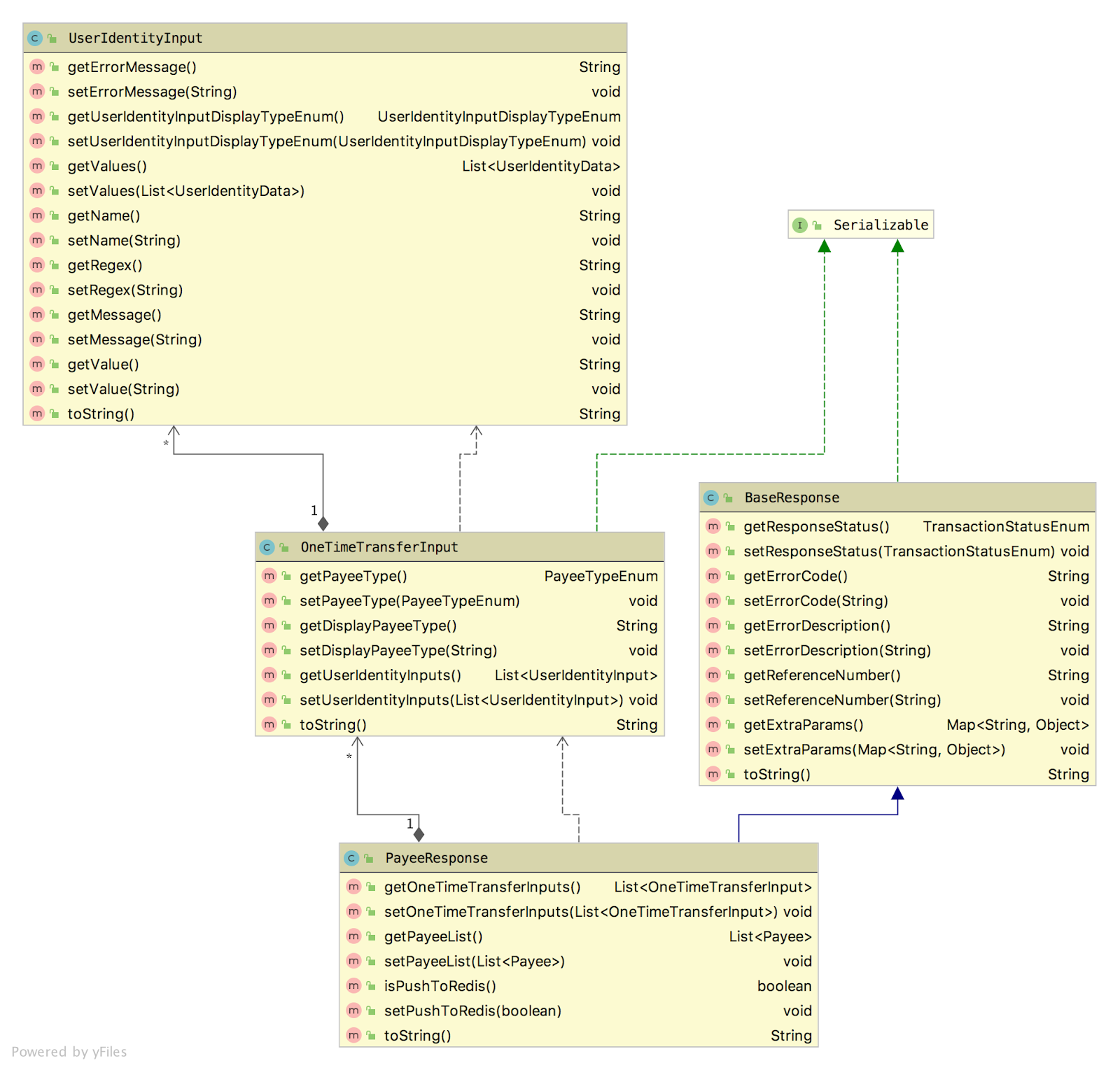

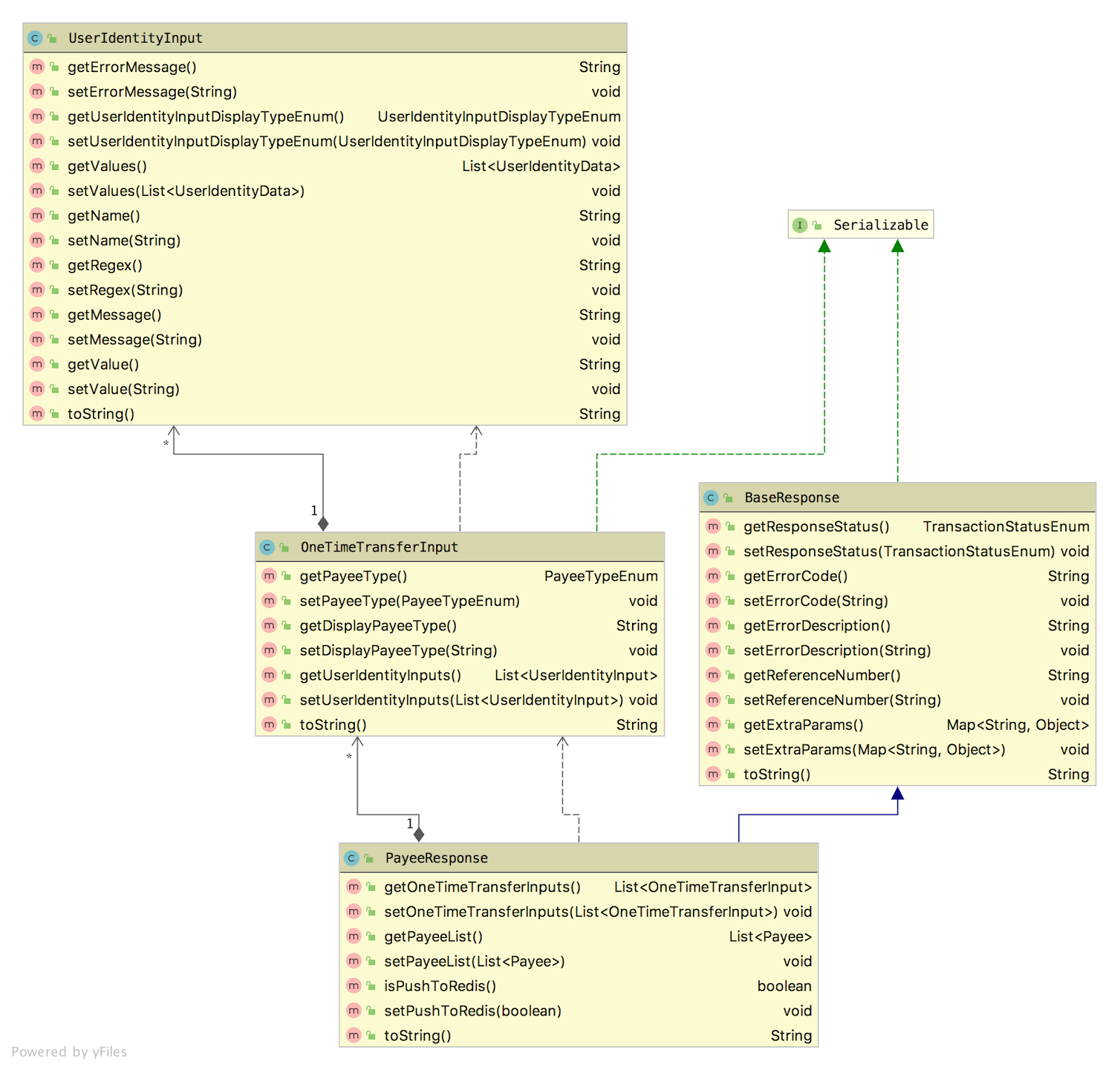

Fig 1.3 PayeeResponse

Fig 1.3 PayeeResponse

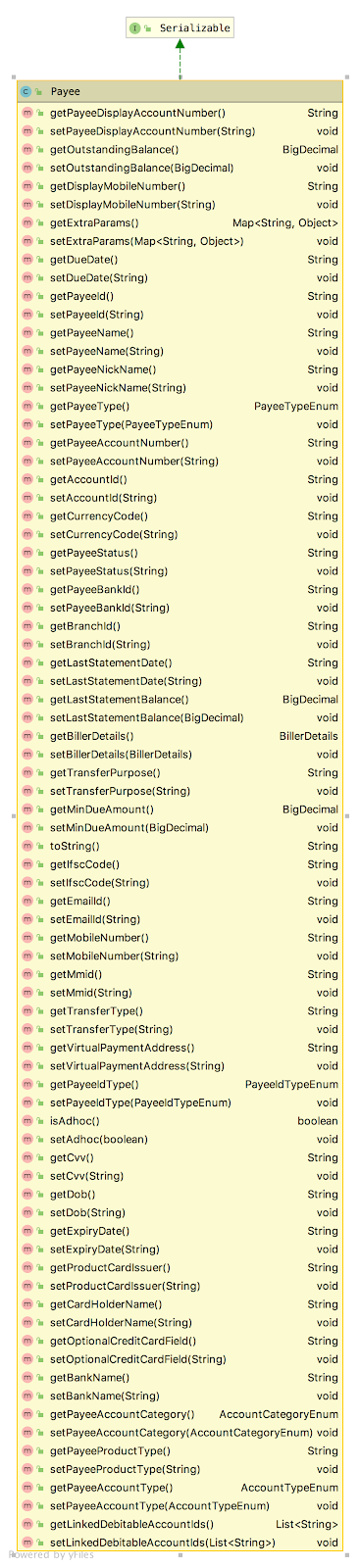

Fig 1.4. Payee

Fig 1.4. Payee

Response Customisation

Messages

Kindly refer messages for this use case on admin by selecting respective category (Like Bill Payment,Transaction Common) as shown here

Templates

- need to add template properties

Kindly refer Templates for this use case on admin by selecting a category (like Bill Payment

,Transaction Common) as shown here

Template ID's

Amount confirmation Template

BP_AMOUNT_CONFIRM_TEMPLATE_ID=BillPaymentAmountConfirm

Customer preference confirmation

BILL_PAYMENT_CUST_PREF_CONFIRM_TEMPLATE_ID=BillPaymentPrefConfirm

Biller Category list

txn-moneymovement_BILLPAYMENT_CATEGORY_TEMPLATE_ID=BillerCategoryList

Biller Category list with show more

txn-moneymovement_BILLPAYMENT_CATEGORY_SHOWMORE_TEMPLATE_ID=BillerCategoryShowMoreList

Billers list

txn-moneymovement_BILLPAYMENT_BILLER_TEMPLATE_ID=BilllerList

Billers list with show more

txn-moneymovement_BILLPAYMENT_BILLER_SHOWMORE_TEMPLATE_ID=BillerShowMoreList

Bill payment decision whether it is Registered biller, card payment, etc,.

txn-moneymovement_BP_DECISION_TEMPLATE_ID=BillPaymentDecision

Web view to identify billers information for one time payment

BILLER_USER_INPUTS_VIEW_TEMPLATE_ID=BillerUserInputsView

BILLER_USER_INPUTS_VIEW_URL_TEMPLATE_ID=BillerUserInputsViewUrl

Single account message template

billpayment_SingleAccountMsg=BillPaymentSingleAccountMsg

txn-moneymovement_BILLER_PRESENCE_TEMPLATE_ID=BillerPresence

Biller list to enabl;e autopay

txn-moneymovement_AUTOPAYBILLER_LIST=AutoPayBilllerList

txn-moneymovement_AUTO_PAY_BILLER_TEMPLATE_NAME=AddAutoPayBiller

Account selection confirmation on context

billpayment_AcctConfirm=PayBillConfirmAccount

All Accounts shown

billpayment_ALL_ACCOUNTS_TEMPLATE_ID=BillPaymentAccounts

Single account shown

billpayment_SINGLE_ACCOUNT_TEMPLATE_ID=BillPaymentAccounts

All Accounts after mismatch

billpayment_ACCT_SELECT_TEMPLATE_ID=BillPaymentAccountsMismatch

All account shown with show more after mismatch

billpayment_ACCT_SELECT_WITH_SHOW_MORE_TEMPLATE_ID=BillPaymentAccountsWithShowMore

Success template

BP_SUCCESS_HTML_TEMPLATE_NAME=BillPaymentSuccessHtml

All account shown with show more billpayment_ACCOUNTS_WITH_SHOW_MORE_TEMPLATE_ID=BillPaymentAccountsWithShowMore

All account shown with after clicking show more

billpayment_ACCOUNTS_SHOW_MORE_REQ_TEMPLATE_ID=BillPaymentAccountsWithShowMore

Hooks or Fulfilments

Kindly refer Hooks or Fulfilments for name(bill_payment) use case on admin as guided on here.

Customization of Image Properties:-

To customise images. Kindly refere here

Block Card

Overview

| Use case name | Block card |

| Type | Service request |

| Intent | txn-productclosure |

| Entities |

|

| Banking products supported | Cards |

| Channels supported | Web, Mobile, FB messenger, Alexa |

| Login | Yes |

| 2FA | Yes |

| API availability | Yes |

| Integrations done | NA |

| Stub data availability | Yes |

Features

Summary

The user will be able to block a debit or credit card

They can specify the card number that has to be blocked or choose from a list

Block type can be temporary or permanent subject to API availability

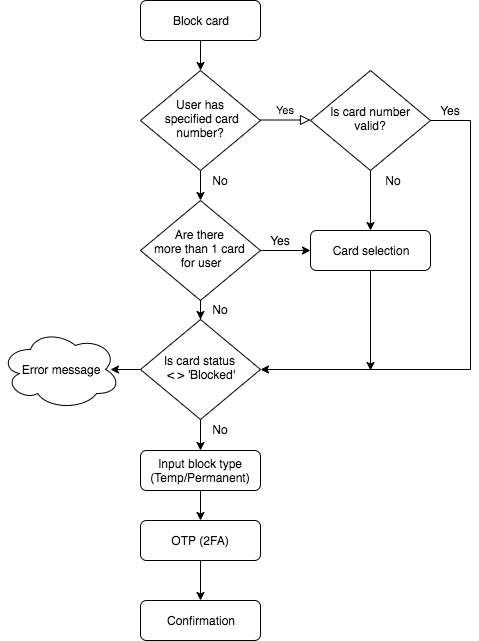

Detailed

User whose debit or credit card is lost, stolen or damaged may ask for their card to be blocked.

User can simply say ‘block card’ OR specify a card that needs to be blocked.

- In the first case, the system would check if there are more than one card available for the customer. If ‘yes’, it would present card selection options, else proceed with the only card

- If user has specified the card number for blocking, system would proceed to block card flow

Next user will be prompted to input card block type

- Temporary, OR

- Permanent

If the card is not in blocked status , system will proceed to block the card after user confirmation

It will be possible to configure OTP or any 2FA at this stage

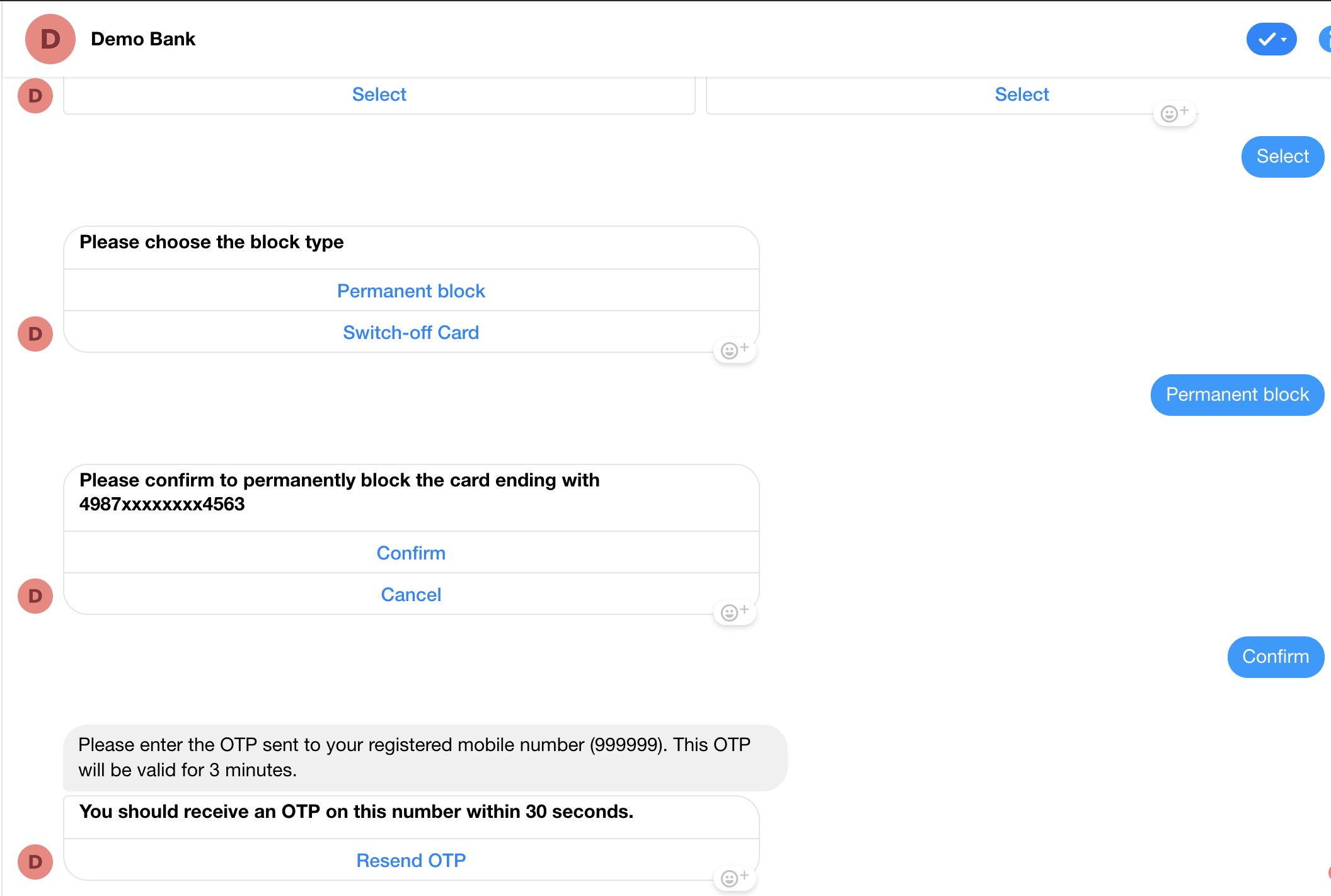

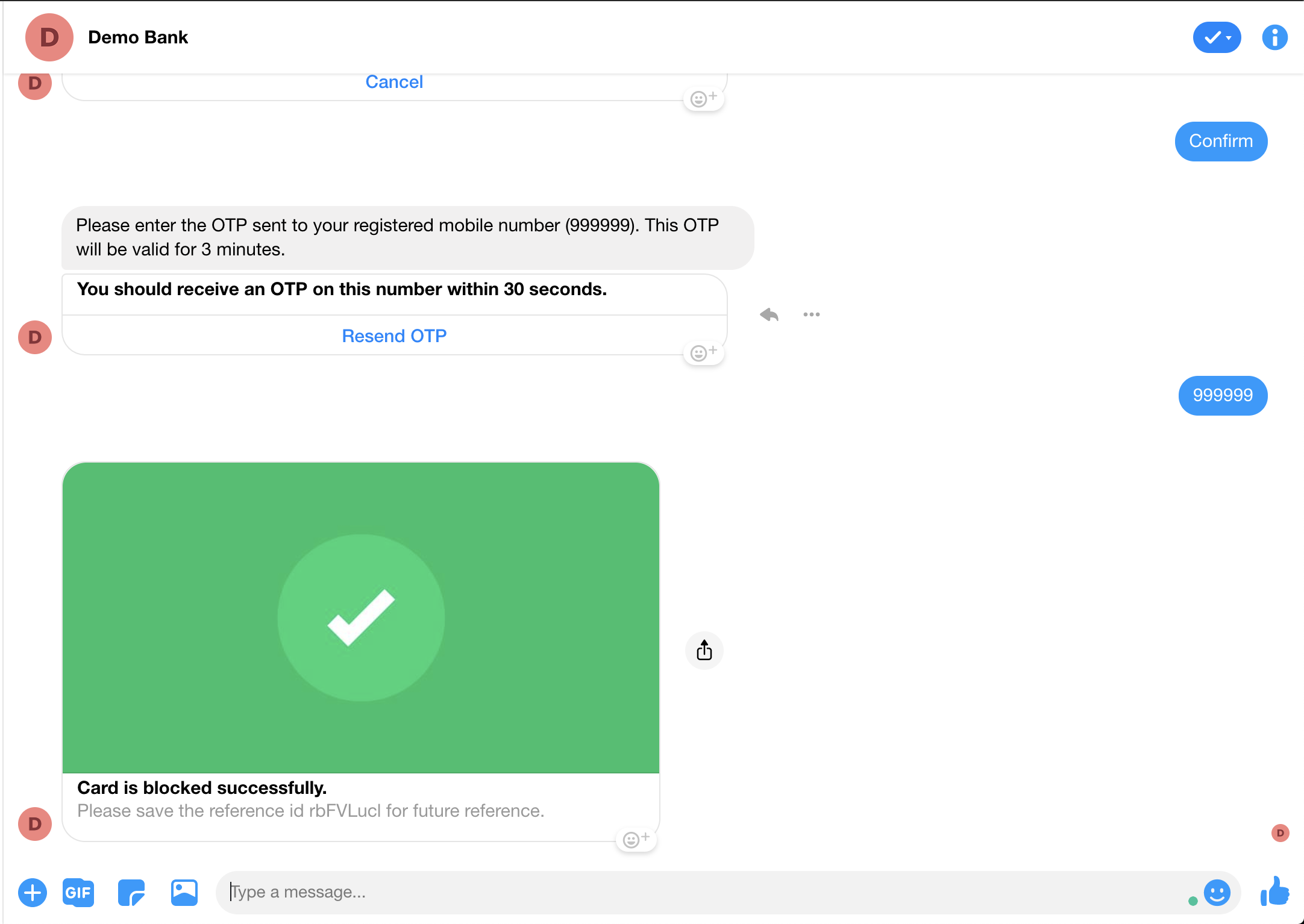

Flow CX

Default Flow - List of Cards ---> Select Block Type ---> Card Blocking Confirmation ---> OTP ---> Card Blocked Status

Note: This can be flowchart / GIF or screenshot to represent OOTB flow

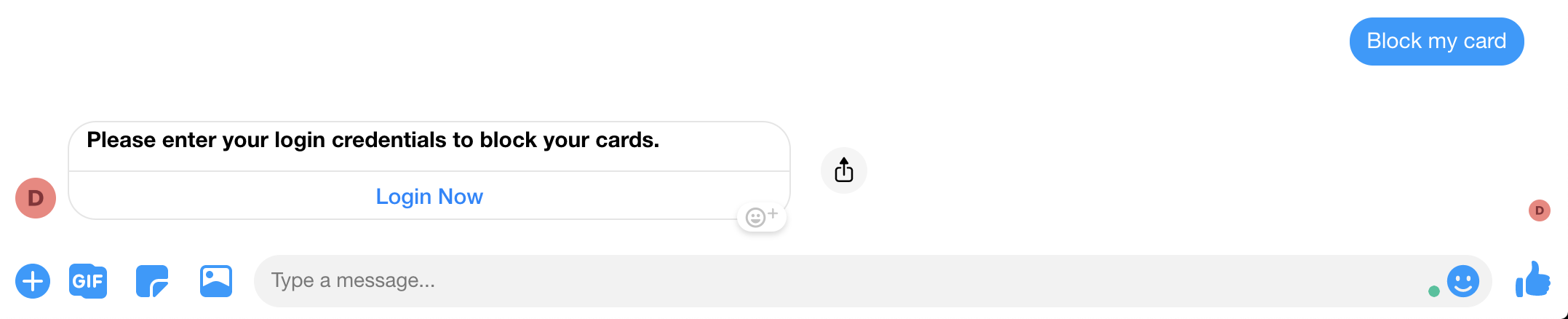

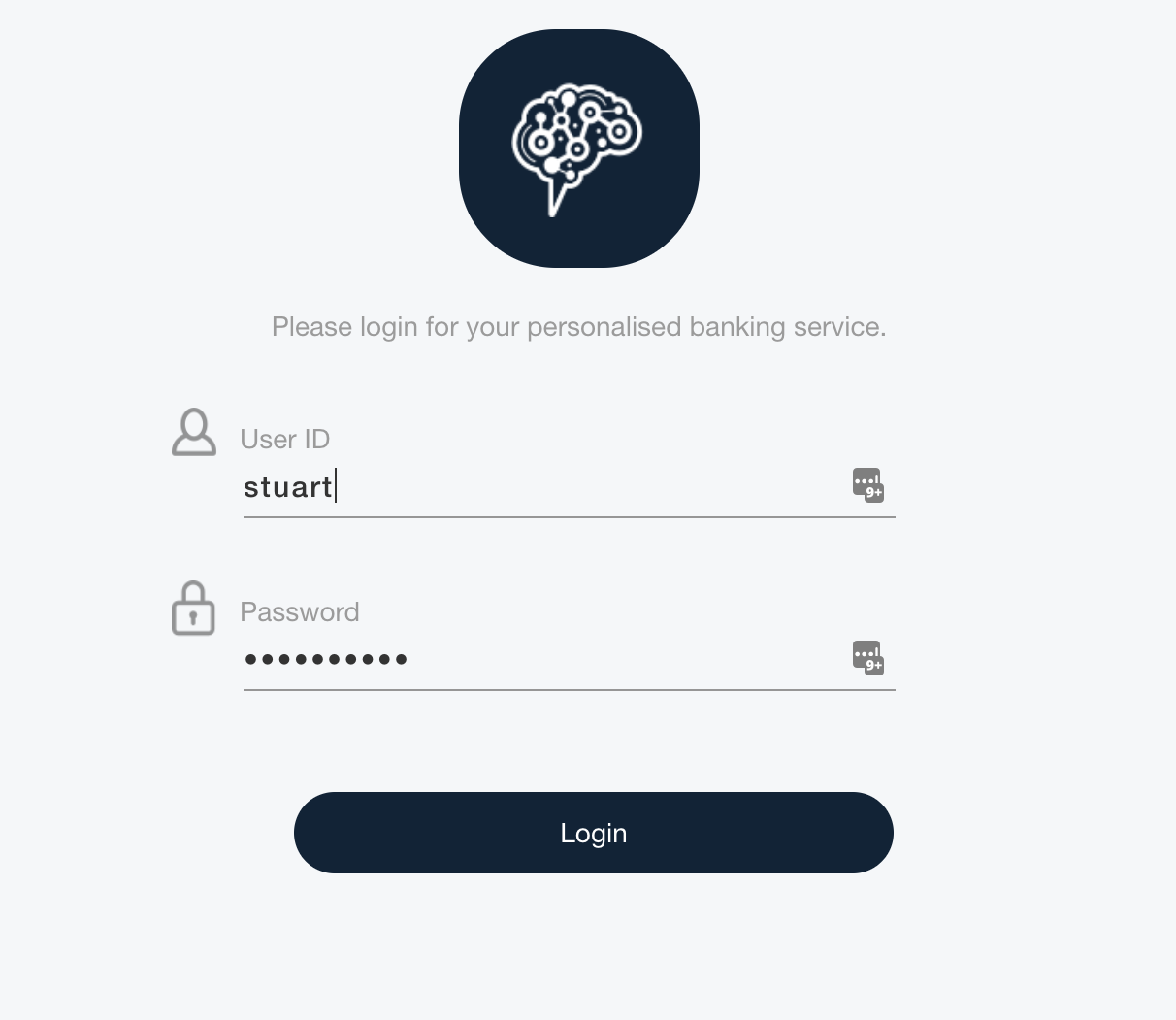

Facebook Flow -

Sample utterances that works as per the flow

Block my card ending with 1234 (valid card number)

Block my visa card (only 1 visa card)

Block my card ending with 0000 (invalid card number)

Block my master card (more than 1 card exists)

Configurations

Generic Configurations

Different product categories supported in Block Card, as configured the supported categories are Credit Card, Debit Card & Forex Card.

E.g. If ‘Prepaid Card’ need to be supported, the same need to appended as ‘prepaidcard’

blockcard_ACCOUNT_CATEGORIES=creditcard,debitcard,forexcard

List all cards based on the supported card status, default value is ‘Active’ to list only Active cards. Other supported Status are ‘’

txn-productclosure_blockcard_SUPPORTED_STATUS=ACTIVE

No. of cards to show in the list. Default carousel view is supported, can be changed to list by updated the template. Template details are detailed below.

blockcard_NO_OF_ITEMS_TO_SHOW_IN_LIST=10

Customisation

Integration Customisation

- Checkout the code from the following Repo for quick and easy integration. click here

Integrate with the Bank Login API using the given code, deploy and starts working.

API to fetch list of credit or debit cards

Refer to balance Inquiry for integrating and fetching Cards list.

API for block card Status

Request:

Request URL: http://one-api.active.ai/banking-integration/v1/{customerId}/cards/{cardNumber}/block/confirm

customerId - String

cardNumber -String

Request Schema:

{

"accessToken": "string",

"address": "string",

"blockType": "PERMANENT",

"cardDetails": {

"accountId": "string",

"accountName": "string",

"activationDate": "string",

"amountDue": 0,

"availableCash": 0,

"availableCreditLimit": 0,

"bankName": "string",

"branchAddress": "string",

"branchId": "string",

"branchName": "string",

"cardHolderName": "string",

"cardIssuer": "VISA",

"cardName": "string",

"cardNumber": "string",

"cardStatus": "ISSUED",

"cardType": "CREDIT_CARD",

"cashLimit": "string",

"closingBalance": 0,

"creditLimit": 0,

"currencyCode": "string",

"displayCardNumber": "string",

"domesticATMLimit": "string",

"domesticPOSLimit": "string",

"expiryDate": "string",

"internationalATMLimit": "string",

"internationalEnabled": true,

"internationalPOSLimit": "string",

"isInternationalEnabled": true,

"lastStatementBalance": 0,

"lastStatementDate": "string",

"maxCashLimit": "string",

"maxCreditLimit": "string",

"maxDomesticATMLimit": "string",

"maxDomesticPOSLimit": "string",

"maxInternationalATMLimit": "string",

"maxInternationalPOSLimit": "string",

"minimumPayment": 0,

"openingBalance": 0,

"outStandingAmount": 0,

"oversearCardActivated": true,

"overseasCardActivated": true,

"paymentDueDate": "string",

"permanentCreditLimit": 0,

"productCode": "string",

"productType": "string",

"temporaryCreditLimit": 0

},

"customerId": "string",

"customerName": "string",

"emailId": "string",

"mobileNumber": "string"

}

Success Response: ```` JSON Status : 200

Meaning: OK

Description: OK

````

Schema:

JSON

{

"referenceId": "string",

"result":

{

"message": "string",

"messageCode": "string",

"status": 0},

"status": "SUCCESS"

}

Using custom integration service-

You can call the bank API by changing the URL in service of banking integration project.

Classes- |Package |Class Name |Method Name|Details | |---|---|---|---|---| |service|CardsService|getBlockCardResponseEntity()|You can call your API inside this method.| |domain-->request|BlockCardRequest||Request Class| |domain-->response|BlockCardResponse||Response Class| |mapper-->response|BlockCardResponseMapper||Map API response to this mapper class| |model|Card||Fields, Getter/Setter methods| |||||

- Developing new code to Integrate with new code.

At the end of the Block Card flow, the request object is sent to the configured API using which bank API can be integrated with. And the response should be mapped with block card response object.

You can directly call your API from integration camel by following below steps-

A. Check for property BLOCK_CARD_ROUTE_URI value.

B. Go to that route id.

C. Check for the API url and change it by your API url and map the response accordingly.

Refer here for request and response images.

- Using Workflow webhook

You can directly call your API using a workflow webhook and customize your response.

Response Customisation

Messages

Kindly refer to messages for this use case on admin by selecting the respective category (Block Card).

Templates

Kindly refer to templates for this use case on admin by selecting the respective category (Block Card). /* Following are the default templates for the given flow, which can be customised to show more details in template or add more buttons using Template Editor. */

Following are the template properties-

- Default card list templates are carousel to change it to list use template editor *

When all cards list to be shown and list size<4. Default is carousel template

blockcard_ALL_ACCOUNTS_TEMPLATE_ID=BlockCardAllAccounts

When all cards list to be shown as list and list size>4 and show more is enabled.

blockcard_ACCOUNTS_WITH_SHOW_MORE_TEMPLATE_ID=BlockCardAccountsWithShowMore

When all cards in the list need to be displayed for selection, after clicking show more button

blockcard_ACCOUNTS_SHOW_MORE_REQ_TEMPLATE_ID=BlockCardAccountsWithShowMore

When the list contains only one card. Default is card template

blockcard_SINGLE_ACCOUNT_TEMPLATE_ID=BlockCardSingleAcctSelection

Shows list of cards in case of card number mismatch scenario. Default is carousel

blockcard_ACCT_SELECT_TEMPLATE_ID=BlockCardAccountMismatch

Show all cards in a list in case of card number mismatch scenario when show more is clicked

blockcard_ACCT_SELECT_WITH_SHOW_MORE_TEMPLATE_ID=BlockCardAccountsWithShowMore

txn-productclosure_blockcard_CONFIRM_TEMPLATE_ID=BlockCardConfirm

Displays the supported block type. Default is the button template.

BLOCK_CARD_TYPE_TEMPLATE_ID=BlockCardType

To handle single account text templates

blockcard_SingleAccountMsg=BlockCardSingleAccountMsg

Hooks or Fulfillment's

Kindly refer to hooks for this use case on admin by selecting the respective category (Block Card).

Customization of Image Properties:-

To customise images. Kindly refere here

Change International Usage Of Card

Overview

| Use case name | Update international usage |

| Type | Service request |

| Intent |

|

| Entities |

|

| Banking products supported | Cards |

| Channels supported | Web, Mobile, FB messenger, Alexa |

| Login | Yes |

| 2FA | Yes |

| API availability | Yes |

| Integrations done | NA |

| Stub data availability | Yes |

Features

Summary

User can request to toggle their card’s international usage status i.e. an enabled card can be disabled , and a disabled card can be enabled for international usage.

Typically for enablement a data range for usage will be sought.

Detailed

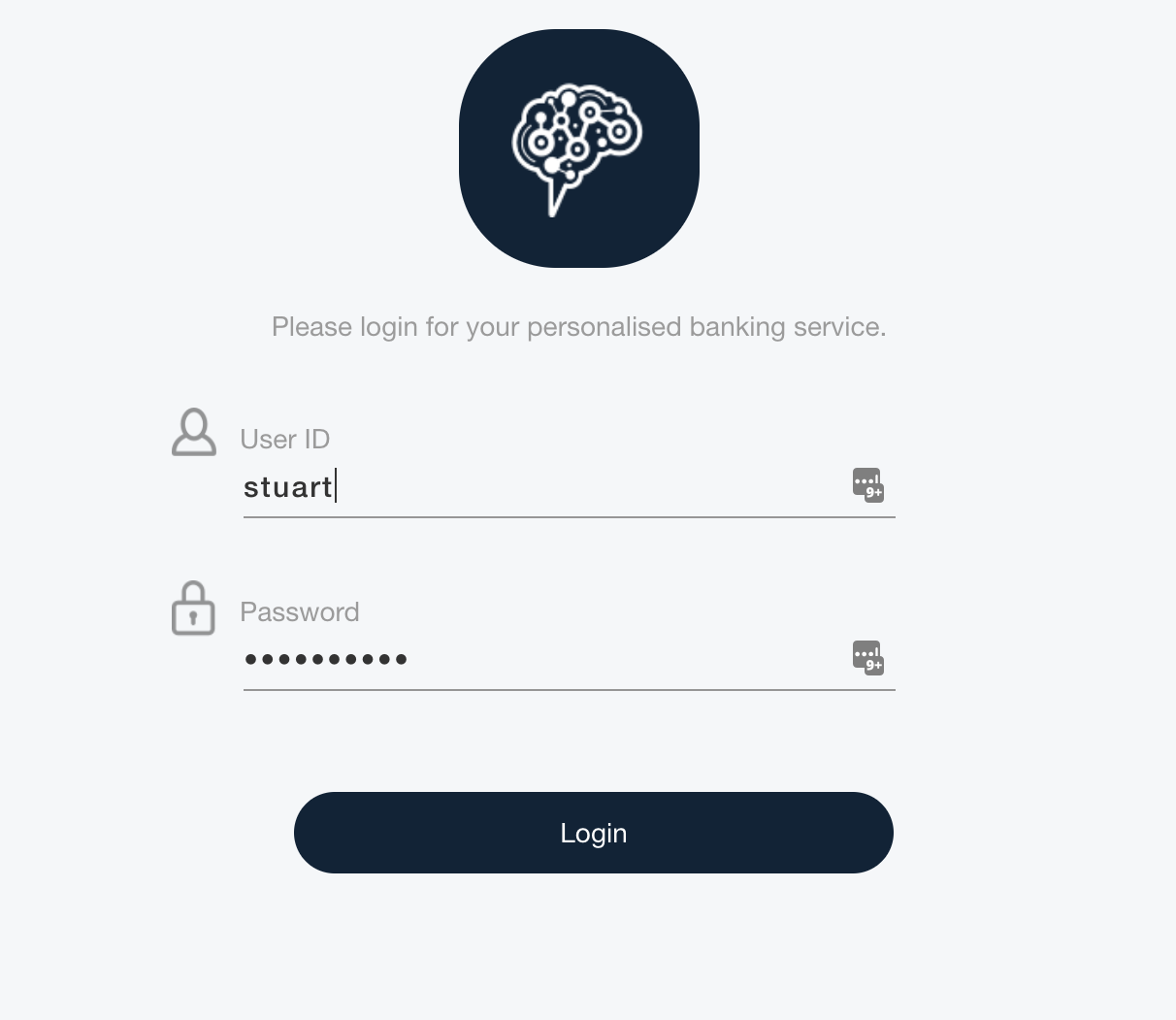

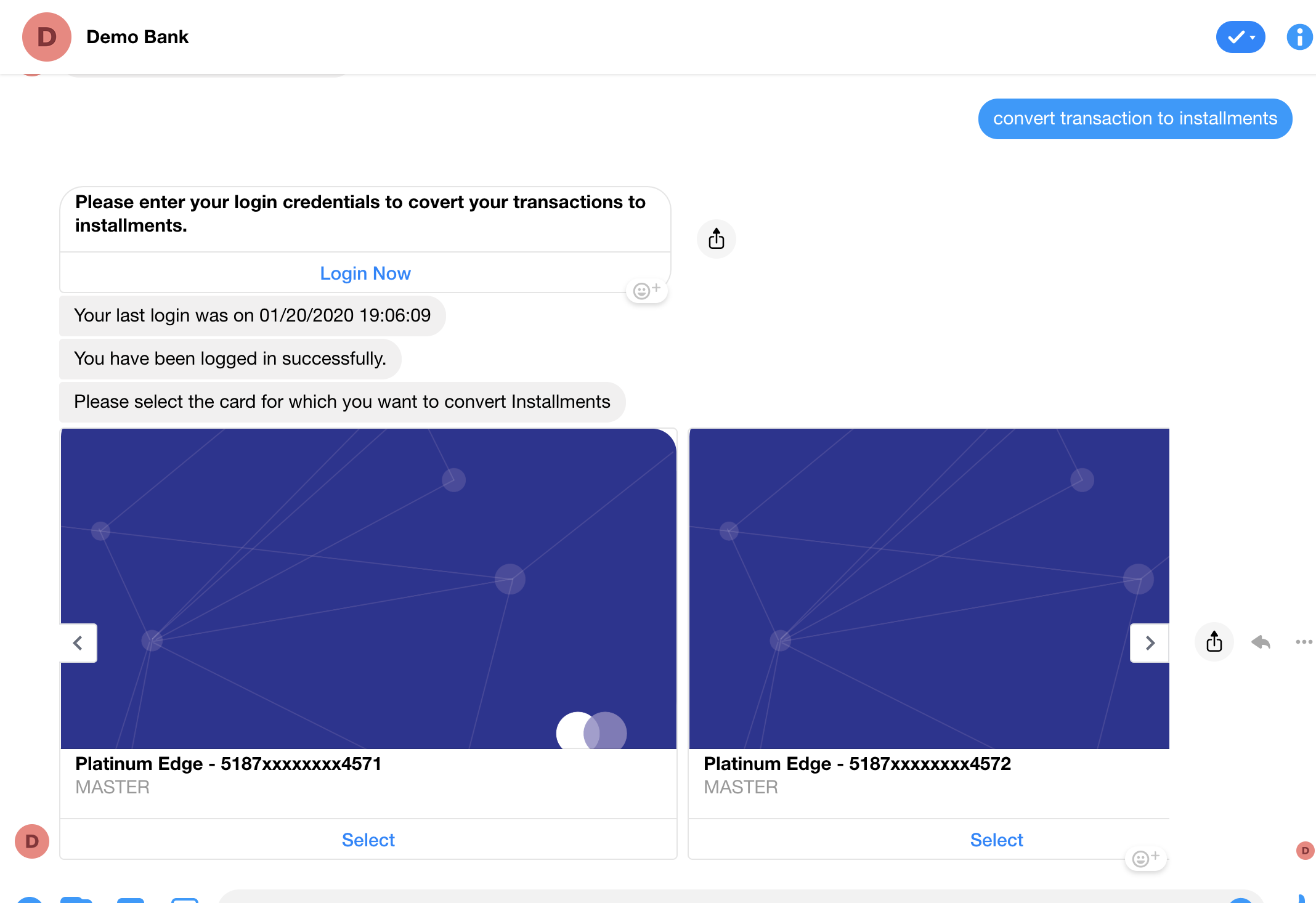

If user is traveling out of the country, they can request to activate their card for international usage.

Post card selection system will expect data range (from- to ) for activation.

- any additional step like country/region for travel can be customised.

- Once changed system will provide appropriate confirmation message to the user.

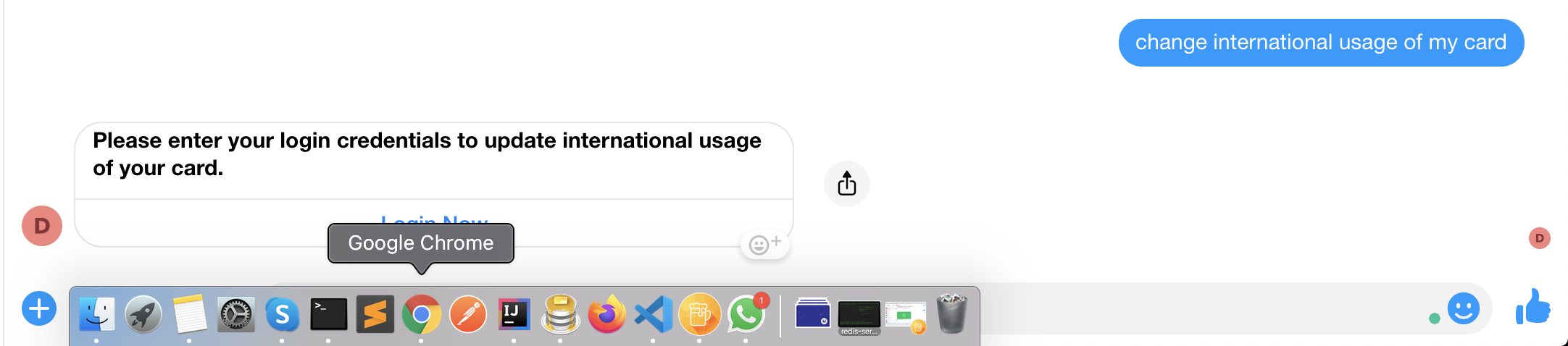

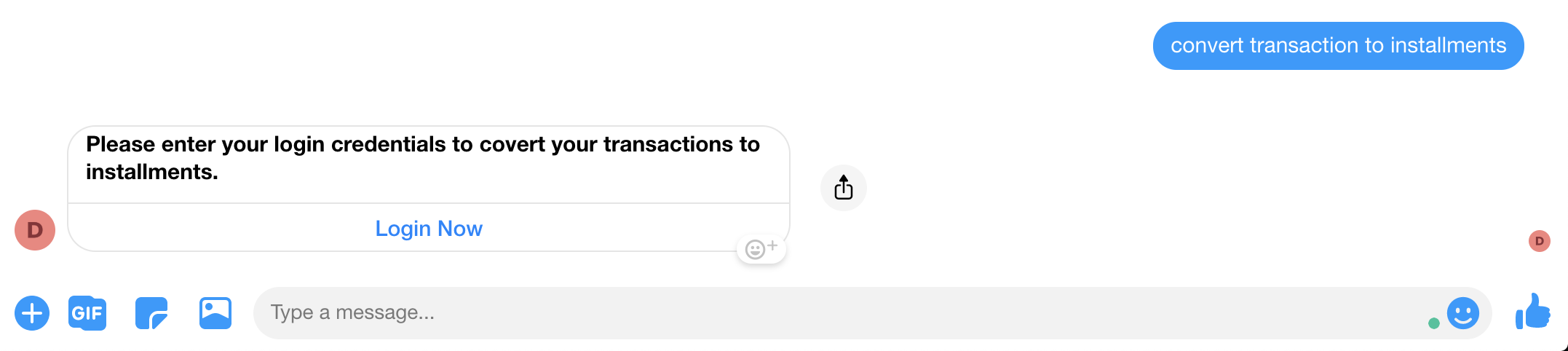

Flow CX

Default Flow:-

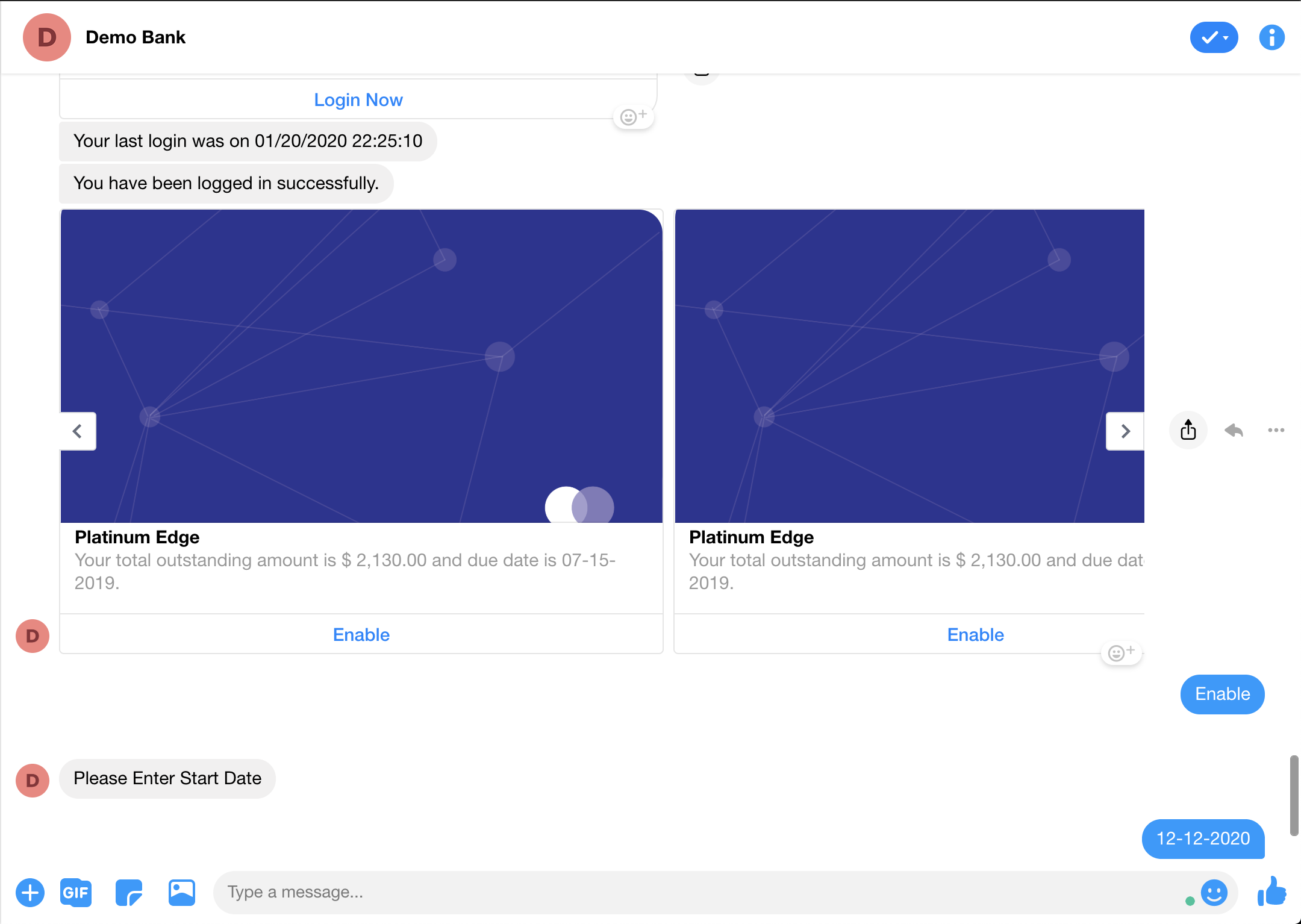

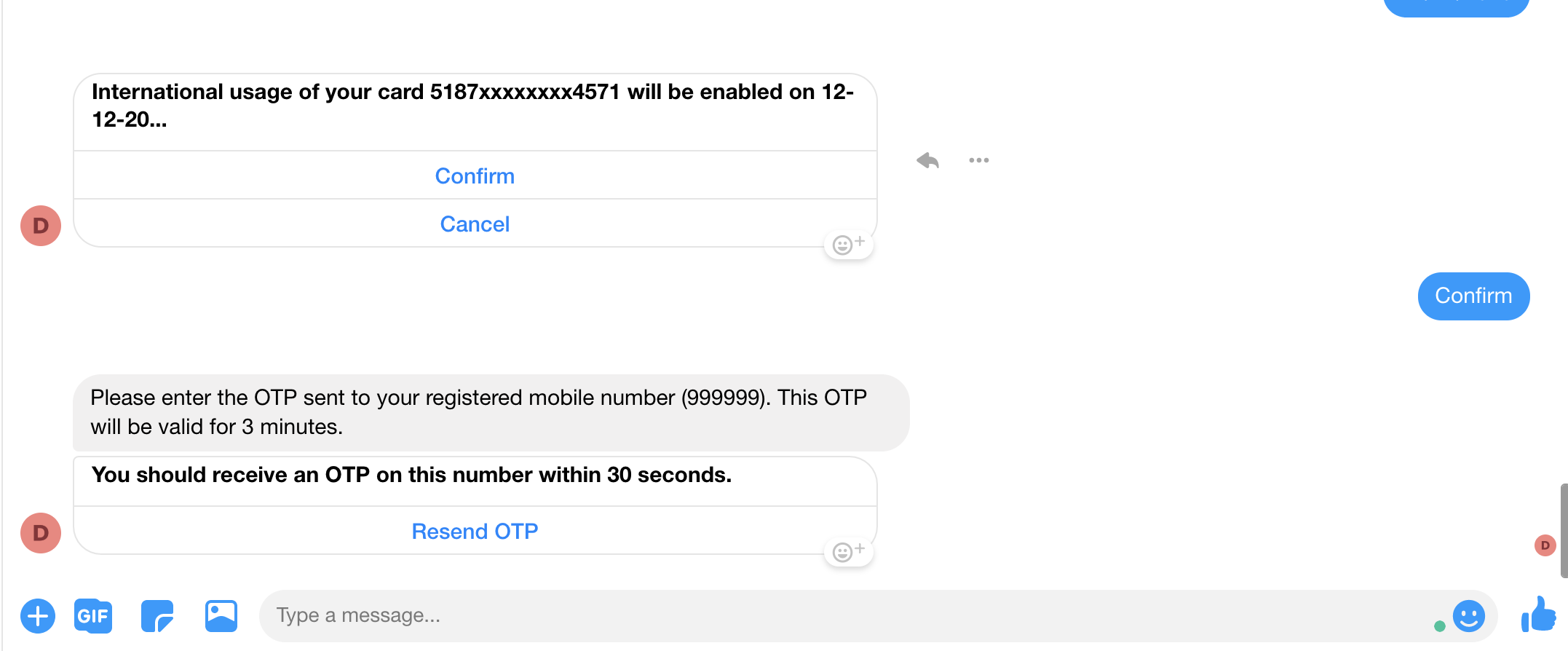

(if want to Enabled International Usage) List of Cards -> Enter Start Date -> Enter End Date-> Confirm -> Enter OTP -> Status of International Usage.

(if want to Disabled International Usage) List of Cards -> Confirm -> Enter OTP -> Status of International Usage.

Sample CX for default flow

Note: This can be flowchart / GIF or screenshot to represent OOTB flow

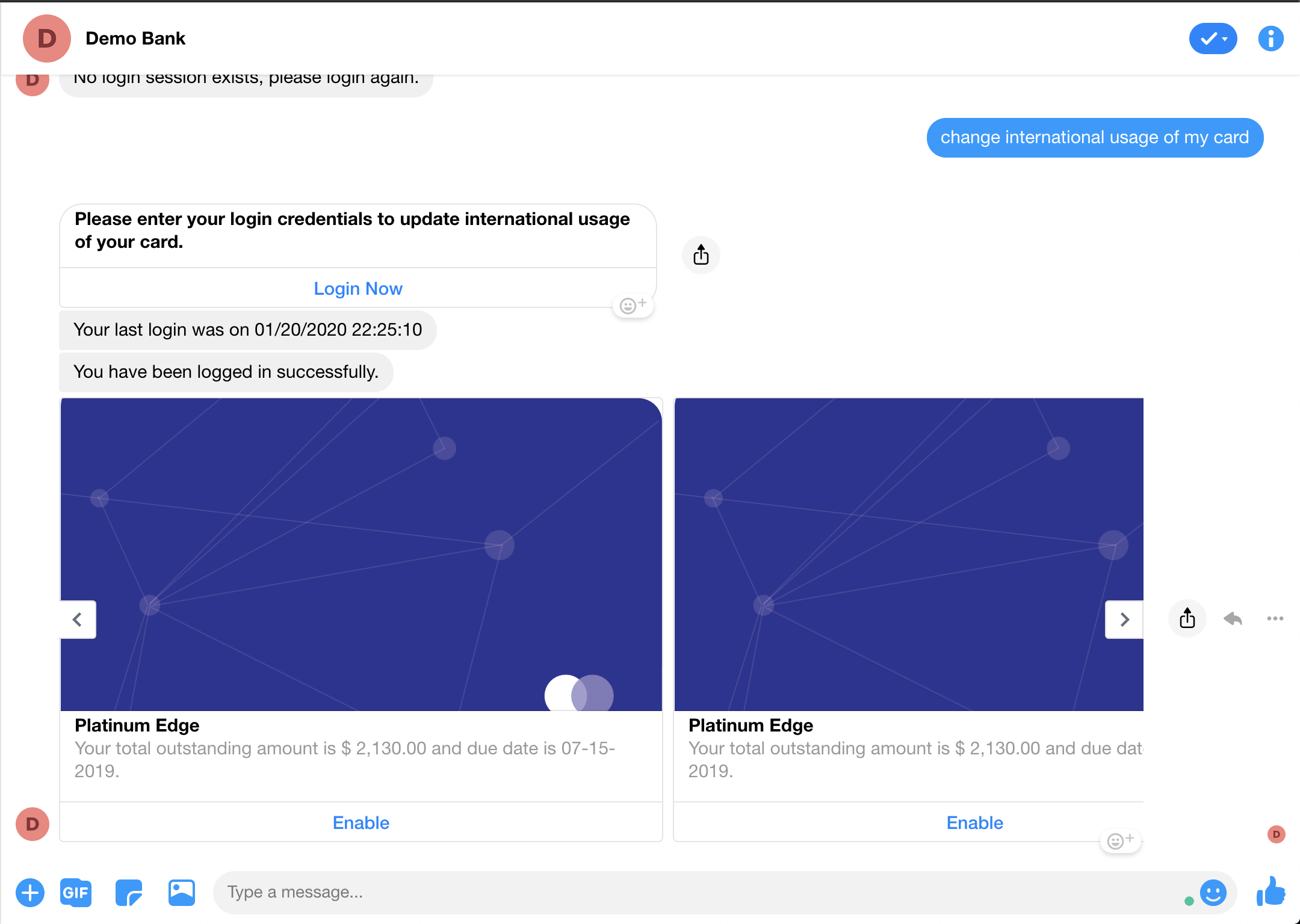

Facebook Flow -

Sample Utterance

Sample utterances that work as per the flow:-

Change International Usage of my card

Change International Usage of my card ending with 1234 (valid card number).

Change International Usage of my visa card (only 1 visa card).

Change International Usage of my card ending with 0000 (invalid card number).

Change International Usage of my master card (more than 1 card exists).

Configuration

Generic Configuration

internationalusage_ACCOUNT_CATEGORIES=creditcard,debitcard,forexcard

List all cards based on the supported card status, default value is ‘Active’ to list only Active cards. Other supported Status are ‘Inactive’, ‘Issued’, ’Closed’. txn-cardsettings_internationalusage_SUPPORTED_STATUS=ACTIVE txn-productclosure_internationalusage_SUPPORTED_STATUS=ACTIVE

No. of cards to show in the list. Default carousel view is supported, can be changed to list by updated the template. Template details are detailed below. internationalusage_NO_OF_ITEMS_TO_SHOW_IN_LIST=10

Customisation

Integration Customisation

Pre-Requirement To fetch the API of credit and debit cards list, refer to the Balance Inquiry.

API for International Usage Status

Request

Request URL:- [http://one-api.active.ai/banking-integration/v1/{customerId}/cards/{cardNumber}/internationalUsage/api

customerId- String

cardNumber- String

Schema

{

"accessToken": "string",

"address": "string",

"cardDetails": {

"accountId": "string",

"accountName": "string",

"activationDate": "string",

"amountDue": 0,

"availableCash": 0,

"availableCreditLimit": 0,

"bankName": "string",

"branchAddress": "string",

"branchId": "string",

"branchName": "string",

"cardHolderName": "string",

"cardIssuer": "VISA",

"cardName": "string",

"cardNumber": "string",

"cardStatus": "ISSUED",

"cardType": "CREDIT_CARD",

"cashLimit": "string",

"closingBalance": 0,

"creditLimit": 0,

"currencyCode": "string",

"displayCardNumber": "string",

"domesticATMLimit": "string",

"domesticPOSLimit": "string",

"expiryDate": "string",

"internationalATMLimit": "string",

"internationalEnabled": true,

"internationalPOSLimit": "string",

"isInternationalEnabled": true,

"lastStatementBalance": 0,

"lastStatementDate": "string",

"maxCashLimit": "string",

"maxCreditLimit": "string",

"maxDomesticATMLimit": "string",

"maxDomesticPOSLimit": "string",

"maxInternationalATMLimit": "string",

"maxInternationalPOSLimit": "string",

"minimumPayment": 0,

"openingBalance": 0,

"outStandingAmount": 0,

"oversearCardActivated": true,

"overseasCardActivated": true,

"paymentDueDate": "string",

"permanentCreditLimit": 0,

"productCode": "string",

"productType": "string",

"temporaryCreditLimit": 0

},

"customerId": "string",

"customerName": "string",

"emailId": "string",

"mobileNumber": "string"

}{

"accessToken": "string",

"address": "string",

"cardDetails": {

"accountId": "string",

"accountName": "string",

"activationDate": "string",

"amountDue": 0,

"availableCash": 0,

"availableCreditLimit": 0,

"bankName": "string",

"branchAddress": "string",

"branchId": "string",

"branchName": "string",

"cardHolderName": "string",

"cardIssuer": "VISA",

"cardName": "string",

"cardNumber": "string",

"cardStatus": "ISSUED",

"cardType": "CREDIT_CARD",

"cashLimit": "string",

"closingBalance": 0,

"creditLimit": 0,

"currencyCode": "string",

"displayCardNumber": "string",

"domesticATMLimit": "string",

"domesticPOSLimit": "string",

"expiryDate": "string",

"internationalATMLimit": "string",

"internationalEnabled": true,

"internationalPOSLimit": "string",

"isInternationalEnabled": true,

"lastStatementBalance": 0,

"lastStatementDate": "string",

"maxCashLimit": "string",

"maxCreditLimit": "string",

"maxDomesticATMLimit": "string",

"maxDomesticPOSLimit": "string",

"maxInternationalATMLimit": "string",

"maxInternationalPOSLimit": "string",

"minimumPayment": 0,

"openingBalance": 0,

"outStandingAmount": 0,

"oversearCardActivated": true,

"overseasCardActivated": true,

"paymentDueDate": "string",

"permanentCreditLimit": 0,

"productCode": "string",

"productType": "string",

"temporaryCreditLimit": 0

},

"customerId": "string",

"customerName": "string",

"emailId": "string",

"mobileNumber": "string"

}

Response

Schema

{

"internationalEnabled": true,

"isInternationalEnabled": true,

"referenceId": "string",

"result": {

"message": "string",

"messageCode": "string",

"status": 0

},

"transactionStatus": "SUCCESS"

}

Following are the types to customize the integration for the International Usage:-

Pre requirement

Cards(Debit/Credit Card) APIs should already be integrated.

Service API to integrate with Bank API

| Package | Class Name | Method Name | Details |

| services | CardsService | updateInternationalUsageFinalApiCall() | You can call your API inside this method. |

| domain request | InternationalUsageCardRequest | Request Class | |

| domain response | InternationalUsageCardResponse | Response Class | |

| mapper response | CardsResponseMapper | Map API response to this mapper class. | |

| model | Card | Fields, Getter/Setter methods |